29Jan12:27 pmEST

Emerging Markets: The Ultimate Mirage?

Over the weekend I saw some data that flows into emerging markets reached the highest level in quite some time, as investors likely see bargains relative to America in the likes of China. However, that has been a sexy thesis for a while now, one which never seemed to pan out as China stocks grew weaker and weaker, defying even the late, great Charlie Munger.

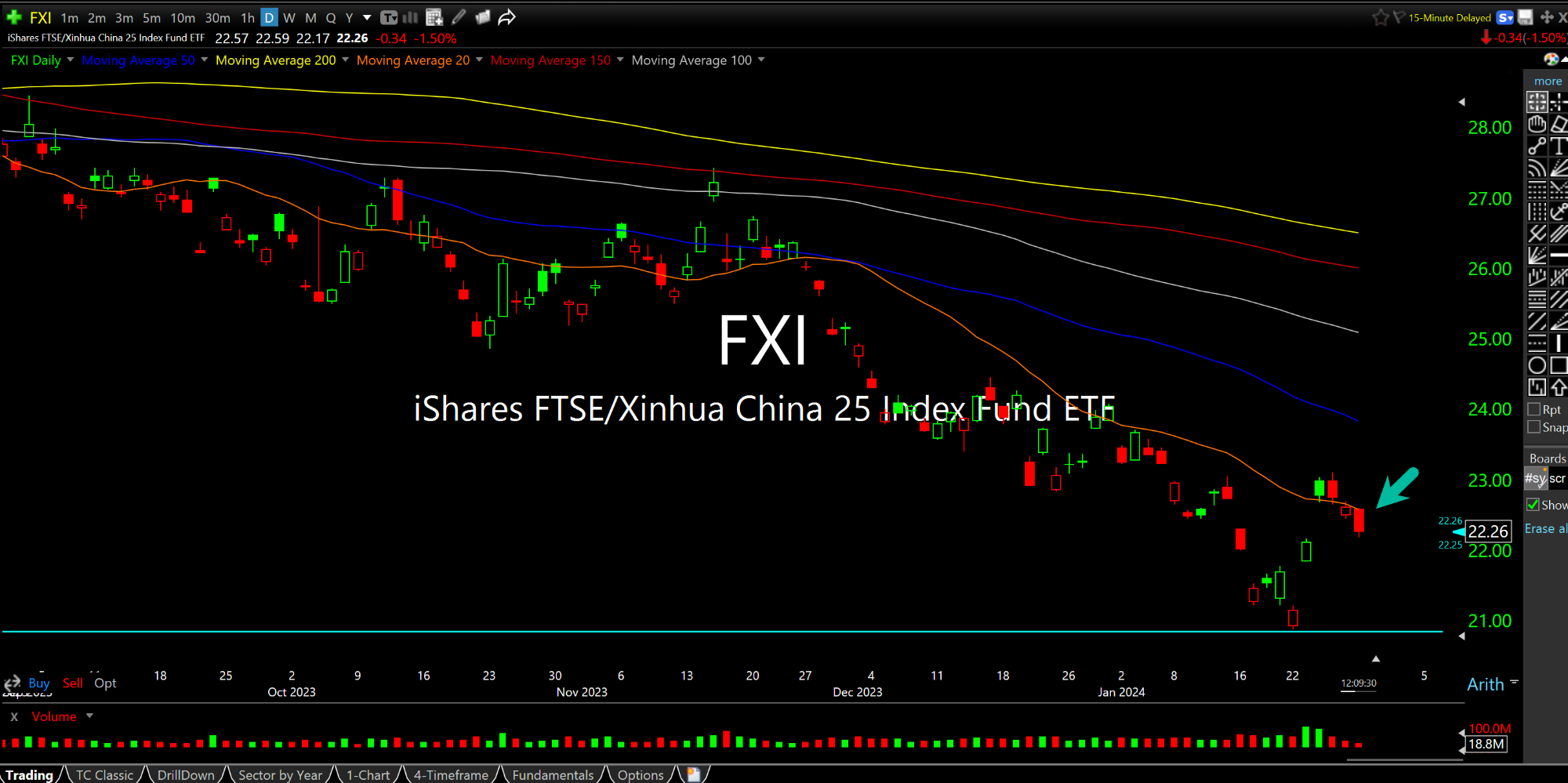

On the FXI daily chart, below, which is the ETF for China stocks at-large, we can see a clear and strong technical downtrend.

The recent bounce up to the 20-day simple moving average (arrow) came as price tried to find support at multi-decade prior key levels (bottom light blue line). As you can see, China stocks are lagging today and at risk of rolling back over.

So can it really be that easy for the recent inflows? Is it truly that easy to time the exact bottom in China stocks? As you might imagine, I beg to differ.

One thing is for sure: The classic bifurcation between multi-decade lows in China stocks versus all-time highs for some of the senior indices in America is historically pronounced. Typically, this level of bifurcation (well beyond the real of mere winners versus losers in markets) does not resolve with the laggard (China) catching up to the winners in America, but rather the other way around, if you gauge history.

YANG is a liquid China bear ETF we noted for Members over the weekend, and that looks to still be in play.

Weekend Overview and Analysi... Time for Chips to Finally So...