09Dec10:56 amEST

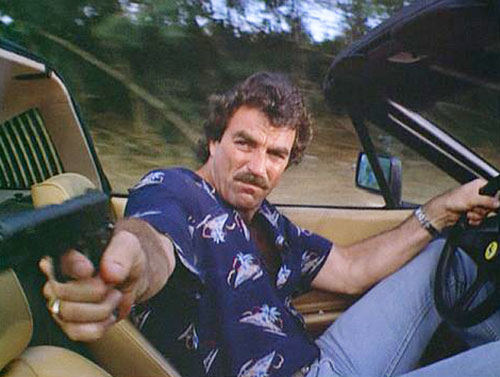

Who is the Real P.I.?

Despite a hotter than expected PPI (Producer Price Index) print this morning, stocks are mostly muted in their response thus far on a December Friday. Crude oil is still trying to bounce off its prior September lows, and the S&P 500 is trying to hold back above 3950 as we speak.

As we have been noting with Members it is highly likely that the market is looking beyond the PPI to the CPI and FOMC combo next week, with the CPI being the consumer price index inflation reading. Until then, showing that extra bit of patience may be critical as hyperactive traders have almost assuredly been getting chopped to pieces (despite whatever braggadocio you may be seeing).

One interesting technical note is on natural gas ETF UNG (daily chart, below) with a wintry cold front finally moving in--Note UNG back up to the scene of its recent breakdown. If it can recapture and hold $20 into next week I would give the rally more respect as winter heating season rapidly approaches.

Weekend Overview and Analysi... Lunch is for Wimps So Here i...