09Nov12:18 pmEST

Waiting to Pull Out the Big Gun

Notable weakness in the biotechnology sector ETFs, IBB and XBI, is spreading to Cathie Wood's ARKK ETF and even the small caps in the IWM at-large, so far today. In addition, the regional banks in the KRE ETF are below the key $42 level as we speak.

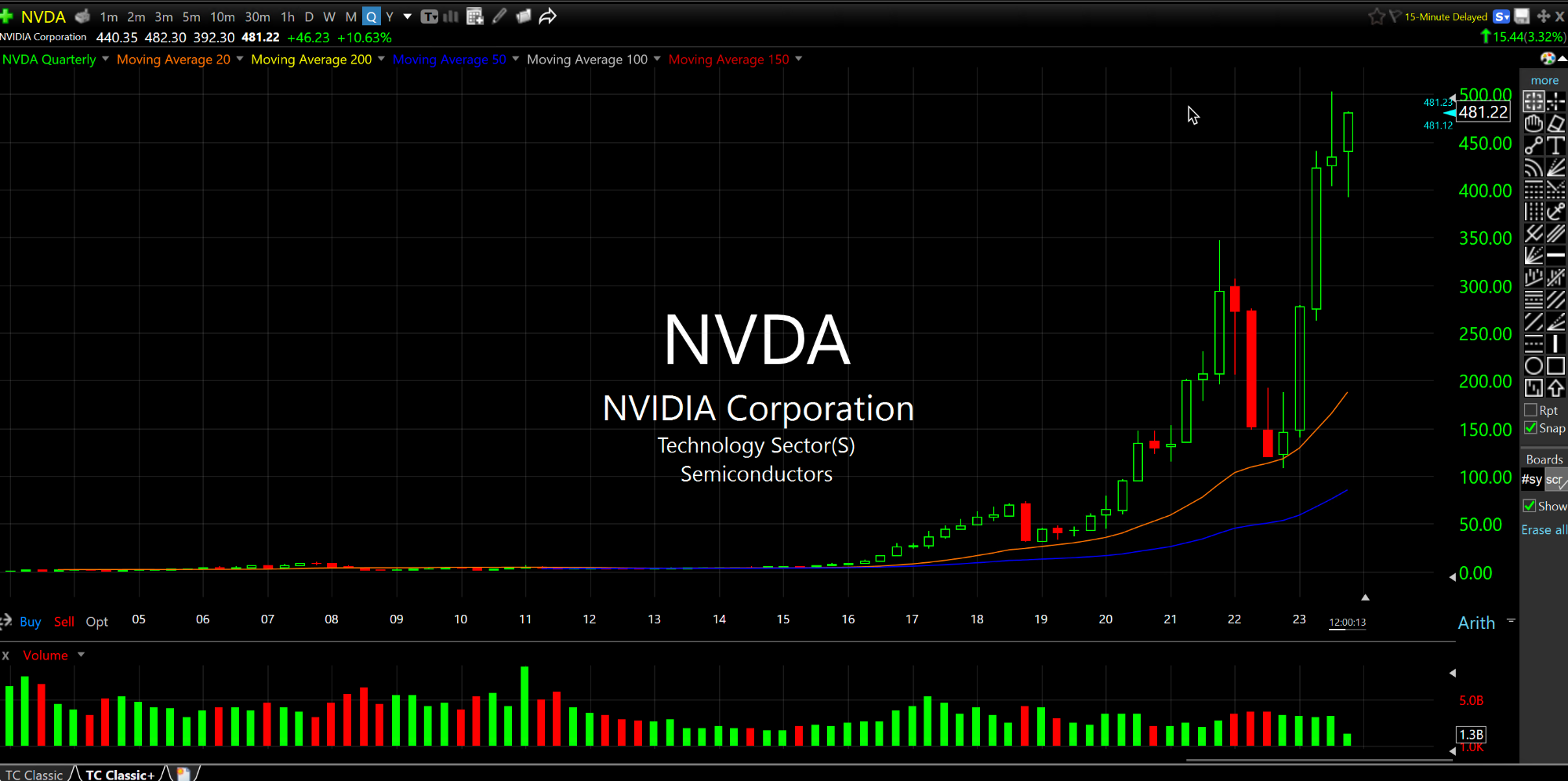

However, that weakness is being offset by persistent strength in the semiconductors, with NVIDIA still leading the way.

On the multi-year chart for NVDA, below, I continue to see a parabola which rhymes with the bubbles throughout world history, be it the South Sea Bubble, Dutch Tulip Mania, John Law and the Mississippi Stock Bubble, etc.. NVDA's next earnings will be two days before Thanksgiving, on November 21st. So, you can be sure that bulls are feeling like they have some room to run into the report.

We do have Powell speaking later today, though he is on a panel and it remains uncertain if he will say anything impactful to markets. Thus, what still matters most if whether bulls can offset the damage in many parts of the market by simply gunning the expensive mega caps higher, once again. In order for me to add more shorts and press hard(er) in various other bear ETFs, I still want to see that moment when the mega caps simply fall under their own weight.

I also keep returning to two issues beyond the technical analysis: 1) Warren Buffett is sitting on a record amount of cash yielding about 5% because he sees virtually no bargains in markets, and 2) 87 out of 100 economists predict The Fed is done hiking for this cycle. Economists notoriously, especially when all on the same side of the boat, commit heinous blunders at critical junctures in the business cycle.

So, I still retain my overall view of being bearish both stocks and bonds.