03Feb10:57 amEST

An Important Message Lurking in the Shadows

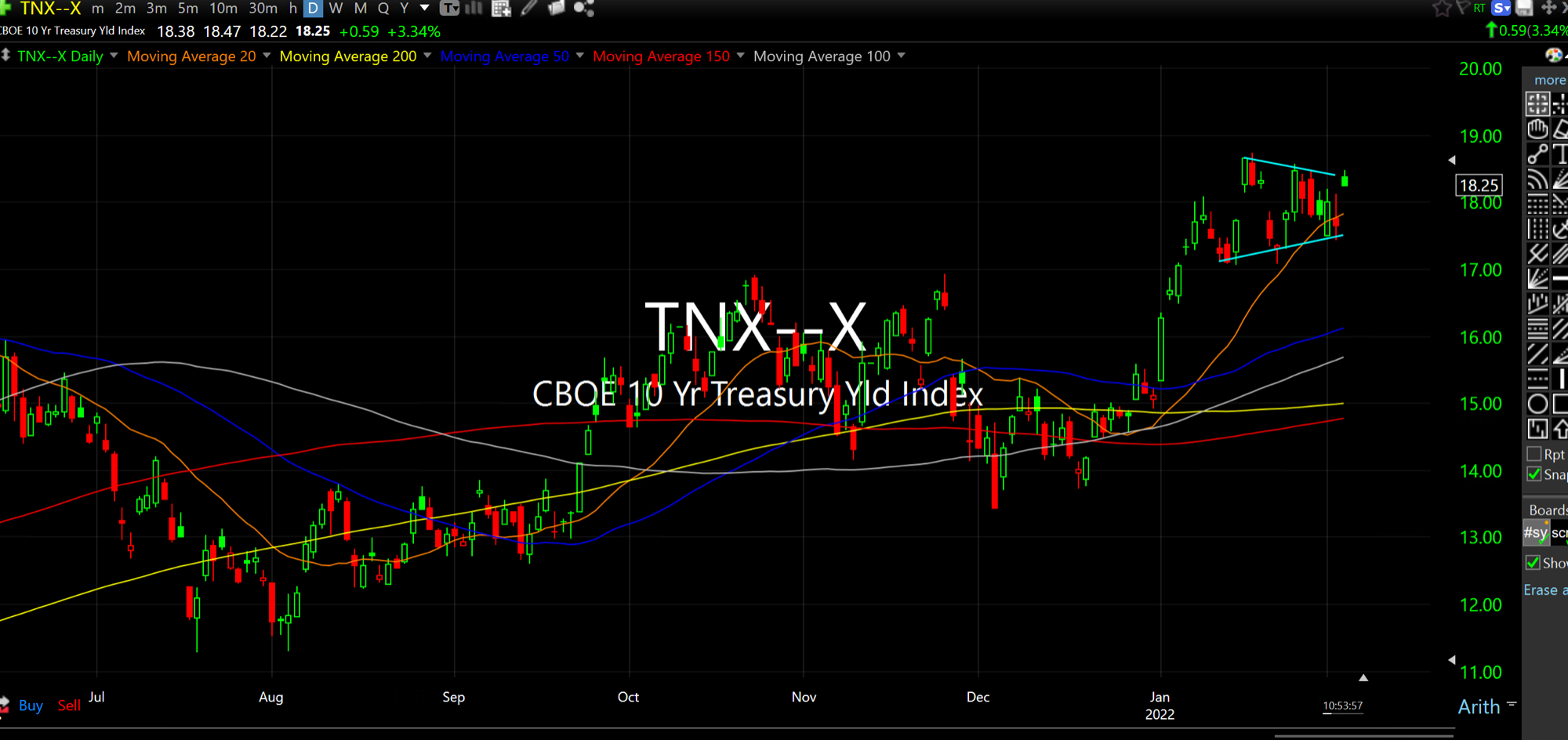

Between the FB earnings calamity, not to mention SPOT, plus a broad market gap lower on the back of hawkish comments out of the ECB it can be rather easy to overlook the move higher in rates this morning. After all, I am sure most equities-driven traders probably just assumed that Treasuries would receive a safe haven bid into the teeth of a tech driven selloff.

Not so far, however, as rates are actually on the upswing and, perhaps, threatening a fresh push higher.

Headed into 2022, one of the major themes we discussed with VIP Members was the idea of higher rates, and possibly sharply higher at that. What does that mean? Rates above 2% and possibly 3% on the 10-Year Note much sooner than most expect, for starters.

But generally an increasing amount of evidence that the four decade bull run in Treasuries is ending.

Mind you, the major central banks in the developed economies are all laughably behind the curve, with The Fed clearly nervous as they realize just how truly trapped they are with a fragile market, slowing jobs growth (let's see tomorrow with NFP, though) amid sticky high inflation. The conventional wisdom is that a trapped Fed means they will stay accommodative for longer.

However, that argument misses the risk of the bond market slipping out of The Fed's grasp and taking on a life of its own. Yes, it has happened before, albeit a long time ago. And it can assuredly happen again. To me, that is the greatest risk of all in the coming quarters.

Short-term let's see if the move on the TNX (Index for rates the 10-Year Note, daily chart, below) can push over 18.75, or roughly 1.875%.

Oil: Where's the Tip-Tip-Tip... Stock Market Recap 02/03/22 ...