04Oct10:28 amEST

You'd Better Be Street Smart with Where We're Going

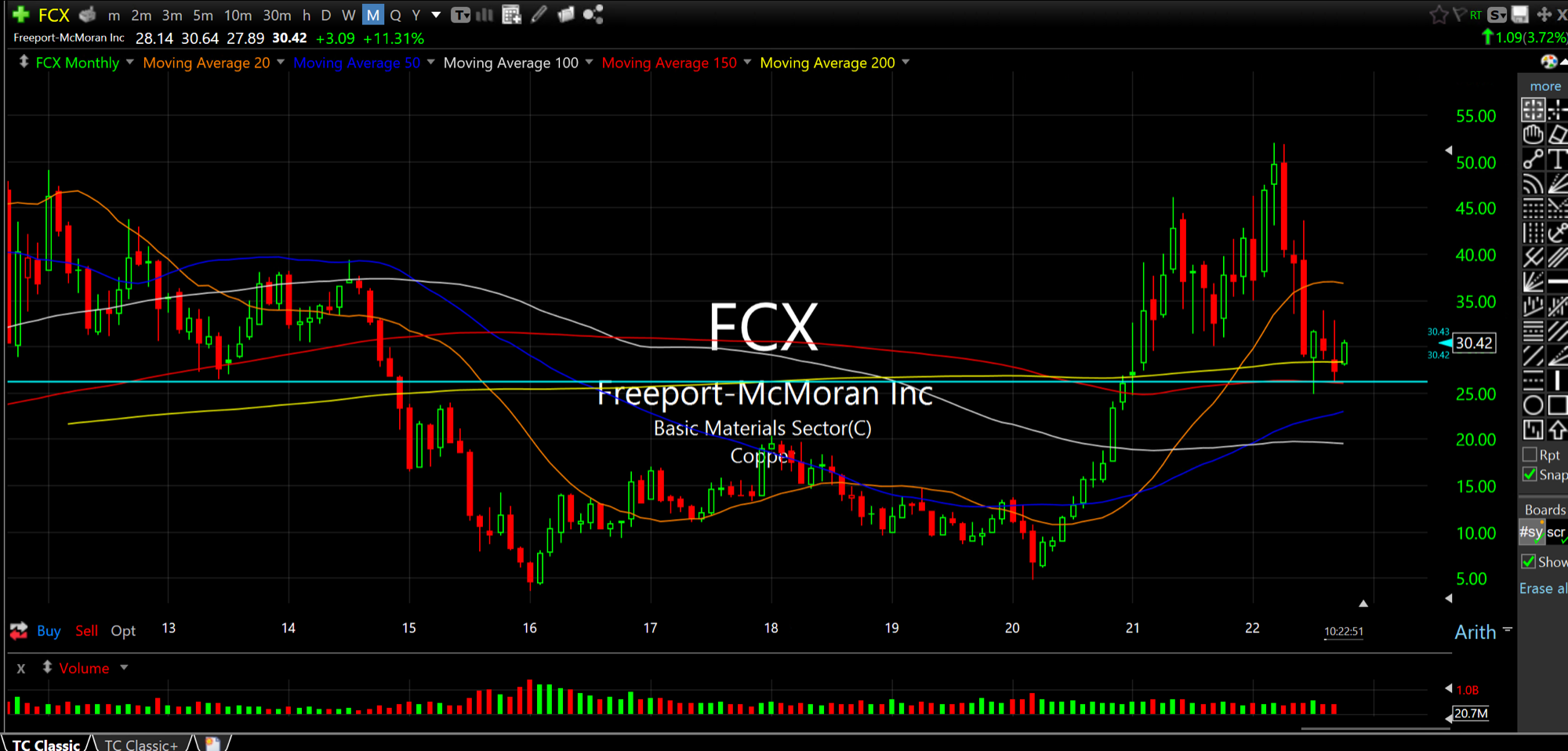

After being among the very best performers for commodity names off the March 2020, a bonafide and elusive ten bagger, copper miner Freeport-McMoran since suffered a 50% haircut--You can see as much on the FCX monthly chart, below.

Currently Freeport is rallying sharply this week with most commodity names.

That said, the big picture is that as equities as a whole became near-term beaten-down and the bear side of the boat became rather loud and notably crowded both last week and especially over the weekend, we now have what looks to be a painful short squeeze playing out so far this young quarter.

And then comes the issue of whether The Fed will actually soften its stance. I would be surprised, still, if they cut rates anytime soon. But pressure is clearly building on them to at least back away from continued aggressive rate hikes, lest they "break something" like we nearly saw in the UK last week with their pension system.

To be clearly, long-term view is that there is no easy way out of this predicament. The monetary and fiscal blunders have already been made. My personal view is that we should just take the medicine now, like we should have in 2008, and get it over with. Naturally, the political will is not there for that, certainly now at this phase of the American republic.

Should The Fed so much as even hint at not hiking as fast in the coming meetings it is likely that commodities have the green light to probe higher, slowing economy or not, since we know lingering supply issues are still a major factor, not to mention the intrinsic value of owning "real things."

Not getting caught leaning heavily short in the hole has clearly been one of the major trading themes of this bear market in 2022, thus far. The great irony of markets is that the more squeezes like this we see, the more bears simply quit trying to short/buy puts betting on the "big one," and thus the odds begin to rise of an actual crash since the downside speed bumps (i.e. shorts buying back stock to cover their positions and take profits) will become absent.

But right now the market is betting on hope again--Hope that The Fed softens, hope that the economy holds it together, hope that markets will keep using shorts as fodder for squeezes.

Only that hope may very well turn into something far more menacing that any deflationary shocks--Another manic rally in commodities to new highs by the holidays, wrecking all of our costs of living and putting pressure back on The Fed to toughen back up into 2023.

This Year's Fall Classic Wil... Be Careful What You Wish For...