12Oct12:30 pmEST

Value Investing Most Certainly IS Coming Back

About fifteen years ago I was walking through the Rio All-Suite Hotel & Casino in Las Vegas to play the juicy cash games during the World Series of Poker.

David Einhorn, the famous hedge fund manager and avid poker player, was there for the WSOP action. I walked by one of the open air restaurants in the Rio corridor and saw Einhorn with his extended family enjoying a meal. Upon a quick glance, I saw he was making sure they were all squared away with silverware and whatnot before he sat down to eat himself. In other words, he seemed like a square guy and, by all accounts from people I've talked to who have played poker with him, he is just that.

My point is that I am not penning this blog post to take Einhorn on personally.

Instead, I vehemently disagree with his assertion which made major headlines today, that value investing may never come back.

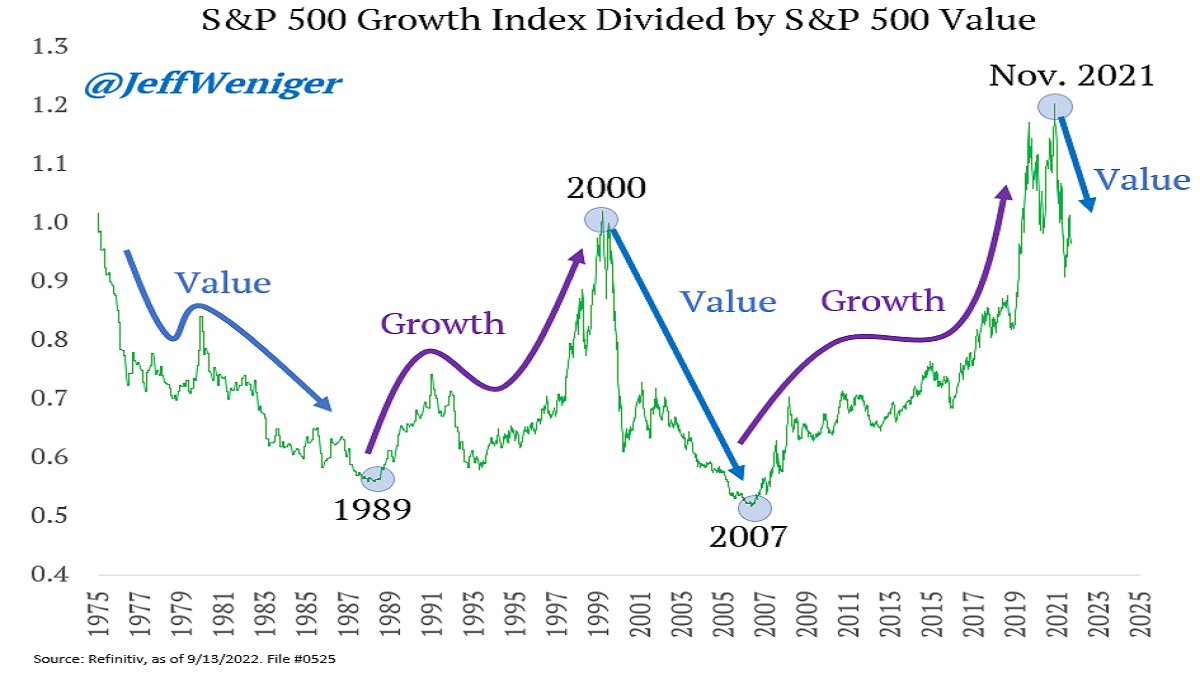

It is my assertion that not only will value investing come back and outperform growth, to already has since late-2021 and is still in its early stages. I expect this new regime of value outperforming growth to last the rest of this decade, and likely well into decade, too.

And if you read the Bloomberg article to which I linked, above, and take an objective step back I think you will find the sentiment which Einhorn displayed, himself a value investor at many junctures, is entirely consistent with the frustration you see when a given strategy has failed for so long.

But it is alway darkest before dawn.

Thus, whenever the next bull run commences, be it later this year (unlikely, in my view), 2023, or even 2024, I suspect the majority will be blown away at how many reasonably priced, strong balance sheet businesses perform compared to the all-sizzle-no-steak flashes in the pan from last decade and then after the pandemic. Dividend stocks, as a general rule, should outperform tech, and I would take Chevron any day of the week over Amazon, Tesla, even Apple for the reminder of the decade.

Au contraire, Mr. Einhorn, value investing is the light at the end of this bear market tunnel.