28Jul1:01 pmEST

Relentless History

The bid in equities certainly seems relentless and is likely historic on many fronts, as we have been noting. As an example, the Bank of Japan yield curve control semi-"tweak" overnight was taken n stride, at least for now. And CNN's Fear & greed Index its till stubbornly in "Extreme Greed" territory.

However, if you have been following along then you know I am far more focused on rates here in America.

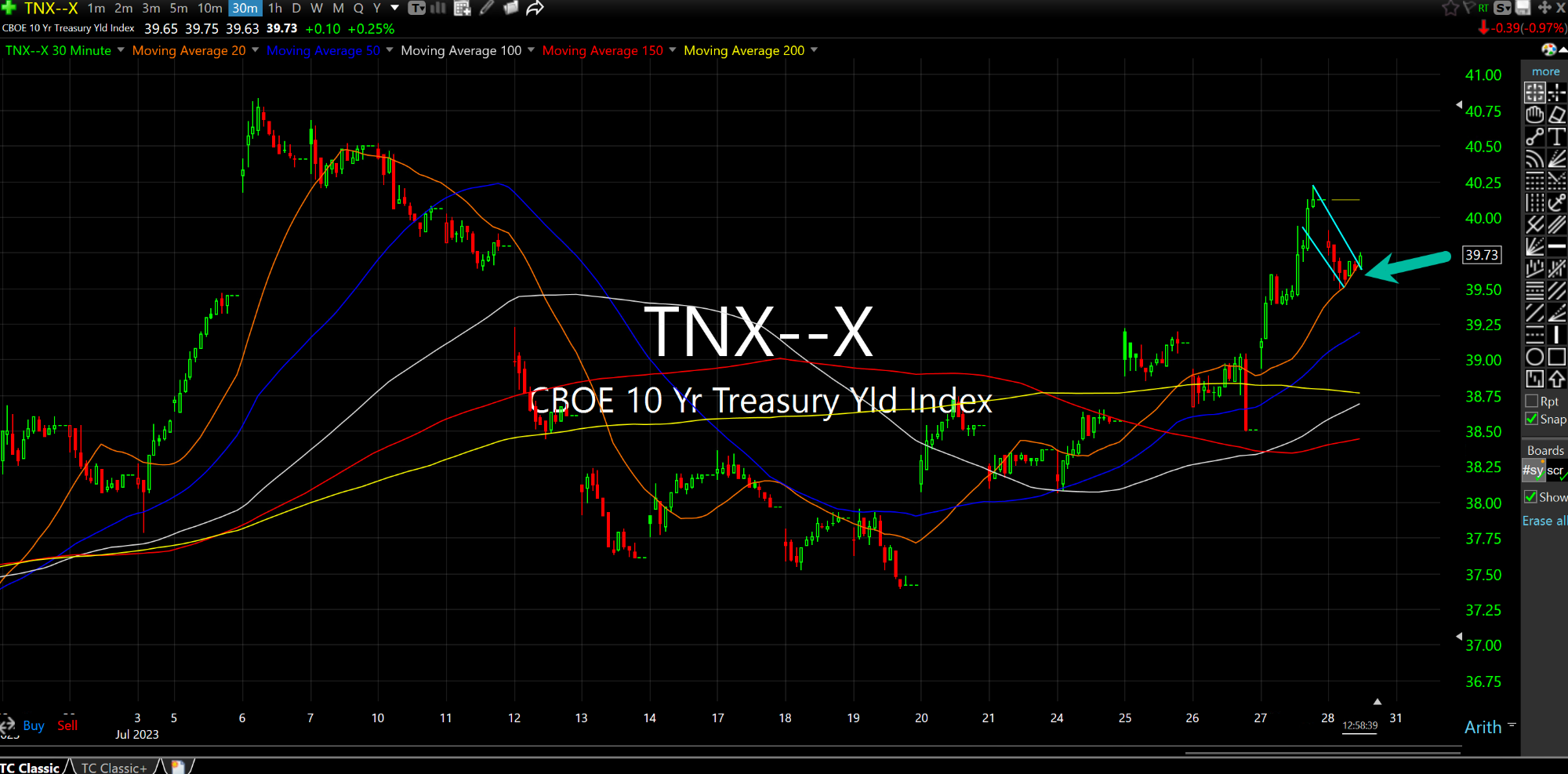

As we head into AAPL AMZN earnings next week, among many others, I care more about whether the TNX (below on the 30-minute timeframe) makes a quick higher low after the week's thrust higher.

So far so good with a bull flag (highlighted), again despite the euphoria with equities which I expect to abate soon enough. Also, as one of our Members noted, the REITs in the IYR are badly lagging today's rally, and they are a rate-sensitive group indeed.

Overall, the market is trying its best to run from higher rates, gas prices, etc.. The critical issue is how much longer they can ride, and then eventually hide.