05Jul1:36 pmEST

Rates Don't Matter; Its Cool, Guys

Coming off the holiday, and in front of the Fed Minutes at the bottom of the hour, we have rates on the 10-Year Note zooming up beyond 3.9% as I write this.

Equities are mixed, with the Nasdaq turning in another too-cool-for-school session so far, completely ignoring the spike in rates. Bulls are pointing to this as even more evidence that both the economy and markets can handle higher rates.

But just as we saw in mid-2008 with the spike in oil, and then the COVID headlines ignoring in January/February 2020, sometimes a delayed reaction by markets can be the most bearish situation possible.

Here, the pertinent issue is whether equities wake up and panic that they have been asleep at the switch as rates, in fact, will not be cut anytime soon (at least not without a crisis/crash first). Furthermore, the risk in rates is much higher from here.

Powell and the Fed have outright said the next few meetings will be "live" insofar as possible raising rates again.

However, very few folks are even mentioning, let alone pondering, what would happen if the bond market simply rebels against The Fed and spikes rates on its own, unilaterally regardless of what the FOMC decides to do--A bond market crash may seem unfathomable but it can happen.

And I continue to have conviction that the pain trade is a spike higher in rates which sees the Nasdaq eventually buckle under its own complacent weight.

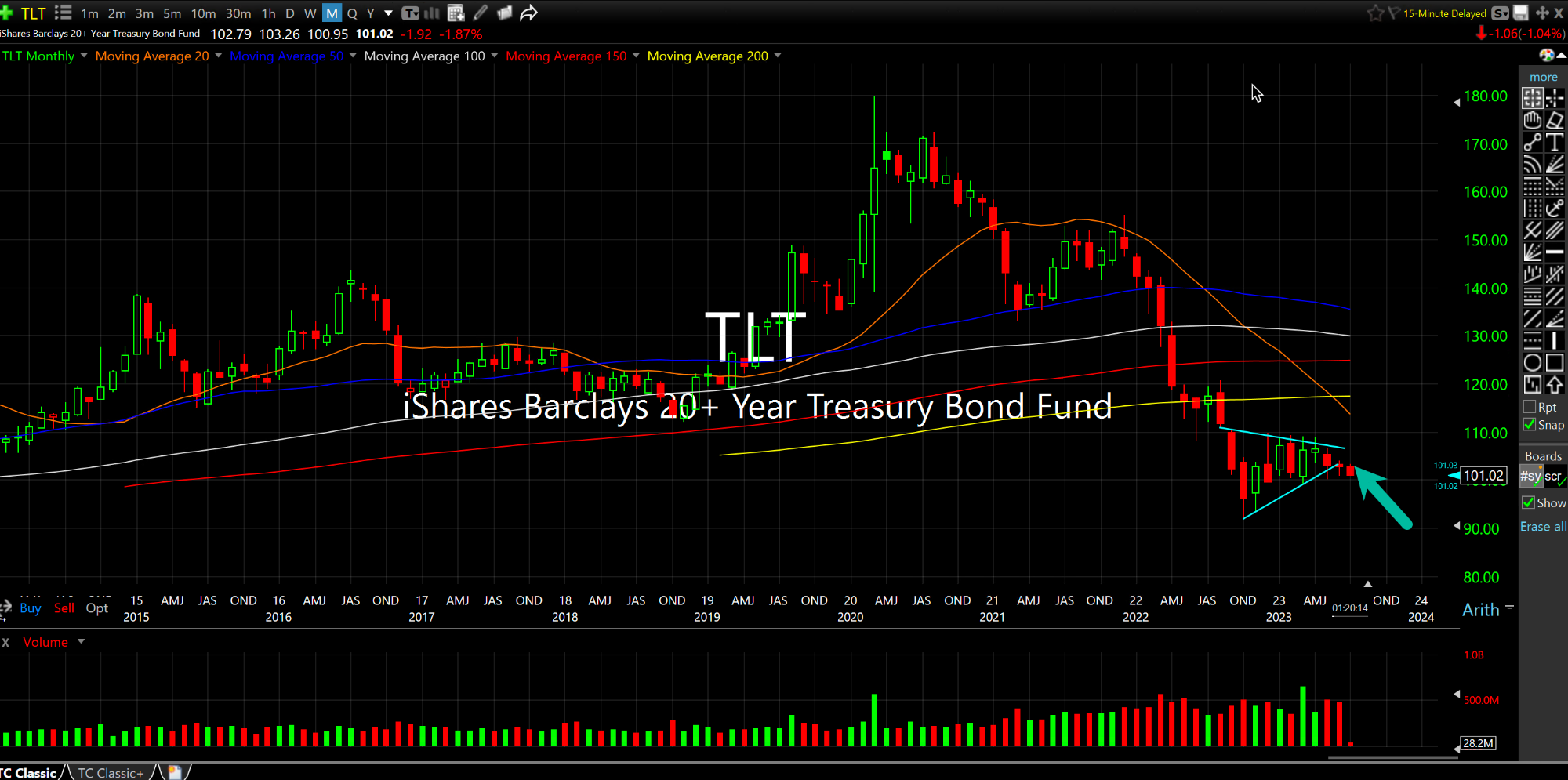

Getting down to the nitty gritty of the price action, gauging the TLT monthly (below), with prices inverse rates on Treasuries, the ominous bear flag could easily be finally breaking down today and into the summer of post-holiday trading.

A bond market crash would spoil many a summer in the Hamptons and Cape Cod, that's for sure.

Stock Market Recap 08/10/17 ... Saturday Night at Market Che...