20May8:25 amEST

Here's the Last Inflationary Bear Market We Had

I know it is a Friday in late-May, with summer ahead of us after a grueling winter. So, you will pardon my sobering update here. But I do believe it to be quite instructive.

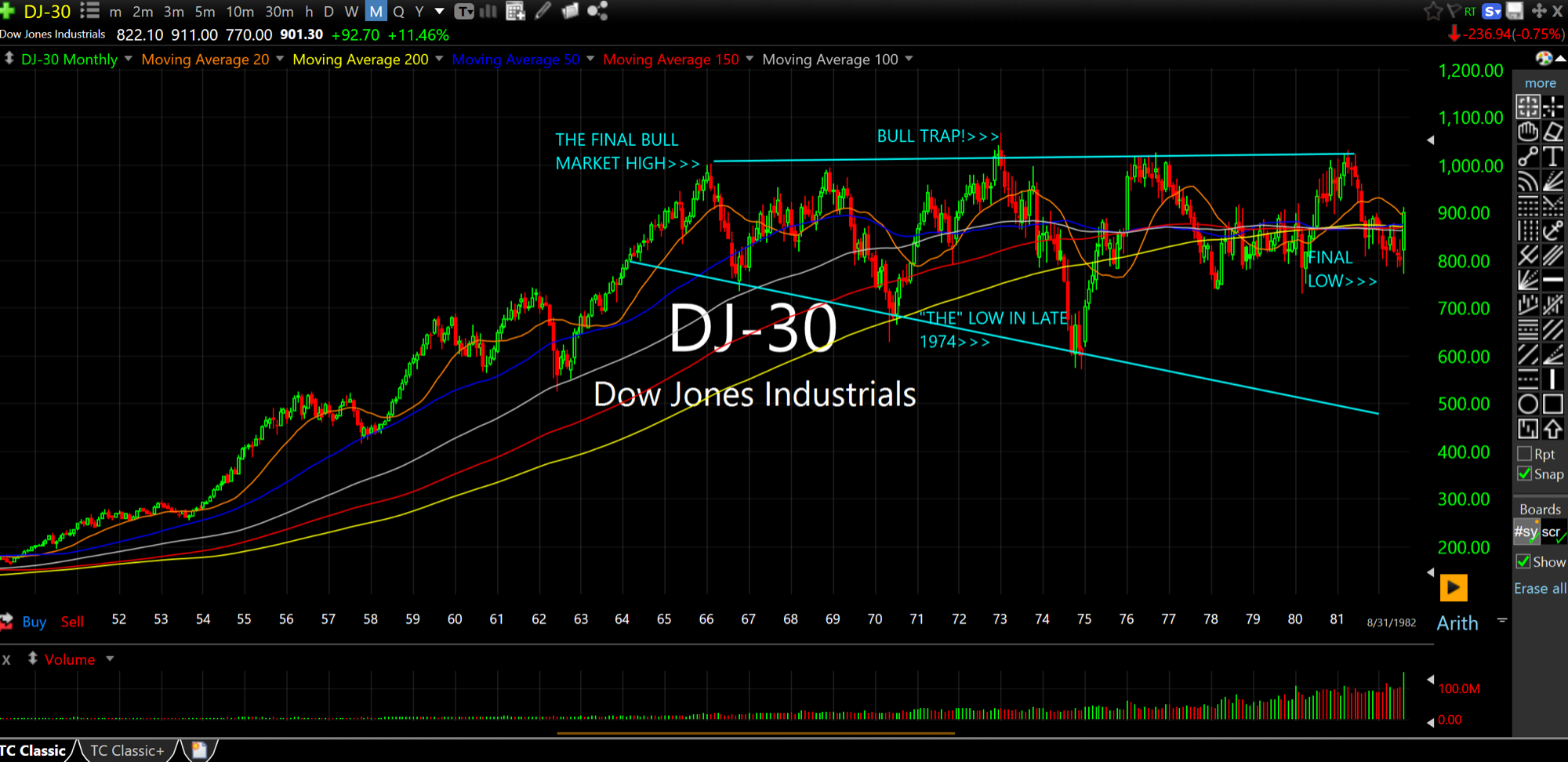

The last time this country saw a protracted inflationary bear market was from 1966-1982.

While it is certainly true that there are various differences between now and then, from a fiscal, social, monetary perspective, among others, there are also enough similarities to explore whether we are still in the rather early stages of another (overall) sideways 10-15 year bear market.

As you can see on the monthly chart of the Dow Jones Industrial Average, below, the prior 1950s epic bull run for America finally ended in the mid-1960s with the high in 1966. From that point on into the end of 1960s, the market grew weary of inflation just as we saw retail euphoria in a variety of the hottest mega cap stocks going at the time, otherwise known as the "Nifty Fifty" (i.e. a youthful IBM).

We then saw a series of cyclical bull AND bear runs within the overarching secular bear until August of 1982 (all the way to the right) for the final low in the midpoint of the massive, dead money range since the mid-1960s.

Could that happen now, with the highs in late-2021/early-2022 kicking off a good 10-15 years before we decisively break them again?

The answer is yes, since I suspect even some the more cautious types in this type of market still expect new highs within 1-3 years once "this storm passes," or something along those lines.

However, as we have been noting both here and with Members, secular shifts and regime changes seem afoot. Value should continue to outperform growth, which means many growth stocks which used to be darling either will not come back or will come back slowly.

And, most importantly, I do not think we will see a durable low (i.e. one which holds for months) in growth stocks until at least a few of the former high flyers file for bankruptcy as the cost of capital increases and the good ole easy money days are in the rear view mirror.

Yes, The Fed can seek to destroy demand to kill inflation, but fighting off this particular inflation, what with its supply issues, still may prove to be a much taller task than many expect. And that means a prolonged period of the market discounting inflation and its consequences, which almost always means much lower PE ratios on stocks and the market at-large than we currently have even now after the decline so far this year.

It is also worth touching on the cyclical bull runs we saw from 1966-1982.

They lasted a few quarters at a time, but were not led higher by the former high flyers. Instead, the leaders were gold, oil, silver, and value stocks overall. In other words, bulls pining for the go-go days of the 1950s and then the Nifty Fifty were disappointed even when we did, in fact, get a few quarters of relief within the scope of the secular bear.

They're Trying to Mask it Fr... Weekend Overview and Analysi...