18Jan2:15 pmEST

Not Buying the AI Decadence

AMD reports earnings on January 29th, while NVDA reports out in February 28th. While I fully acknowledge the variance that earnings reports carry, I also view the action in AMD, especially, to be symptomatic of an "echo bubble" in chips based on the AI craze. We have seen as much in NVDA for a good while now.

But AMD recently has gone bananas to the upside, including this morning's sharp move higher which faded into the afternoon, pending today's close of course.

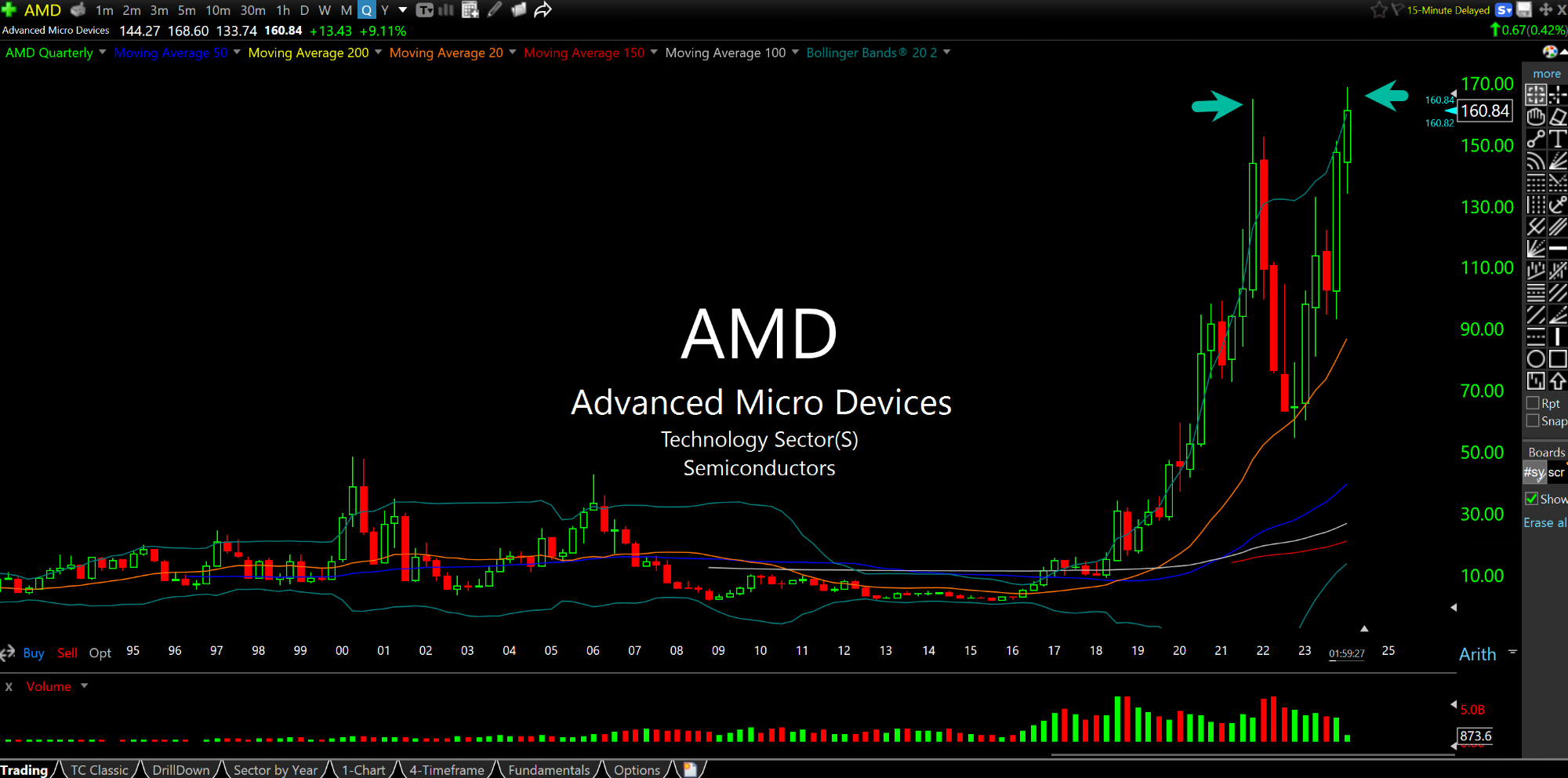

On the AMD quarterly chart, below, we can see the Q1 2024 candle, still young of course, punching up through the upper Bollinger Band and fading a bit, not unlike the Q4 2021 reversal candle, which led to large drawdown into 2022.

Now, here is where the disagreement is: Bulls view the AI theme as catapulting chips in a new bull market, while I view the AI craze as part of an echo bubble from the pandemic-era rally, basically a last gasp of the bull since 2009 which is in its final days. Without question, this has been a uniquely long, drawn out affair and likely will be remembered in history as an epic speculative bubble. History teaches us that epic bubbles lead to even more epic drawdowns. And I do not believe 2022 was sufficiently, at all, to erase the excesses from the system.

As a result, I am on close watch for AMD, NVDA, and the chips at-large to burn out in the coming weeks--It could be something as simple as Powell holding off on rate cut language at the January 31st FOMC to prick the bubble.

Elsewhere, TSLA and biotechs in the XBI are notable laggards today as the indices try to ignore rates pushing higher.

Sorting Through Winter Battl... Too Much Money Chasing After...