26Jan12:16 pmEST

All of a Sudden, Intel Matters Again

We are seeing the first real chink in the armor for the red-hot semiconductors today, as Intel and KLAC lead the selloff lower.

Next week will see a ton of monster leaders reporting earnings, headlined by AAPL the same day as the FOMC on Wednesday. So, you can be sure tons of event risk is ahead of us. Of course, given this market's recent history, bulls are noting that any lack of a real downside shock will see yet another squeeze higher. Whichever bias you have, however, there is no denying that next week is filled with tons of significant micro and macro events.

For now, Intel is suddenly relevant again. For a while there it seemed like INTC had been deemed too old, so to speak, to matter much in a sector filled with hot, young things.

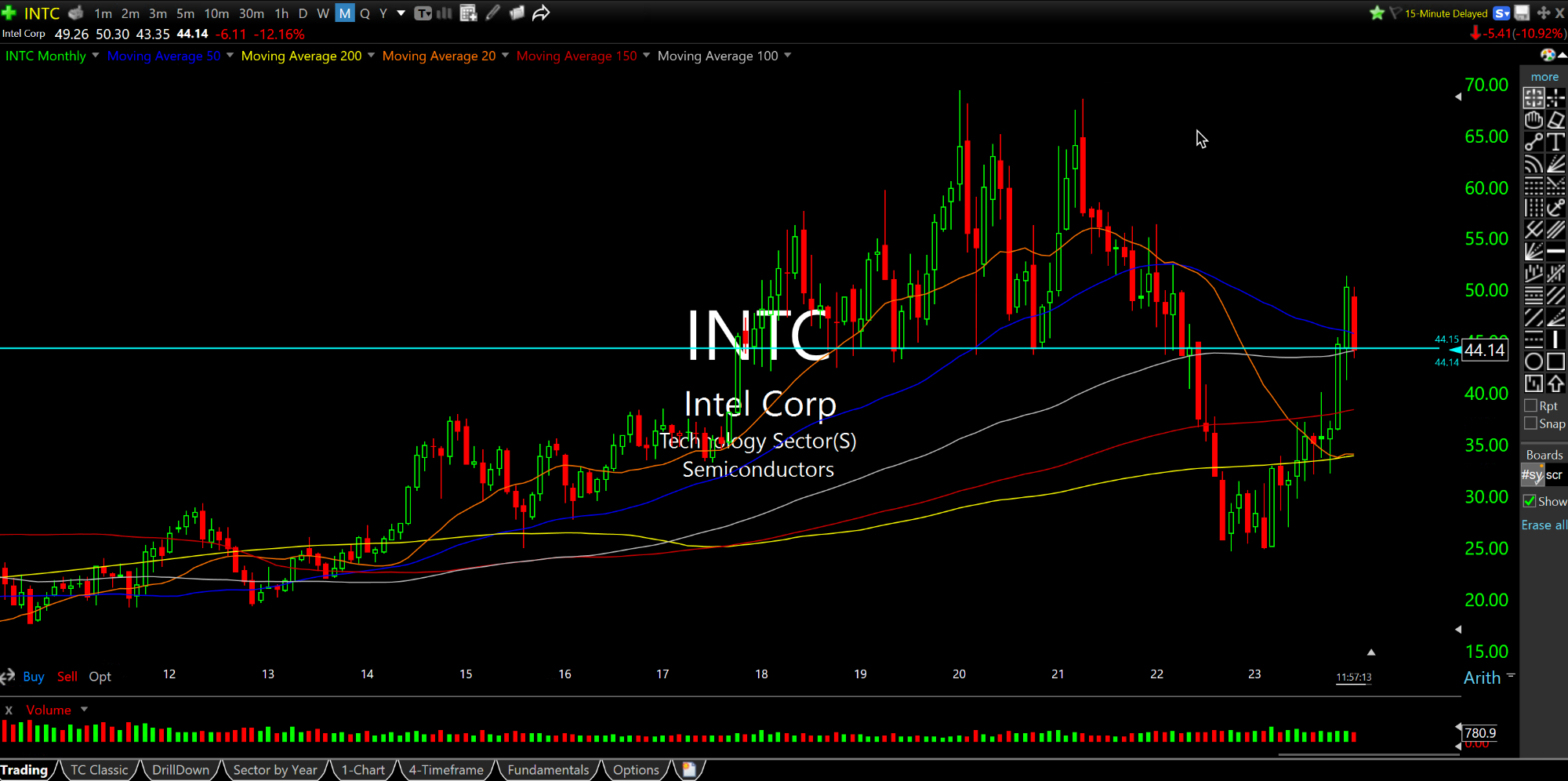

But the INTC move, down nearly 11% as I write this, seems to be holding more water than some may have expected. On the Intel monthly chart, below, note the overshoot of $45, up to $50, saw the stock finding resistance at a prior key, tough area.

What this means, perhaps, is that the NVDA ebullience may have been overdone (to say the least). And Intel may be telling the true story for the sector at-large insofar as the AI hype.

Even with today's down move, for example, the SMH ETF is still about 7% above its 20-day moving average, short-term reference point.

So while next week may be just another bunch of risk events to squeeze shorts and volatility longs, if it goes the other way there is certainly plenty of room to drop in the semis...despite bulls' blind spots to it.