16Jan11:13 amEST

Soft Landings Are for Loch Ness Monster Believers

My highest conviction view for 2024 remains that the now much-ballyhooed economic "soft landing" is in fact a mirage in the middle of the vast desert created by troubled monetary and fiscal policies coming home to roost, finally, after decades of can-kicking.

While The Fed achieving that elusive soft landing, meaning inflation cools off satisfactorily all the while we avoid a deep recession, became the consensus view headed into this year, or pretty darn close to consensus, I maintain that if rates do, perchance, head substantially lower and we see Fed rate cuts it will only be against the backdrop of equities cratering lower and a deep recession.

In other words, it is a classic case of one being careful wishing for something, lest they actually receive it.

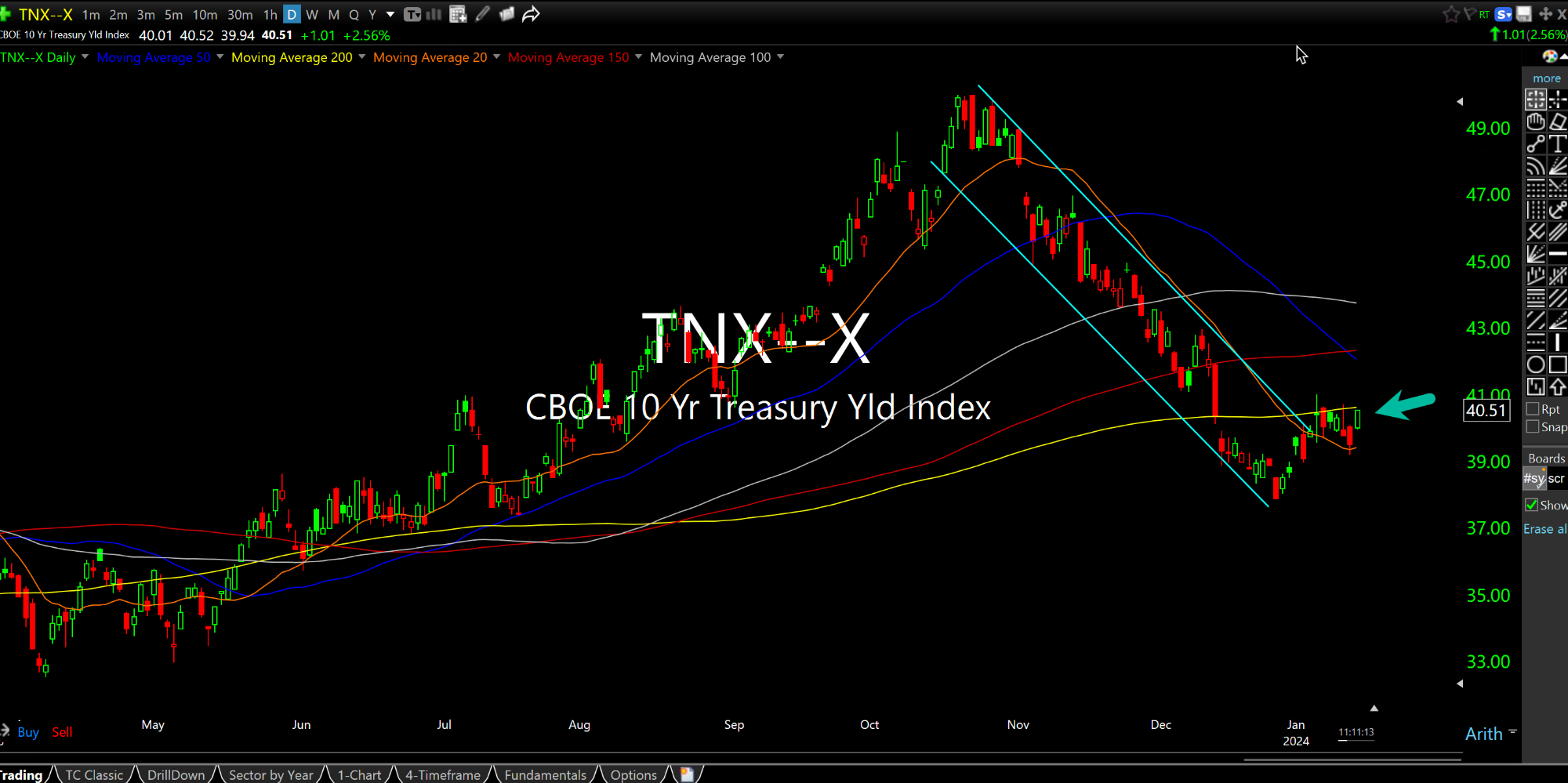

On the other side of the coin, I still maintain that rates could easily head higher--And I am positioned for that outcome with Members. The pain trade in rates is likely seeing 10-Year head above 5% (which is roughly 50 on the daily chart for TNX, below, which is an Index for rates on the 10-Year Note).

As you can see, rates on the 10-Year have been basing sideways since the beginning of 2024. The next directional move will be pivotal, to say the least, with the FOMC on January 31st as a known risk event.

As for equities this morning, we finally have seasonality turning bearish starting this week. Even bears are pretty much expecting dip-buyers to show up, however, which makes for an intriguing setup to short if the soft landing crowd finally runs into trouble...for a change.

Holiday Overview and Analysi... Sorting Through Winter Battl...