29Jul10:44 amEST

Powell Can't Win Unless He Becomes the Villain

The aesthetics look great.

At each and seemingly every FOMC press conference in recent memory, Fed Chair Jay Powell walks to the podium and delivers remarks followed by Q&A chock-full of Fed-speak--Toeing the line and striking the perfect balance between acknowledging the problems that the economy faces while also whispering enough sweet-nothings in the market's ears to ignite a powerful short squeeze higher.

During the deflation/disinflationary years, that sort of strategy can work incredibly well, as evidenced by the "success" Alan Greenspan, Ben Bernanke, and Janet Yellen often enjoyed.

But with sticky inflation as the backdrop, Powell's aesthetics are the worst possible outcome if his true desire is to actually slay inflation. If markets are ebullient above 4,000 on the S&P 500 because Powell only raised 75 bps and signaled it is entirely possible to slow down with the rate hikes come autumn, then in nominal terms the markets simply have no fear. A more cynical way to say it is that markets are laughing directly in Powell's face, with rates on the 10-Year back below 2.7% amid the multi-decade high CPI and now PCE.

While aggressively long bulls (I currently have no short positions on in my trading account, by the way) are likely loving this rally, understand that the dangerous wildcard is if commodities stage a fresh leg higher.

On the UGA daily chart, updated below, the ETF for gasoline futures shows an upside breakout from a multi-month correction after the prior uptrend. I see no reason to believe this is a major top, yet. And, again, with Powell enjoying the market's short-term adulation at the expense of more seriously fighting inflation (he could raise by 100-125 bps, also do a surprise rate hike in August, and pick up the pace of quantitative tightening, for example, not to mention even just talking tougher against inflation), there is every reason to think that the pain trade for commodities is, in fact, still higher yet despite a slowing economy.

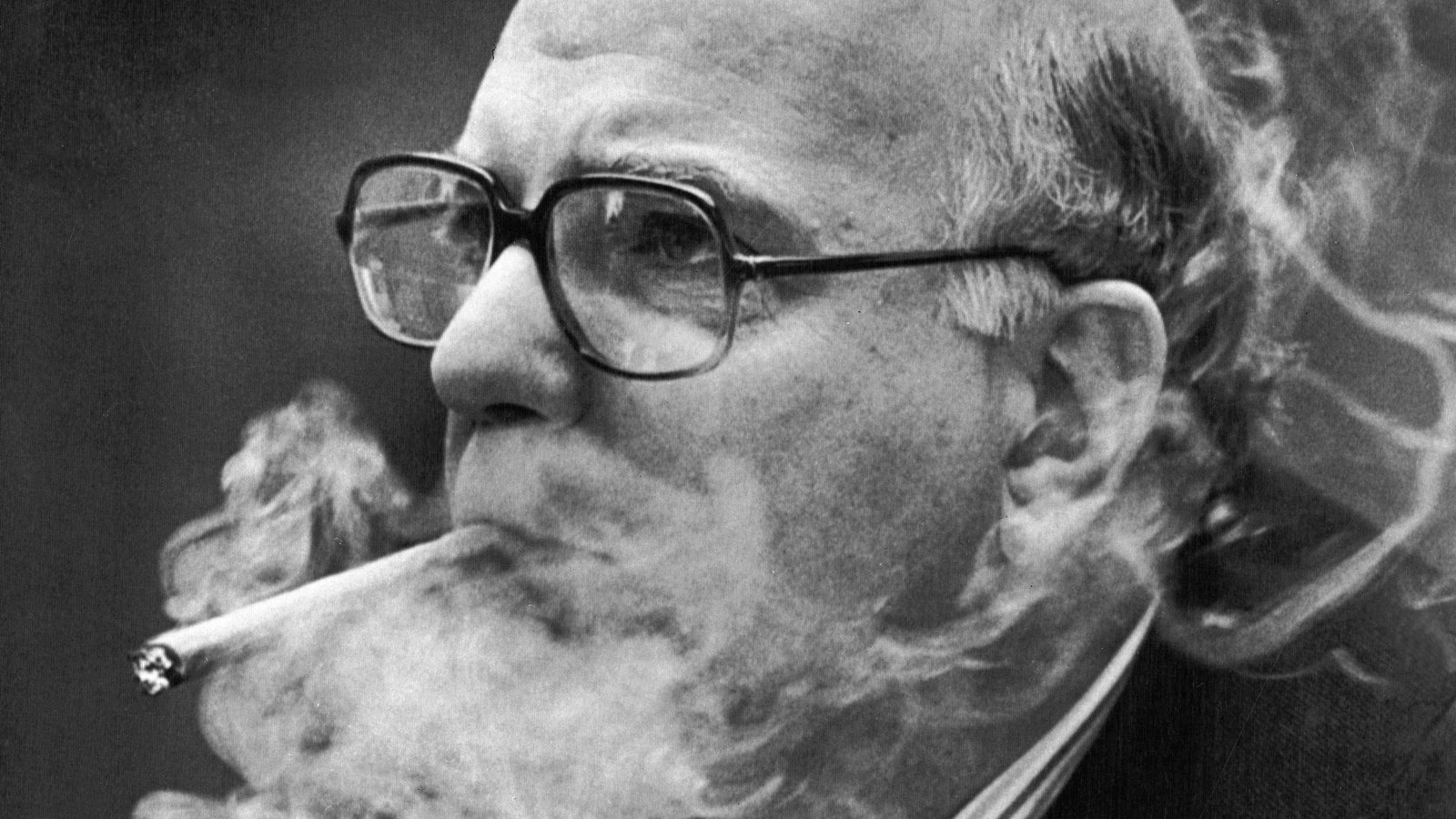

There is a reason why Paul Volcker more effectively fought the back off a nasty, entrenched inflation in the 1970s through early-80: He actually relished being the villain, what with surprise rate hikes and a full awareness that he needed to cause a deep recession to fully crush inflation.

Powell is the polar opposite in mindset and demeanor--Apologetic about raising rates and quick to try to soothe markets at each and every juncture, hopeful he can pull off the elusive "soft landing." That may very well earn his more praise in the short-term, but it raises the odds significantly that inflation remains sticky for much, much longer than markets currently expect.

What Would Mr. Miyagi Would ... Weekend Overview and Analysi...