04Dec12:54 pmEST

Genco Grows Up to Be a Strong Man

Just when everyone forgot about the baby shippers, heres comes Genco Shipping, GNK, (and Eagle Bulk Shipping, EGLE), surging above their respective 200-day simple moving averages (yellow line on daily GNK chart, below).

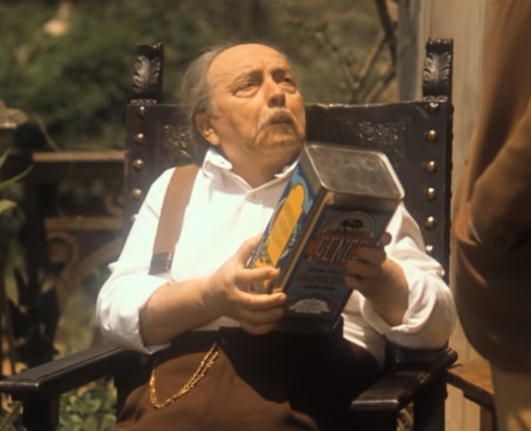

What we want to see now is a few days of consolidation, starting with today's dip, which does not breach the 200-day below. Ideally, Genco (not to be confused with the olive oil brand in The Godfather Part II.) holds above $15.50 on a daily closing basis to form a bull flag into mid-week.

With turmoil around the world, shippers may be a case of demand being "pulled forward," in terms of orders being placed now in fear of the nebulous future. Similar comments apply to steels and materials plays like CLF.

That said, the niche, non-oil commodity pockets of strength persists, with shippers benefitting now--At least EGLE GNK are.

Elsewhere, with the crypto bonanza keep an eye on the components in the BLOK ETF. RBLX has some exposure there and is sporting a coiled chart.

Weekend Overview and Analysi... The Big Picture is Still The...