15Dec1:56 pmEST

Watch Your Back, Even During the Holidays

The next official sustained period of seasonal weakness is not until late-January/February. However, into the market melt-up it is likely worth noting sectors which have squeezed back up to what should be difficult levels on a long-term basis.

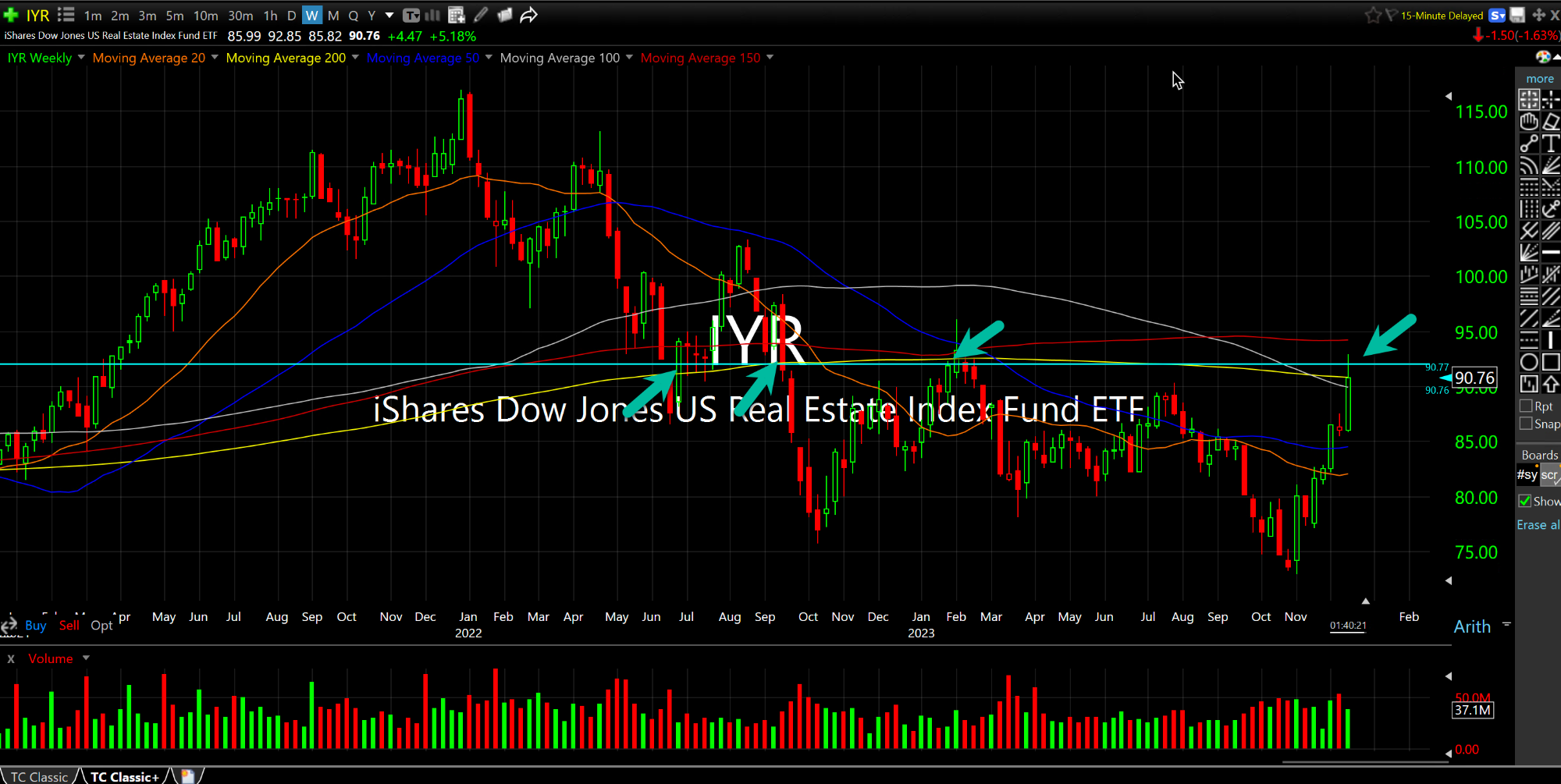

The commercial real estate stocks in the IYR ETF, below on the weekly timeframe, represent one such case.

As you can see, the IYR is back up to its 200-period weekly moving average (yellow line), around the $90 level, which has been a tough area dating back at least eighteen months.

And given the consensus now of a soft landing and lower rates coming, a bearish entry into IYR looking out to 2024 (perhaps via long-dated puts) seems like a brewing contrarian angle. After all, if rates surprise back higher this rally will almost assuredly have been made under false pretenses.

But more importantly, it would align with the long-term technical picture of a sharp rally directly up to a prior difficult level, especially during a time of year with weaker than average volume to support said rally.

There is Beauty in That Deca... Complacency Before the Storm...