26Oct12:24 pmEST

Here's the Punchline: The Selling is Still Orderly!

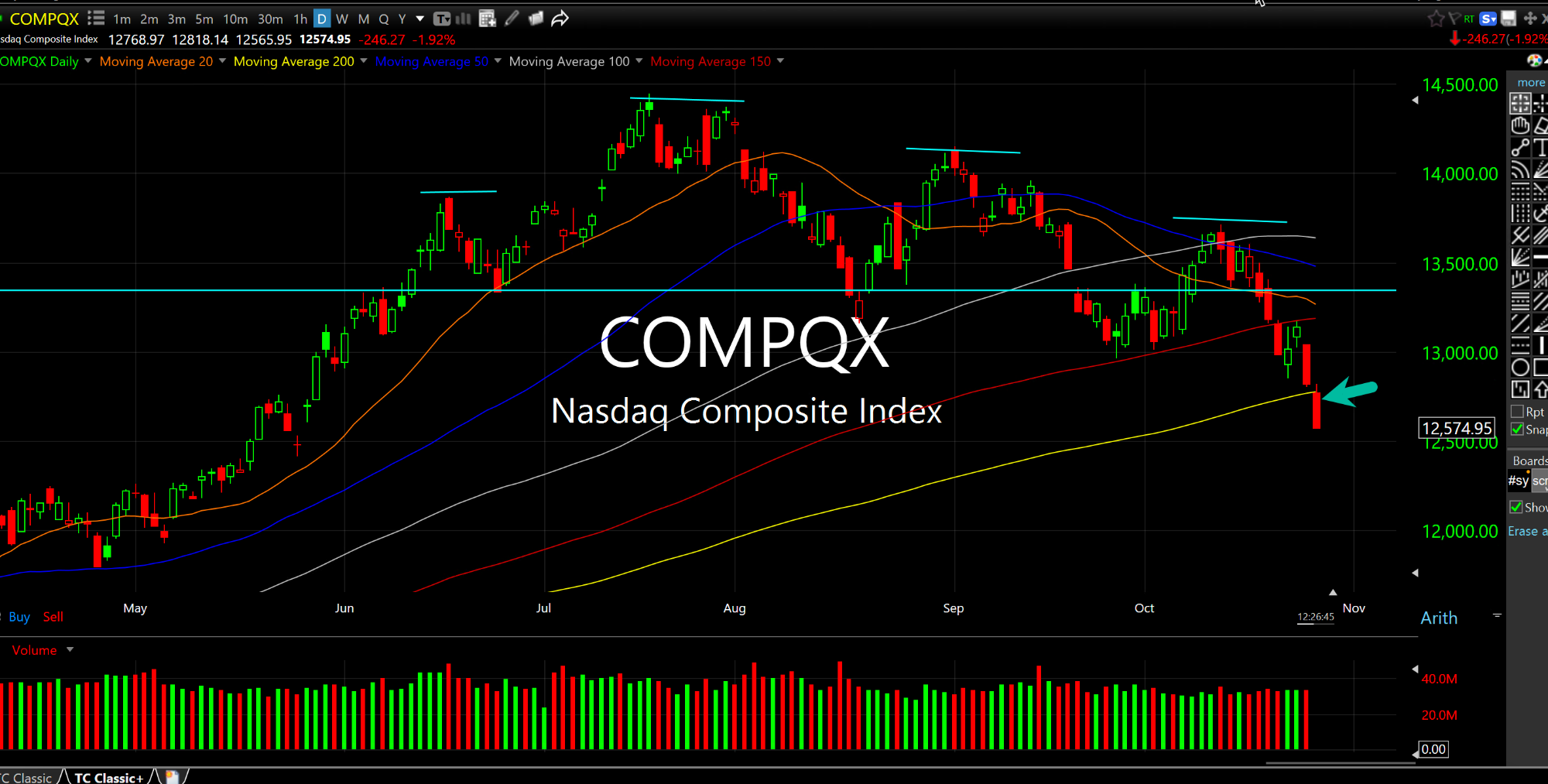

With the Nasdaq Composite Index finally (finally!) losing its 200-day simple moving average today, at least so far, every single stock index is below its 200-day m.a.. This circumstance typically begets more selling, not unlike on the way up the buying led to more buying which is a consequences of system/automated trading strategies.

That said, I would submit to you, as one of our Members noted with the VIX still in the lows 20s, we still have an orderly selloff on our hands. In other words, just because many bulls and dip-buyers have the Pavlovian response to step into every little blip on their screens does not mean this time will oblige with another V-shaped rally to new highs.

In fact, the regime has changed: Sticky high rates (and oil), a roaring U.S. Dollar, and a Fed which has been humbled immensely from the cocky pandemic era trading where they brazenly discussed purposely "letting inflation run hot," just because they could.

Well, I am here to tell you that acts (and omissions) have consequences. I have no sympathy for bulls, money printing central bankers, and anyone else for that matter who sought to write me off this year. My downside targets for the indices remain much, much lower from here. Put another way, the S&P has no business being above 4,000 here, and has not for quite some time.

More than anything else, the substantial risk remains of the selling intensity picking up with actual fear making a long overdue comeback on Wall Street. After all, we clearly have a deteriorating market now where the glaring issues (rates, Dollar) are still not abating like many had predicted. This leaves the pain trade, still, in rates and the Dollar higher and the pain trade in equities much lower.