08Nov3:14 pmEST

It's Pretty, It's So Pretty

Tons of materials miners, precious and otherwise, are setting up nicely from a technical standpoint and also represent genuine value in terms of their exceedingly low PE ratios and attractive cash flows.

However, because of the nature of the current market melt-up, it is understandable that most speculators continue to favor insanely valued growth stocks and all things crypto. But below the surface, I still maintain the market is sending out subtle signals (e.g. PTON) that it is slowly but surely changing its mind about how generous it will be with sky high PE ratios going forward.

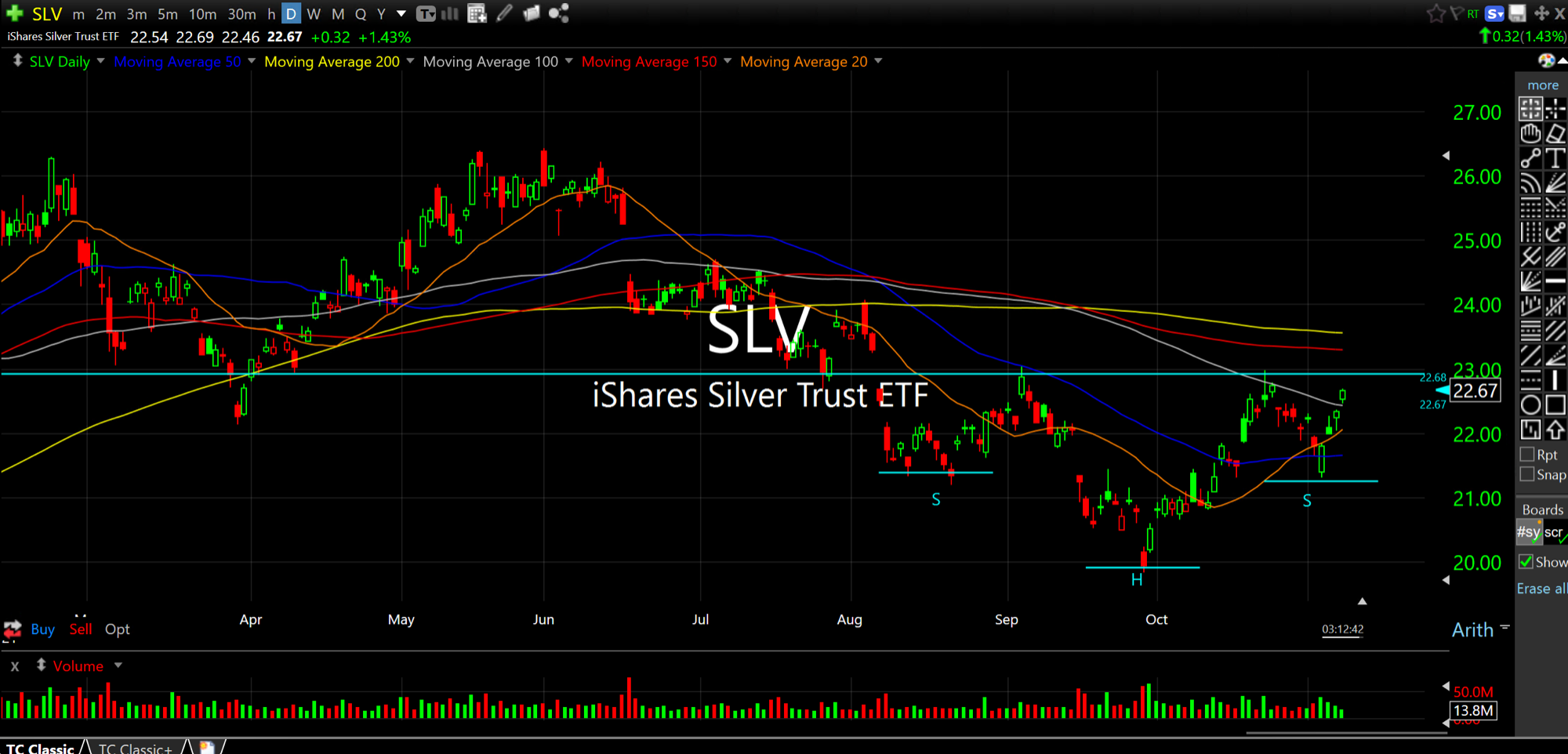

In the meantime, silver is leading gold today. In my experience, when silver leads it is a good thing for the entire precious complex. And like most charts in the sector, you can see a beautiful inverse head and shoulders bottom teed up and ready for bulls to swing for the fences. I am still long SLV, and looking to get longer above $23.

Plenty of folks are pointing to how uninspiring gold and the miners have acted despite all of the headlines about inflation, heretofore. I will remind you that the market has a longstanding history of delayed reactions in situations like these, where it waits out all of the obvious inflation-equals-gold takes and then breaks higher just when all hope seems to be lost.

As a corollary, then-Fed Chair Ben Bernanke announced QE1 back on November 25, 2008, which was still a good four-plus months away from the March 2009 bottom. So, delays happen all the time, and I suspect this precious complex delay has served its purpose in turning sentiment apathetic at just the right time.