12Jan1:33 pmEST

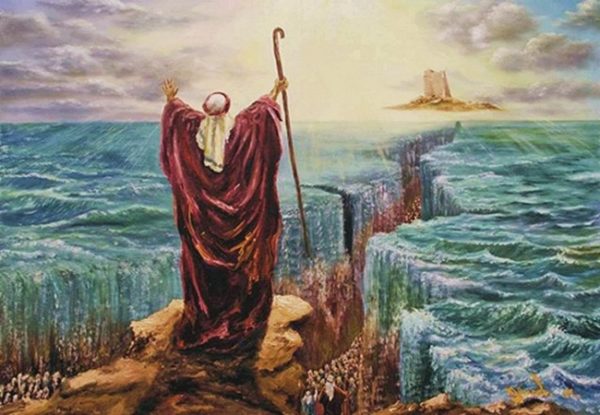

Partying of the Red Sea

It may not be as biblical as the "parting of the Red Sea" by Moses, but some stocks are certainly partying due to the Red Sea tensions escalating today.

Specifically with the U.S./British militaries striking back against Iran-backed Yemen amid Red Sea tensions, we have uranium, oil tanker, and gold miner stocks out in front of a sluggish tape. Small caps continue to lag in general. However, dip-buyers in mega cap monsters like GOOGL META MSFT NFLX, even COST, refuse to quit. All of this despite a name like Tesla clearly lagging and quietly breaking down below $220 support as we speak.

In all likelihood, after the upcoming three-day weekend (markets are closed on Monday for MLK Day), the unfolding of earnings season leading up to the January 31st FOMC will dictate if dip-buyers can keep stepping in with little in the way of fear.

For now, tankers like FRO TK, and uranium plays URG UUUU look the most actionable, as well as GDX back over $30.

With seasonality turning more bearish next week, the long-awaited reckoning for dip-buyers may finally come. Until then, the hot news-related sectors are in play, and were already set-up well technically (not just pure news-related pops).

Rate Cuts?! Rate Cuts?! I Ju... Holiday Overview and Analysi...