20Dec1:21 pmEST

Quite the Picture

Freeport-McMoran, the domestic (Arizona-based) molybdenum producer with tons of copper and gold exposure, too, used to be one of the most prominent stocks in the entire market about thirteen-fifteen years ago.

Back then, we had some ephemeral inflation head-fakes, where folks keyed off FCX for inflationary tells during its exhilarating run-ups before ultimately crashing with just about everything else.

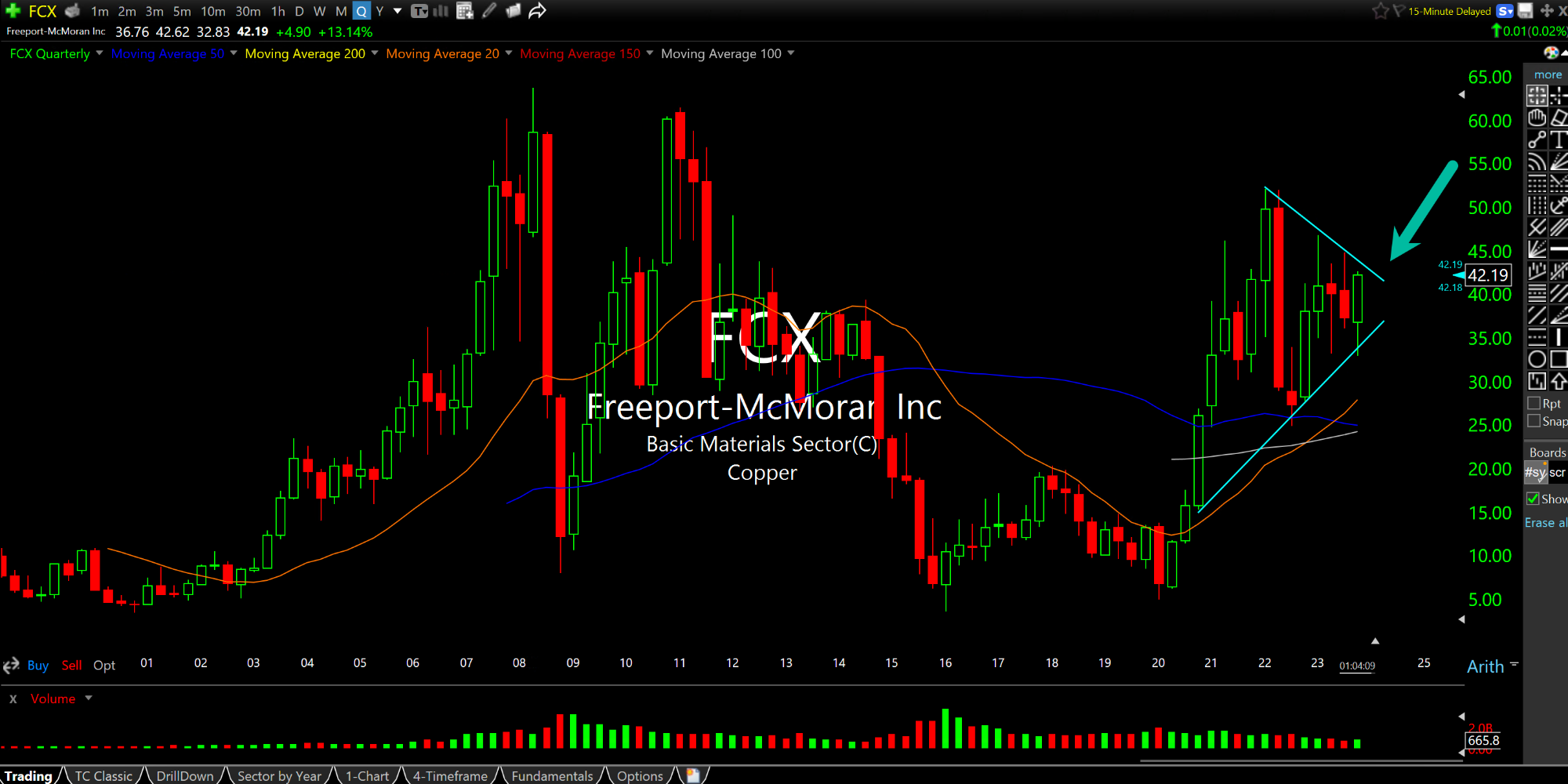

After spending most of last decade lurking in the shadows of Wall Street (and even with commodities at-large), we now have FCX forming a quarterly chart bull pennant consolidation, seen below.

Unlike the prior rallies and swoons from 2007-2011, this move seems like it is building up energy to uncoil higher.

Should FCX do just that, it would confirm the inflationary view that The Fed is making a terrible blunder by pausing its rate hikes and allowing the market to price in multiple rate cuts for next year. In other words, they may be giving commodities the green light to go ballistic to the upside, and Freeport ought to be right in the thick of things given its various important commodity exposure.

Watch for a push over $45, then $50 to confirm a long-term breakout into 2024.

In addition, The Fed's mouthpiece is leaking a story today that Powell is genuinely surprised at the market's reaction to the recent FOMC. Powell can clutch his pearls all he wants, but unless he toughens up and pushes back against the market I still believe the pain trade in 2024 is rates and commodities both sharply higher.

Extremely Rare, Extremely Pr... Let's Just Chalk it Up to Cu...