17Oct11:11 amEST

Not Such Golden Slacks This Time Around

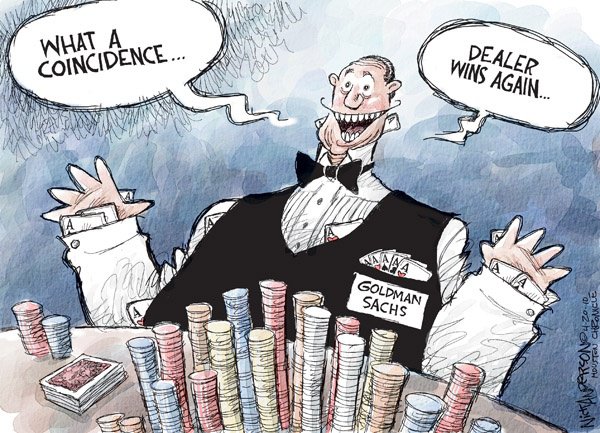

Goldman Sachs (sometimes known as "Golden Slacks," as one its kinder nicknames compared to others) the iconic banking house, reported a top line earnings beat this morning on strong bond trading numbers.

As you can see on the daily chart, however, Goldman is trading lower. More importantly, the overall chart remains bearish and looks much more like an actionable short setup than a long one, given the bear flag in context of an ongoing downtrend.

So in addition to the ongoing divergence of rates spiking higher, corporate credit deteriorating all the while stocks sing the "what, me worry?" tune, a Wall Street icon like GS is not far from multi-year lows and is clearly not signaling bull market action.

That said, the Netflix and Tesla earnings duo tomorrow evening is almost assuredly far more significant to the overall market structure at this point than Goldman. But to cast aside Goldman as no longer relevant seems like a stretch.

And, of course, we have a ton of Fed speakers still to get through this week, including Powell on Thursday,