12Apr11:46 amEST

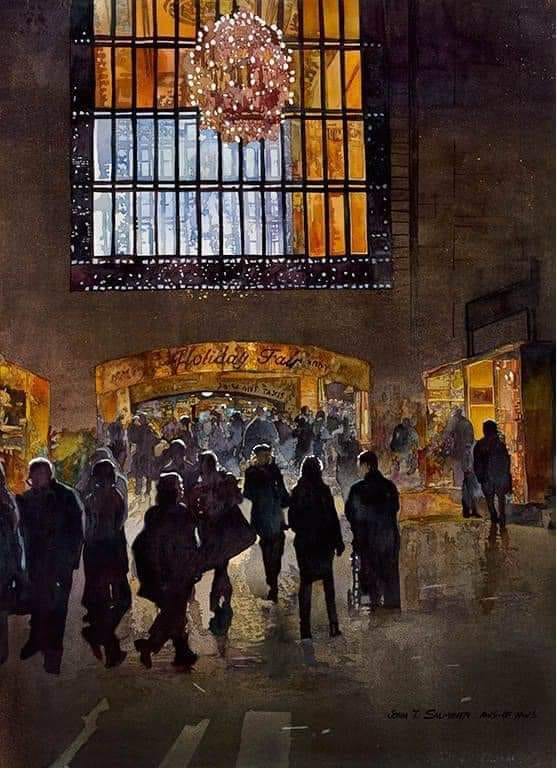

New Buyers Late to the Station

While the CPI came in cooler than both I and the market expected, leading to an initial pre-market futures rally, semiconductors led a reversal lower off the open which is largely sticking as I write this. It is often said that markets which fails to hold rallies off "good news" are increasingly bearish, which means whether we get a recover or not later today should be quite telling.

You will also note that both crude and gasoline futures are higher. So, it is not as though we have a resounding disinflation chorus of price action. In other words, what if this CPI was the last cold print for a while? What, then?

Either way, I am keying off Nasdaq dip-buyers for clues and to see how successful they are with their usual efforts, be it 0DTE players or not.

Amazon continues to be a laggard amid large cap tech, and likely represents a short setups into market softness before its next earnings report.

Overall, with the Fed Minutes looming this afternoon, late buyers off the CPI print are facing some initial stiff tests.