06Nov11:15 amEST

All You Can Eat, Baby

It truly is astonishing just how quickly of a consensus was reached last week, spilling over into the weekend, amongst market players and pundits that a year-end holiday rally is a cinch.

Mind you, as we speak it is only early-November. And, yet, the price action into year end has been declared a can't-miss rally both in stocks and bonds.

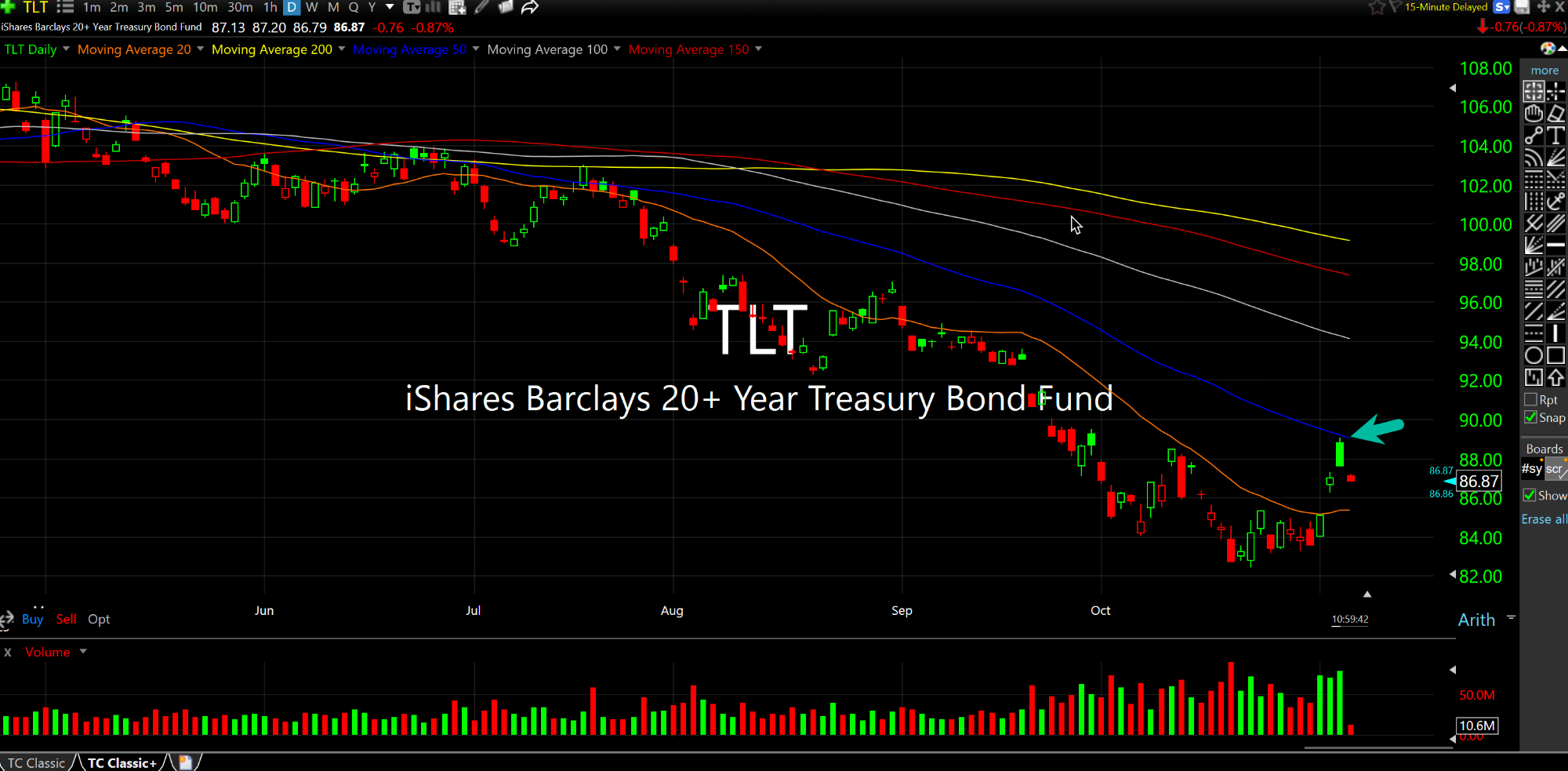

On that note, and you will pardon my ongoing skepticism, you can see TLT showing initial rejection at a declining 50-day moving average as rates are back on the upswing today. Without question, I suspect if the selling in TLT intensifies we could easily see a scramble for the exits from dip-buyers if said "year-end rally" fails to materialize according to the script.

Also note today we have small caps (led nay regional banks and smaller ARKK names) giving back all of Friday's gains and into some gap-fill territories below.

To be sure, it is still extremely early in a week full of Fed speakers and some more prominent earnings like Disney and Twilio. However, if bulls are to get their (now) widely-anticipated all-you-can-eat rally to close out 2023 then rates should probably not immediately bounce back any further than they already have now.