02Nov2:17 pmEST

Plenty of Hot Tips Out There

Whether it concerns seasonality, the Treasury's recent refunding announcement, The Fed being done hiking, Israeli/Hamas, or anything for that matter we have plenty of hot tips circulating as to why it will all be bullish for markets.

And with equities rallying every single day this week bulls are back to feeling their oats.

All of this is happening as we still have Apple earnings tonight, followed by the non-farm payrolls tomorrow morning. Of course, with the likes of AMD ROKU and SHOP surging off earnings this week you cannot fault bulls for expecting the good times to roll with AAPL tonight. But recall that we are still talking about a multi-trillion market cap name, widely owned and widely loved, which is trading expensively on a forward PE basis amid sticky high rates.

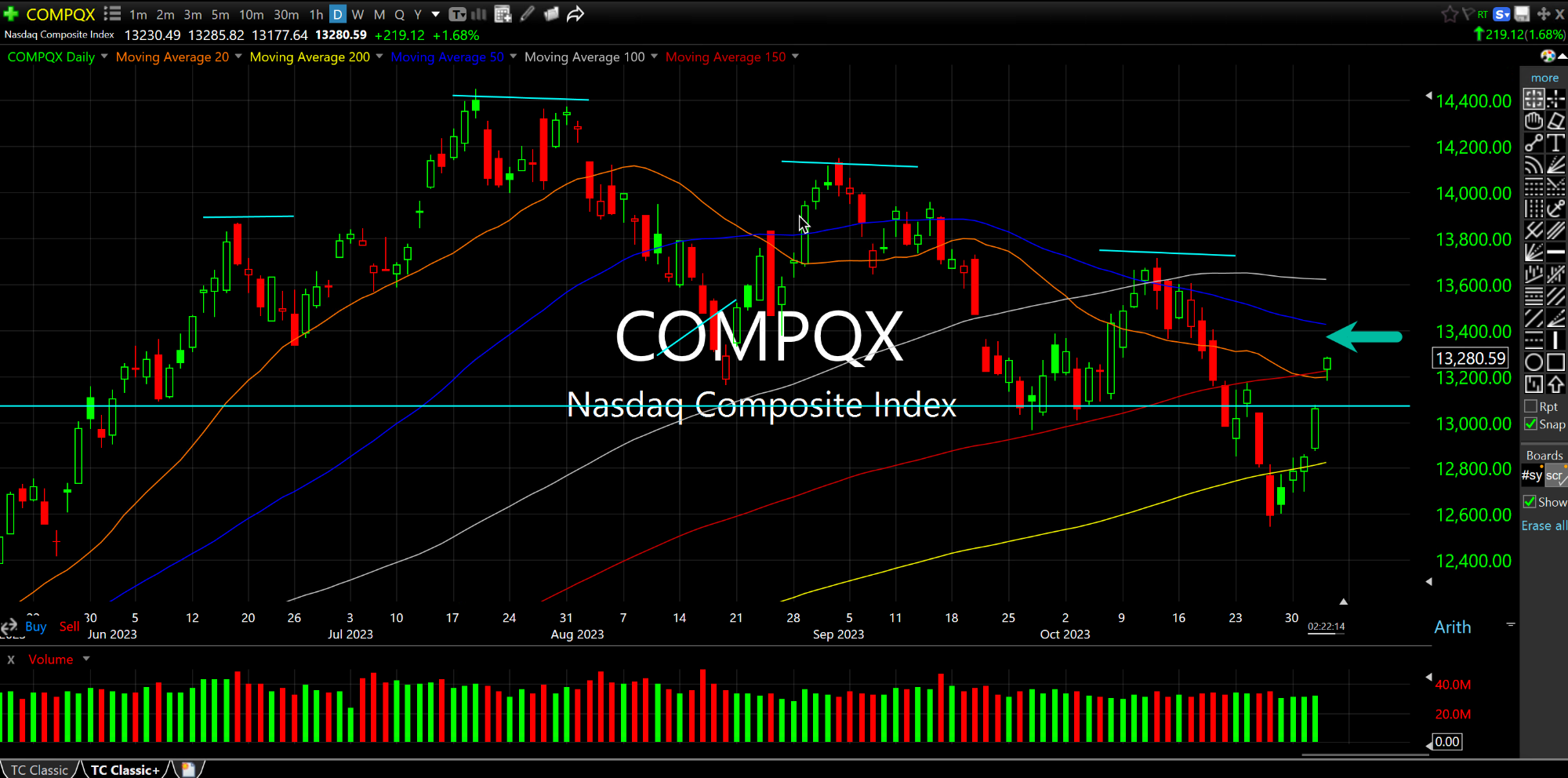

Violent oversold rallies are not the exception in bearish markets--They are the rule and happen frequently as we have seen and are seeing this week. The true test will be if and when the rally fails, as I expect it to, and defies the various hot tips floating around as to why we have bottomed for the year.

You will note, for example, that the Nasdaq is below a declining 50-day moving average. So I remain surprised how many are just assuming a new sustained rally is upon us and a true bottom is in.

One thing is for sure: They bought the heck out of the rumors and news earlier this week. But quite a bit of "news" remains before the week is over.

A Dreary Landing, One Way or... My Vision Differs From Yours