04Feb1:21 pmEST

Shoveling Out from the Selloff

For the time being, which could last as shortly as this afternoon or possibly into next week, Nasdaq bulls have been able to stem the tide of selling thanks to AMZN and the SNAP squeeze. In addition, small caps are stabilizing a bit too alongside software, ARKK, and bios.

Interestingly, the market has been able to shrug off the strong jobs report this morning, despite the implication being that The Fed now has more room to raise aggressively as soon as next month. While all seems better at the moment, the junk/high yield market is selling off (see JNK weekly chart, first below, under the key $105 level we mentioned a few weeks back), to dovetail with rates on the 10-Year over $1.9% as crude pushes $92/barrel.

Hence, the inflationary pressures are still strong and this bounce in growth remains suspect, especially if we see some fireworks into the weekend as bulls reconsider whether they truly want to hold long inventory in the face of another potential gap up in both rates and crude by Sunday evening.

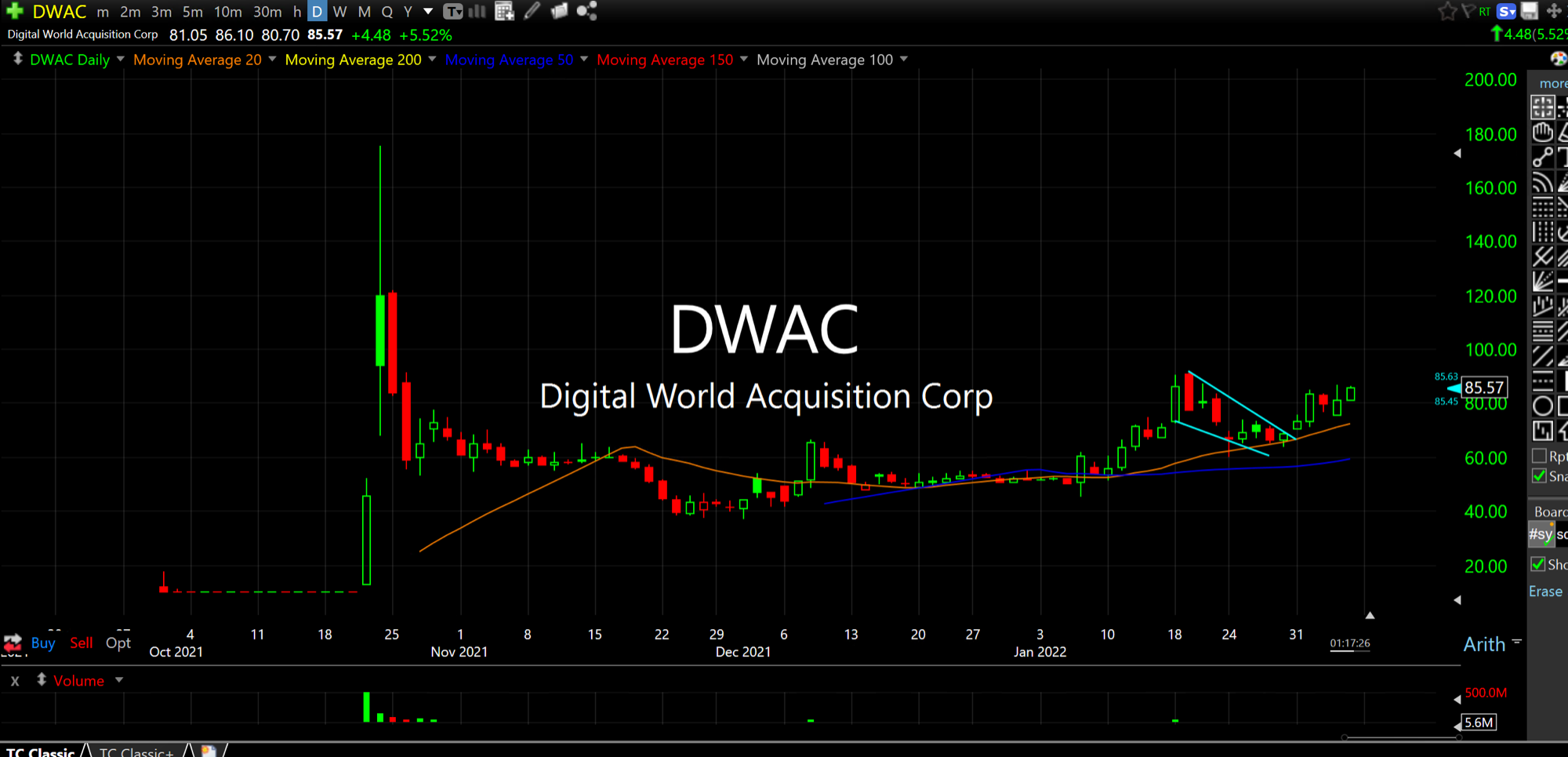

Still, there are always something interesting plays, even beyond commodities and value. DWAC, the Trump SPAC, on the second daily chart below looks just like GME did last spring when it has secondary and tertiary rallies after the initial meme craze.

Stock Market Recap 12/07/20 ... Stock Market Recap 12/08/20 ...