17Nov2:58 pmEST

Ponder This Over a Drink or Ten This Weekend

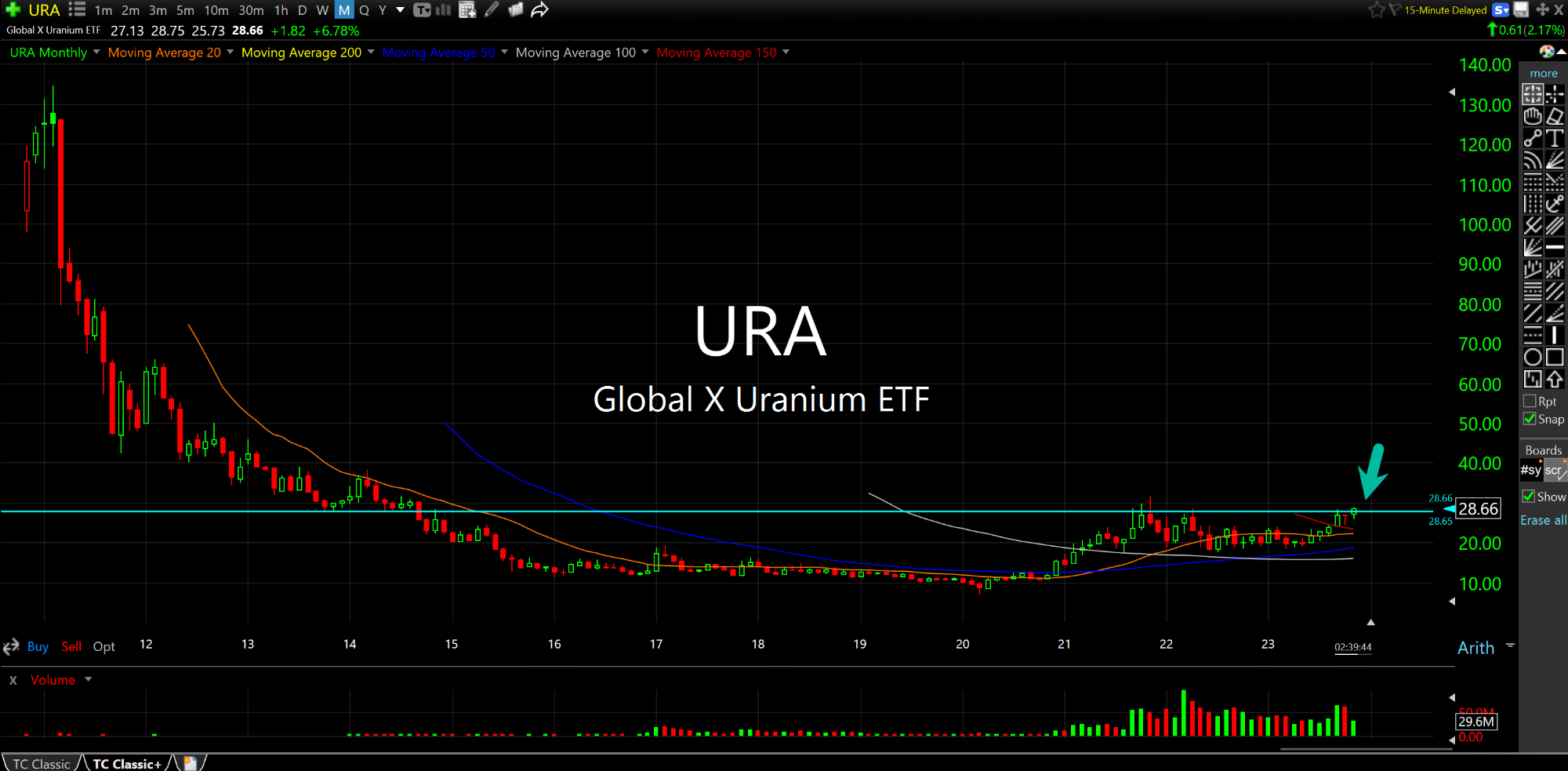

While fund managers chase the likes of Microsoft (with a forward PE of almost 29 and a $2.77 trillion market cap) on a daily basis into year-end, you will note the uranium mining sector ETF (URA, below on the monthly chart) has been in a bear market for over a decade now.

Uranium stocks have been clearly out of favor, with most fund managers likely not even aware of the individual tickers in the sector (e.g. CCJ DNN UEC URG UUUU). The good news for uranium bulls is that the charts have been basing tightly for a while now, and have not made new lows. And the other "good" news is the rising risk of full-blown WWIII coming soon to a history book near you. Also, let us not forget that nuclear power is clean and efficient.

At some point--and I believe soon--the performance chase at all costs into MSFT and other FAANG names will unwind harshly. When it does, it still would not surprise me to see the broad market get hit, what with all of the market cap in those names evaporating.

However, you can be sure I will be watching uranium (and coal) names closely to see if they either avoid the selling altogether or, more likely, immediately find buyers into any swoon in 2024.

Have a good weekend.

Hidden Gems in HACK 06/13/15... Weekend Overview and Analysi...