30Nov12:08 pmEST

Don't You Hurt My Precious!

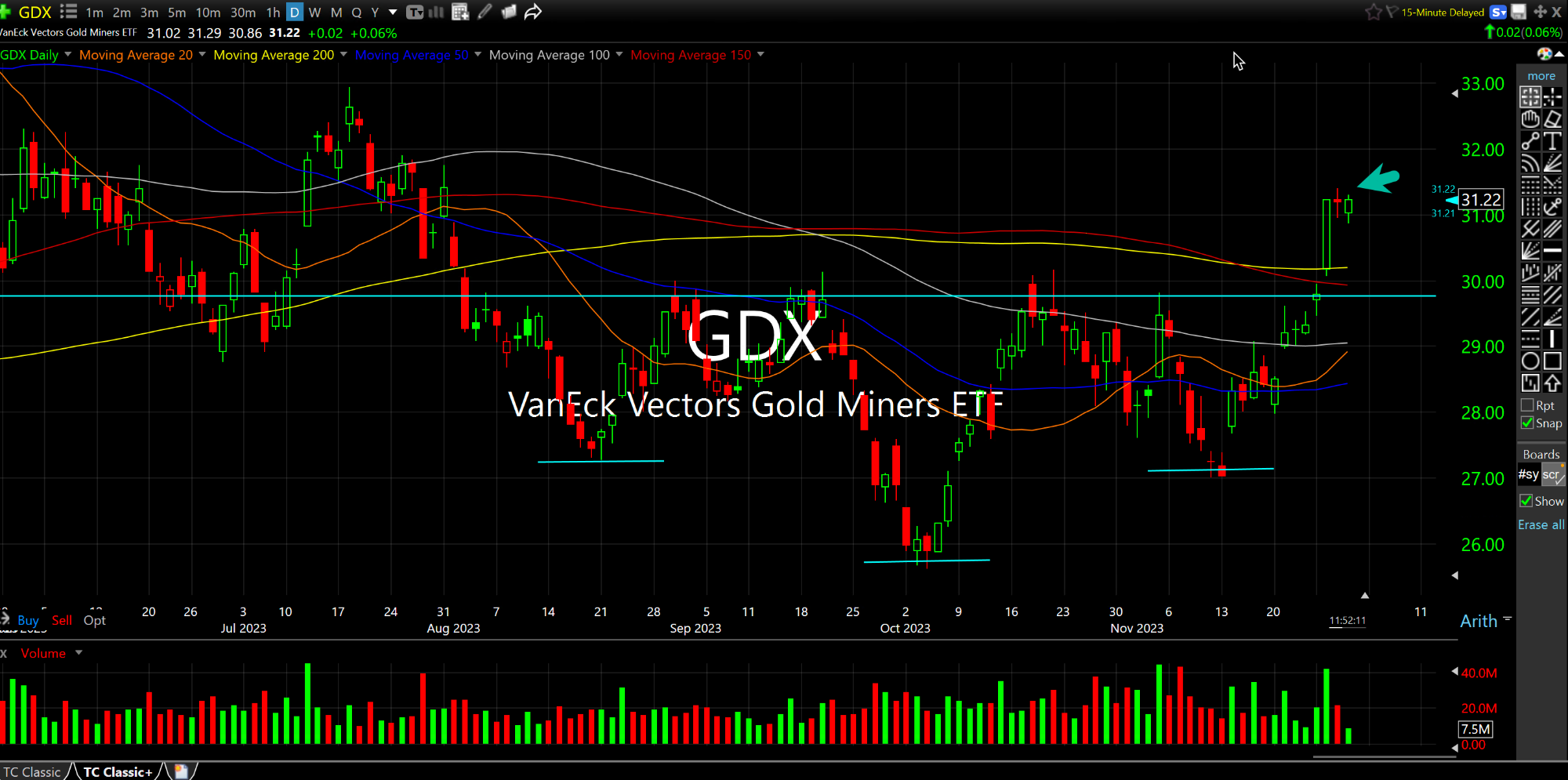

Recall that we are talking about more than three years of sideways-to-down price action in the entire precious mining complex, be it gold, silver, and their derivative miners.

Hence, when we see the sort of strength in the group that we have of late it is only natural to expect yet another trip to heartbreak city. Of course, those who trade natural gas on the long side will know that trip all too well.

But with respect to gold, silver, and their miners, the most objective way to ascertain the veracity of this breakout is to see if the gains are immediately given back (like so many expect, even bulls) or instead of we have the makings of a "lockout" rally.

During a lockout rally, which is often the first leg higher in a new bull run, patient longs are never really given the proper entry they desire, and shorts gaming an "inevitable" rug-pull begin to trap themselves as we squeeze higher and higher with no real giveback beyond 1-3%.

So far, and admittedly it is early, we have seen just that scenario play out on the miners breaking out, with GDX not giving back much of anything.

Going forward, as The Fed toys with rate cuts and seems adamant about pausing the rate hikes, if the gold market sniffs out a scenario where The Fed has to eat its words (again) and loses more credibility in 2024, then that certainly would be the case for gold to stage an exhilarating move higher from here--Much, much higher after a multi-year breakout above $2000/ounce on gold futures.

First things first, however, as the longer GDX holds above $30 without harshly testing it again, the better for gold bugs.

Holiday Season Buyback Panac... Coal and Other Goodies in Yo...