05Jun2:04 pmEST

An Apple Event a Day Keeps Reality Away

We have WWDC kicking off today, and shares of AAPL are in focus again and grabbing most of the headlines, even amid the OPEC cut and oil trying to get a little something going from beaten-down conditions.

With a forward PE north of 27, especially considering the firm's sheer size, Apple is clearly not a value stock despite Mr. Buffett being long in size. In fact, Buffett is reaping his rewards through the dividend payout. True, the stock continues to push higher yet as market players pile into what seems like a sure-thing, can't miss company in a world full of uncertainty.

But I doubt that lasts much longer from here.

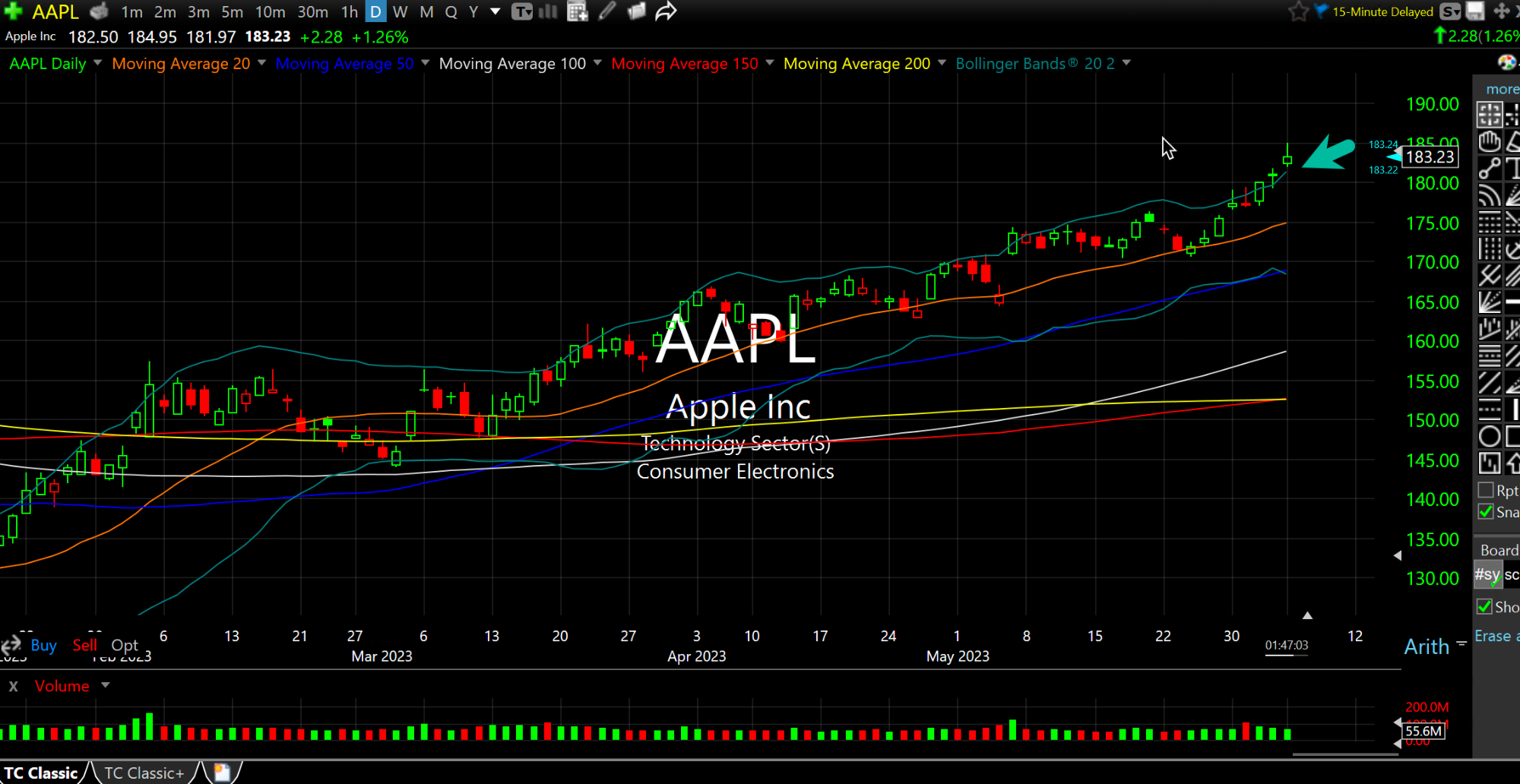

Going back at least six years, I could not find one other example where AAPL's entire daily chart candlestick was entirely outside the upper daily Bollinger Band (arrow, below). Granted, today's session has a few hours to go before the daily candle is complete. And I only did a cursory glance at prior examples. However, I can say with certainty that the move in AAPL is extremely rare if not unprecedented in that regard--There can be little doubt that a handful of mega caps are beyond crowded and beyond expensive at this point.

Overall, this week could easily be one of consolidation for markets as we have a quasi-lull before next week's triple header of CPI, then FOMC, then OpEx, followed by a three-day weekend for Juneteenth.