03Apr10:51 amEST

Oil Up, Tesla Down; New Quarter of Attack

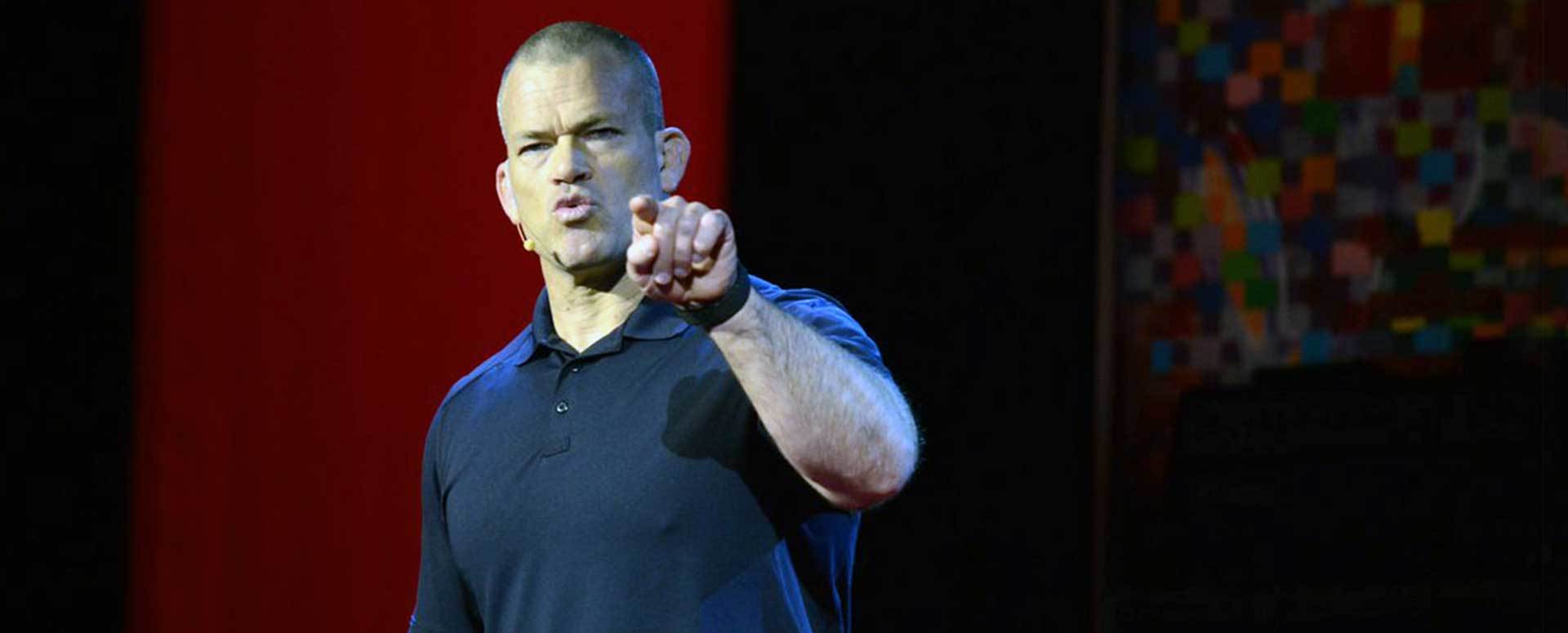

"Get up. Dust off. Reload. Re-calibrate. Re-engage – And go out on the attack.” – Jocko Willink

Just in time for the new month and quarter (funny how that works), OPEC+ meaningfully slashes oil output to send crude prices higher. Oil services names like RIG, which started off 2023 red hot before cooling off amid the tech rally, are back at it this morning albeit with RIG needing to deal with $7 resistance.

Tech is lagging overall on renewed inflation fears, with TSLA even more so as seen on the monthly chart, updated below.

As we have noted before on Tesla, the monthly chart still shows a monstrous stop intact. I recognize this cycle has taken its time to play out, more than 2008 for example, which is to the chagrin of a great many. But the larger point is to maintain the proper long-term perspective amid the short-term frustrations.

And when we do, Tesla is still in a good deal of trouble alongside even the big tech names which rallied hard in Q1, like META or NVDA. Simply put, the long-term tops have not been negated. And think about all of the buying power which was used up despite that!

Going forward, I expect tech to wobble this quarter and possibly tip over, although I am open to that happening later in the year, too. But I still see up-down risk as skewing heavily to the downside.

Regarding oil, USO versus $70 resistance is a pretty good first test on this move to observe the underlying strength after the headline dust clears.

Weekend Overview and Analysi... No Rate Cuts Without Calamit...