27Jan11:27 amEST

Do More Scouting Before You Claim Victory

Considering the Nasdaq and other major indices still have down sloping 200-day simple moving averages, I am amazed at how many market veterans (let alone the newcomers since 2020) are declaring the bear market dead and a new bull market underway.

Then again, this is recency bias at work, what with the one-way spectacular rally we saw off the March 2020 lows.

But this time around there will be no QE/ZIRP, nor widespread "stimmies" at work.

Instead, we have sticky high inflation which, yes, has receded off its highs but, no, is not collapsing in the manner some suggest (or hope).

With the FOMC next week, Powell has telegraphed 25 basis points as the hike number. Sure, he could always surprised with 50 but that is not his style, heretofore. The real issue will be those pesky dot plots guessing the terminal rate (when and where the Fed is finally done hiking) and, more importantly, if Powell forcefully undermines the idea that rate cuts are off the table in the next year or so. If he does that, the market likely get spooked.

If not, the next CPI is on February 14th and likely marks the scene of the next inflation battle.

But before bulls declare victory altogether with a straight face they may want to guard against other asset classes turning before equities do.

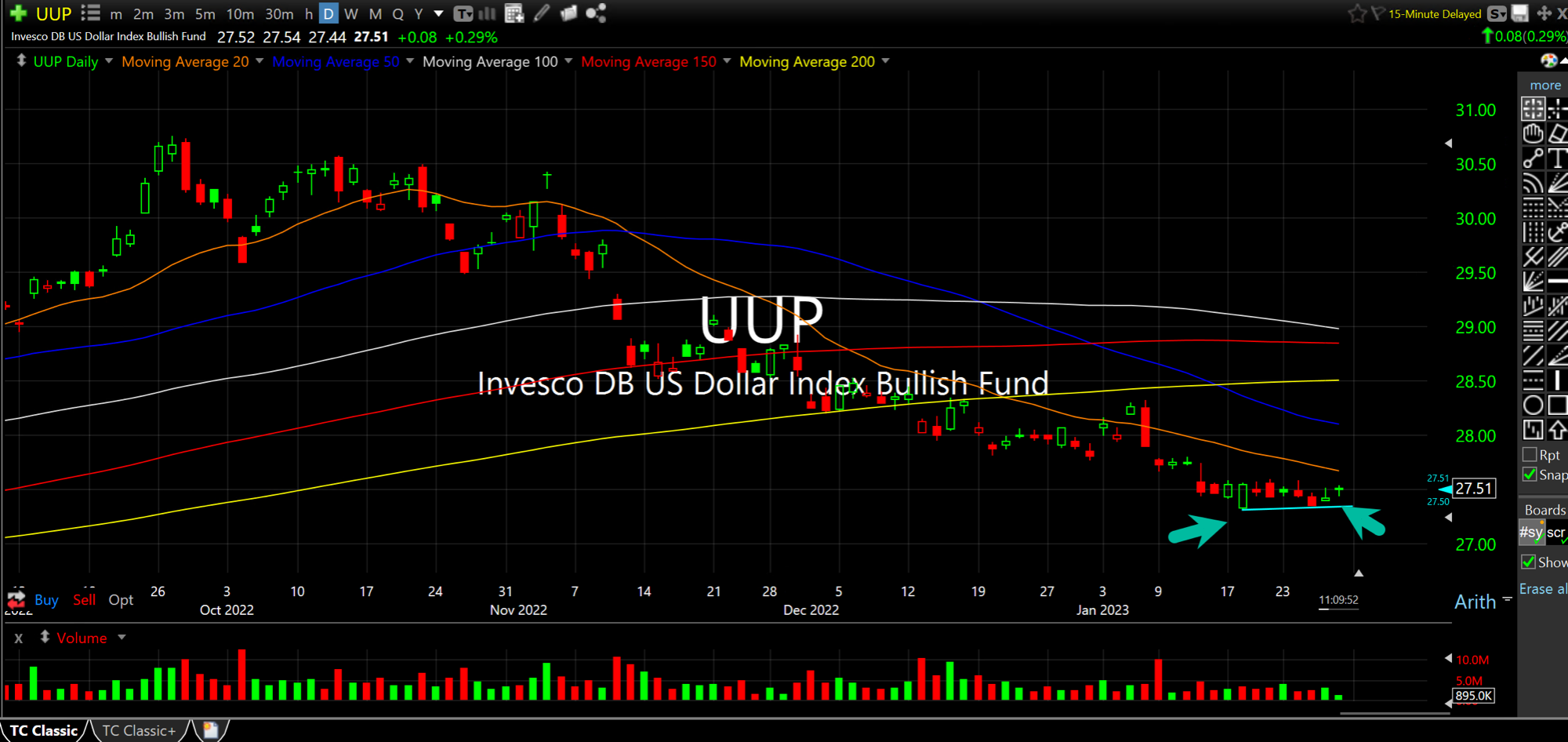

On the UUP ETF for the U.S. Dollar, below, while stocks moved higher this week the Dollar (trading inversely to stocks this cycle) did not make new lows. This qualifies as a divergence especially in front of the FOMC next week which could easily come home to roost.

Stock Market Recap 01/26/23 ... Weekend Overview and Analysi...