05Aug10:15 amEST

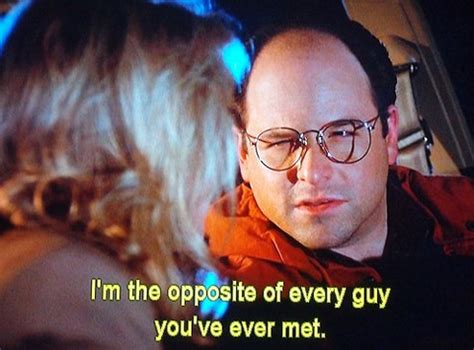

Take Everything You Know About Markets and Flip It

I am quite certain that there is a significant portion of traders out there who likely began trading sometime last decade, or at least became more attentive to markets during that period.

If that is the case then surely they have, understandably, grown accustomed to a market where bad news is often seen as good news; where slow growth was often celebrated and the market cheered loudly. Those rare times markets did sell off, even when things felt a little scary, it did not seem to matter because, inevitably, The Fed would step in with ultra-easy monetary "tools" to smooth markets over. And, boy, did they. Between Bernanke, then Yellen, and then the early years of Powell, there was a constant "heads I win, tails you lose" vibe to markets regardless of how dicey the global economy seemed.

But the boogeyman for all Central Bankers will always be inflation, especially sticky, high inflation which does not conveniently exit stage left upon saying a magic couple of words and maybe making a token few rate hikes. No, when inflation becomes entrenched it can ruin even the most powerful of nations. And the hope of an imminent Fed pivot back to the dovish glory days is just that--A fleeting hope so often seen during doomed bear market rallies.

There is a good reason why inflation is often referred to as a "scourge" in historical literature dating back centuries, and why it is so often said that putting the inflation genie back into the bottle amounts to trying to put toothpaste back into its tub after being squeezed out--It truly is that menacing. The problem for us in the West is that we have become so acclimated to extended periods of disinflation where pedestrian growth without inflation was celebrated by markets as being the ideal "goldilocks" scenario.

However, that era has ended.

Going forward, we would be well served by looking at the market from the opposite perspective--Good news will now be bad news as long as inflation remains sticky (see: this morning's strong jobs report). And the QE/ZIRP monster winners like mega cap tech should surprise to the downside for the coming 3-9 months.

Even if stocks bounce back today, the pressure is building on The Fed to raise by at least 75 bps in September and, frankly, they ought not wait that long--An inter-meeting rate hike is wholly appropriate and, in fact, necessary.

And that goes triple if oil and energy stocks find bids just as many folks wrote them off as dead.

Stock Market Recap 08/04/22 ... Weekend Overview and Analysi...