01Aug10:42 amEST

You Come to Market Chess to Get Away from Petty Drama

We are clearly at a crossroads with this market.

Early-August seasonality is actually a bit better than most expect. However, as the month rolls on the mood tends to shift to a more volatile one as autumn lingers. Thus, even with this morning's softness bulls may have a week or two to make their case (as quite a few seem to be making) that a new bull run is underway.

Even though I am still holding off on shorts, and mostly have been this entire summer, I do not share the view this is a new bull run. Instead, I suspect the rally burns out probably no later than options expiration on August 19th, if not sooner.

True, the Pelosi/Taiwan saga could be an exogenous event if China makes a move, which most seem to think is impossible at this point. Overall, though, the market followed midterm election year seasonality (especially for a first term Democrat President) quite well in July, so I would expect some continuity into August, too.

Another note: It is crucial in this sort of market to pay close attention to the people with which you are surrounding yourself in markets and in life in general. If they are toxic and petty, you can be sure it will filter into your market views. Suddenly, every tick will become too dramatic and you may find yourself becoming emotional at the wrong time. Some life advice: I know you think it is easy to compartmentalize things in life, but not so much when it comes to the subtle ways being on tilt can infiltrate your judgment in all forms of speculation--Ditch the drama and toxic types, especially for what could be coming down the pike this autumn and into 2023.

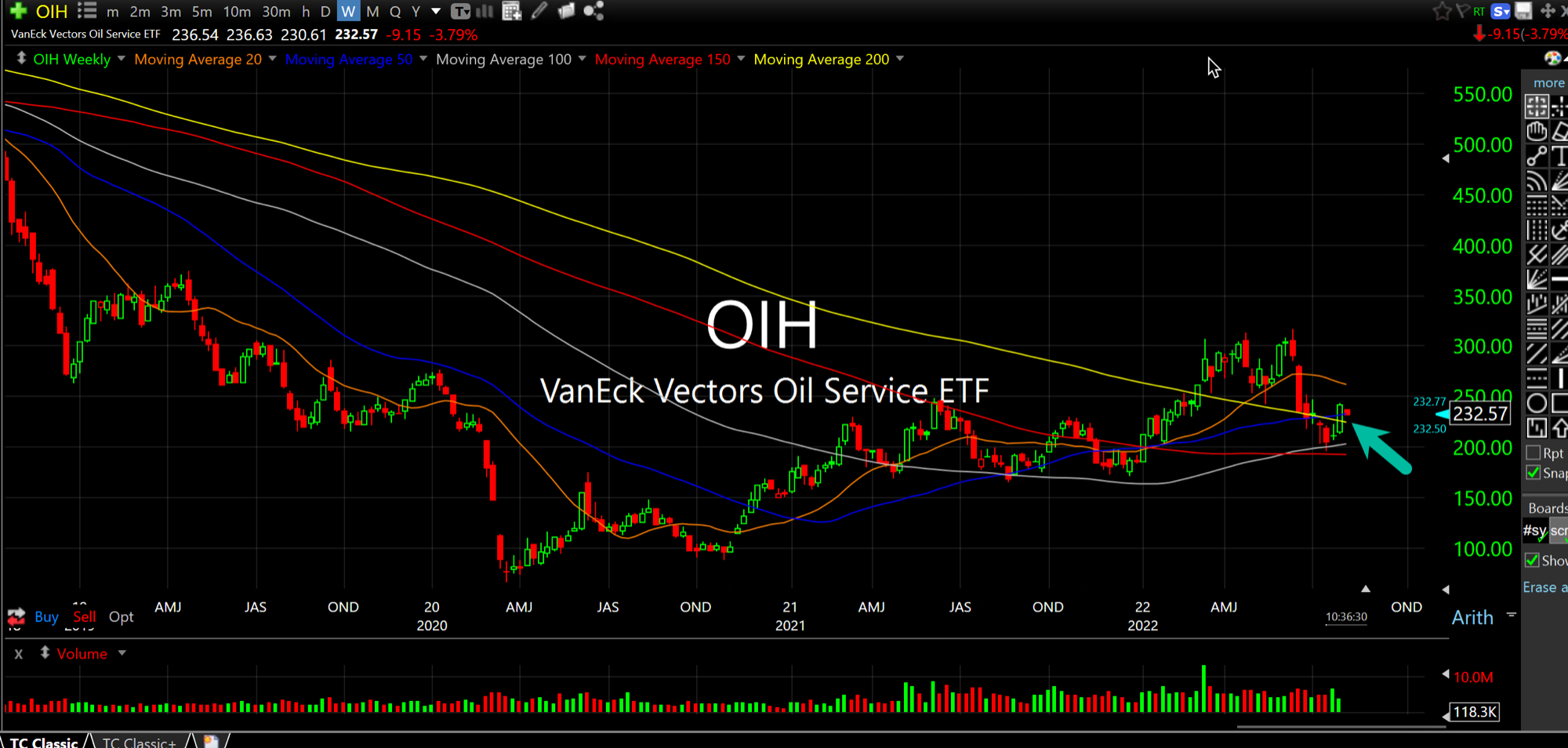

Two charts for perspective: Oil is getting hit but the OIH ETF, the weakest of the big three (XLE OIH XOP ETFs for energy firms), is holding above its 200-period weekly moving average on the first weekly chart below. As long as that continues, shakeouts like this morning may be just that.

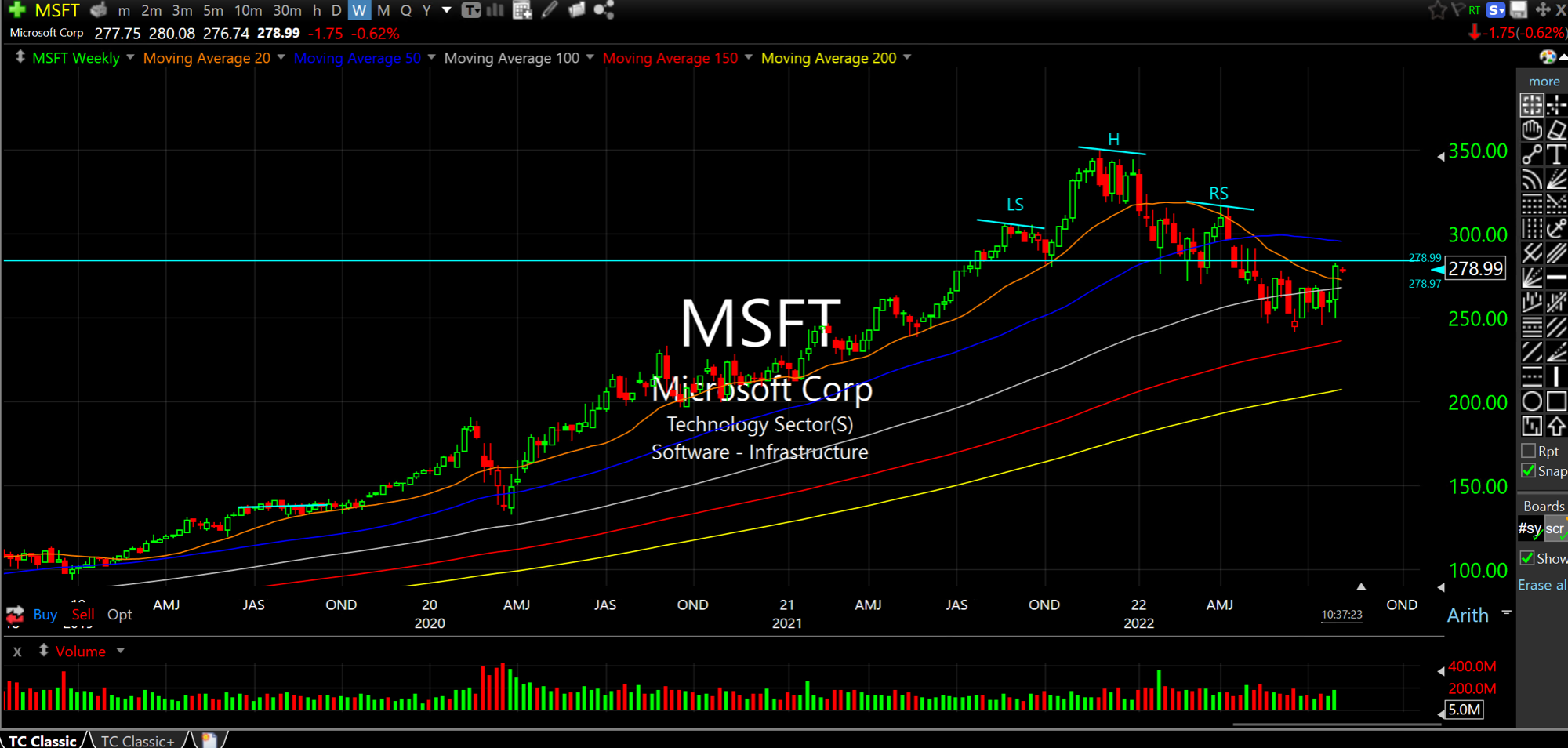

MSFT, on the second weekly chart, below, despite how excited bulls became last week with a strong earnings reaction, is still operating under a confirmed head and shoulders top after a very steep uptrend. The stock is still not cheap at all. I expect the top to be the controlling pattern into the end of 2023 after this bounce peters out.

Weekend Overview and Analysi... Maybe They Should Take Ameri...