13Jun1:10 pmEST

Why Was I Born Handsome Instead of Rich?

Here it is: Daily melt-ups and a one-way tape amid bad news, good news, neutral news altogether. Sentiment assumes a bull market is here and new highs are inevitable, in the bag and a forgone conclusion.

If you wanted to be a contrarian and look for a primo, type A short setup, this would be it. I, myself, certainly did not expect The Fed to step in so quickly back inn March to backstop SVB and regional bank deposits the way they did. And that extra liquidity boost could easily have thrown off the timeline of what I have been looking for in this tape.

But no excuses--We are where we are.

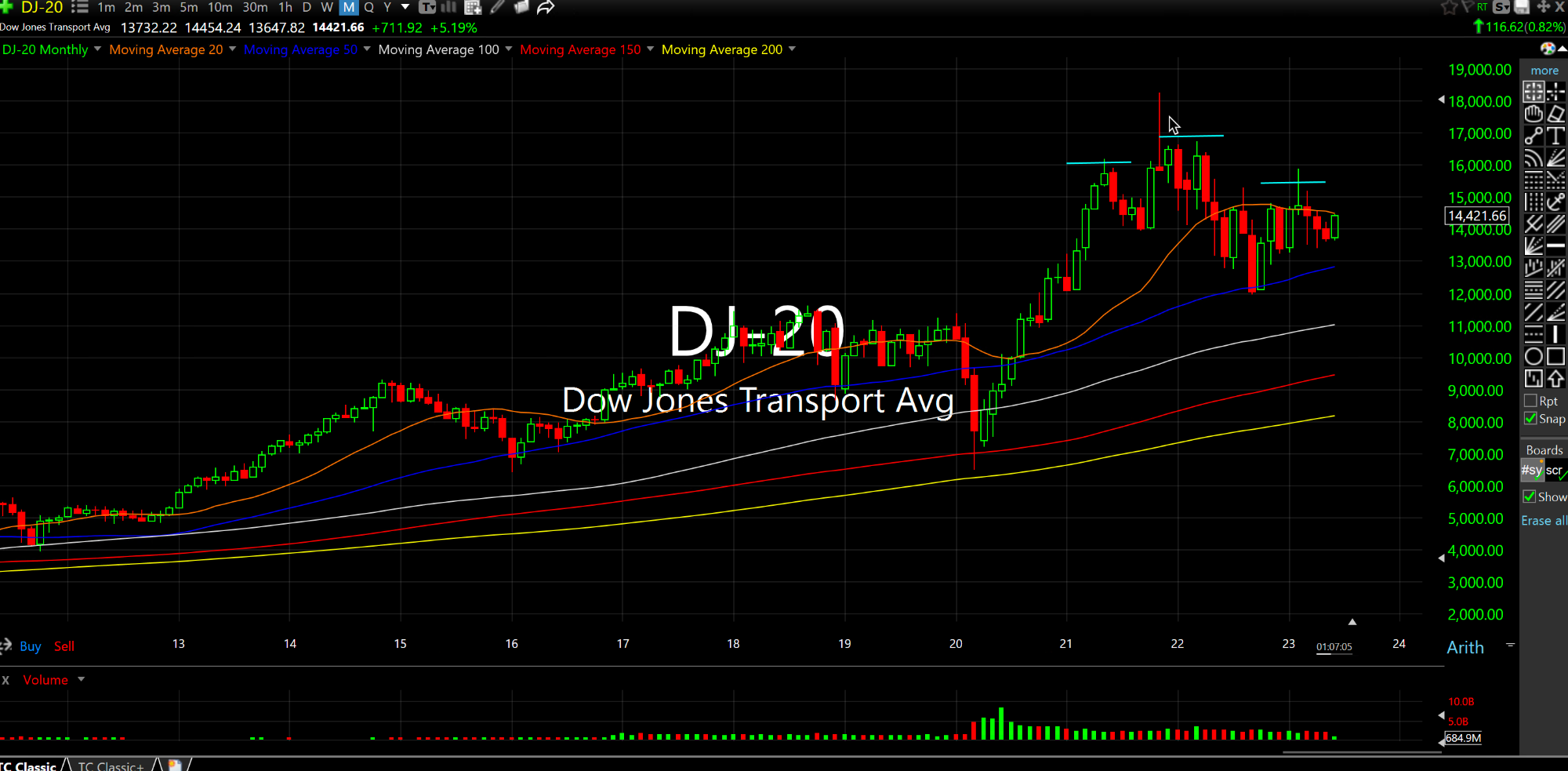

And where we are is, despite all of the bullish assumptions the transports, for example, have not come close to negating the major bearish head and shoulders top (monthly chart, below, for the Dow Jones Transportation Average) which we have seen so often over a period of years during prior bear markets dating back decades on the transports (as an aside, note UNP red and lagging today).

Overall, I maintain this is the final inning of the rally which is setting up for a ruthless version, and then some, into the summer and autumn.

Also note rates, as a few Members noted, staying firm, despite the supposedly cool CPI print this morning (don't look at the ex-food and energy number, however, which was much hotter).