22Nov12:17 pmEST

Almost Time to Take Youse Guys on Again

Say what you will about equities this year. But the fact of the matter is that I have been very much in tune with the bond market, trimming an overweight TBT long (indeed, which had been my largest position by size, which is basically a bet on higher rates that I had been swinging for virtually all of 2023) last month.

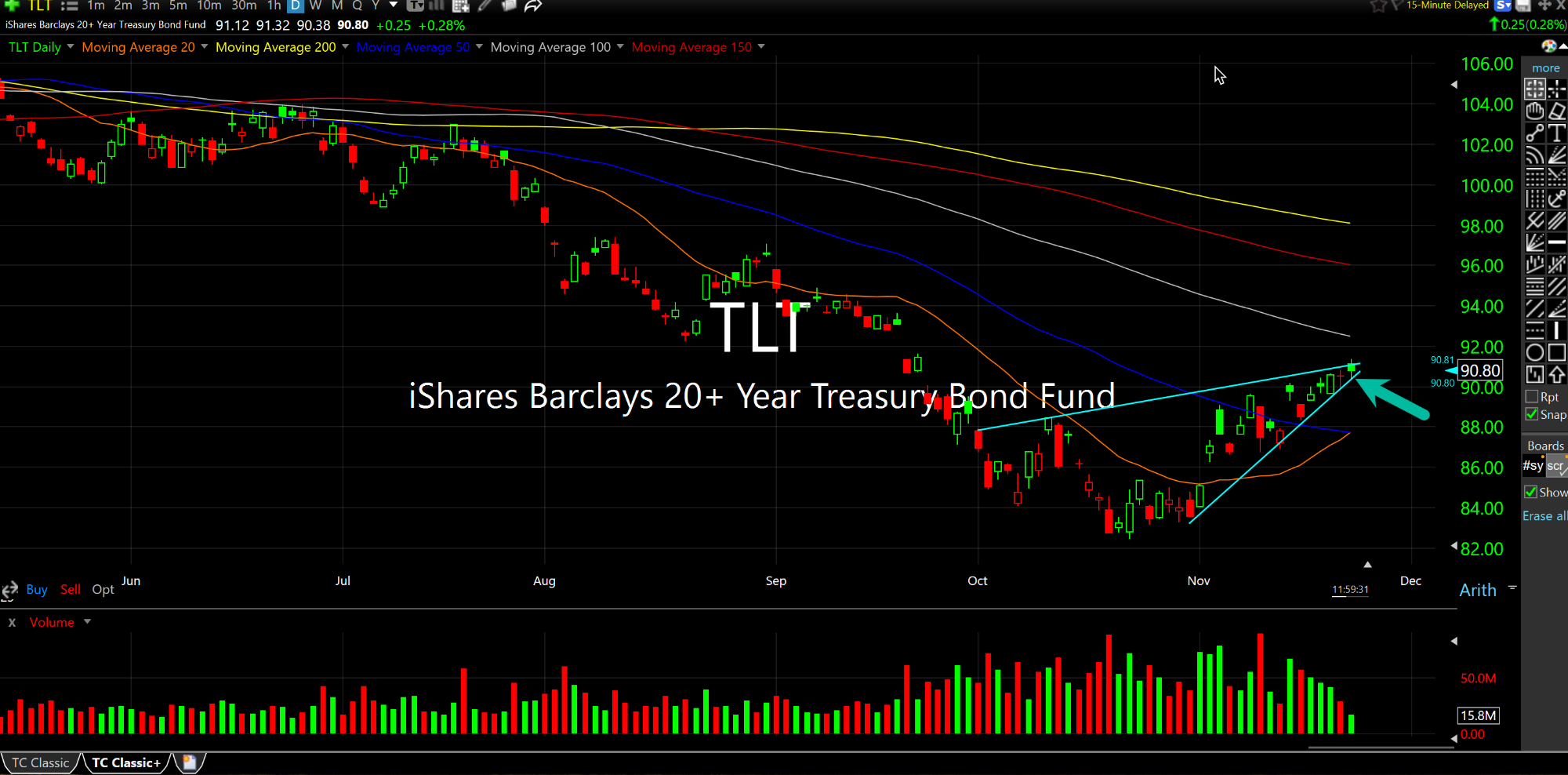

At issue now is whether it is time to add back to TBT to bet on TLT (ETF for Treasury prices, below on the daly chart, which is essentially inverse to rates) rolling back over, since TBT is an ultra-short ETF of TLT.

Once again, I would be in the minority to the many vocal bond bulls who are cocksure rates have topped.

And, once again, I would be willing to be the villain and not care much what the consensus thinks.

Will The Fed really get off so easy this regime? Is inflation really going to go out with a whimper while the economy hums along?

Categorically, no.

TLT, as you can see, is now narrowing to the top of its bearish rising wedge, highlighted below in light blue. A move back below $90 would be a good first step.

True, a 200-day moving average (yellow line) test still may be in the cards by Christmas, which is something we have noted with Members as a reason I have been slow to add back to TBT.

However, headed into 2024 there is nothing wishy-washy about my view. I have boundaries, and I have views. If anything, a 200-day moving average test would only embolden me to add back more aggressively to TBT.

And I do not believe rates have topped out for this cycle, in the least.