02Feb11:13 amEST

Chasing One's Tail for Tail Risk

Nasdaq bulls can try all they want to "front-run rate cuts and a restart of QE."

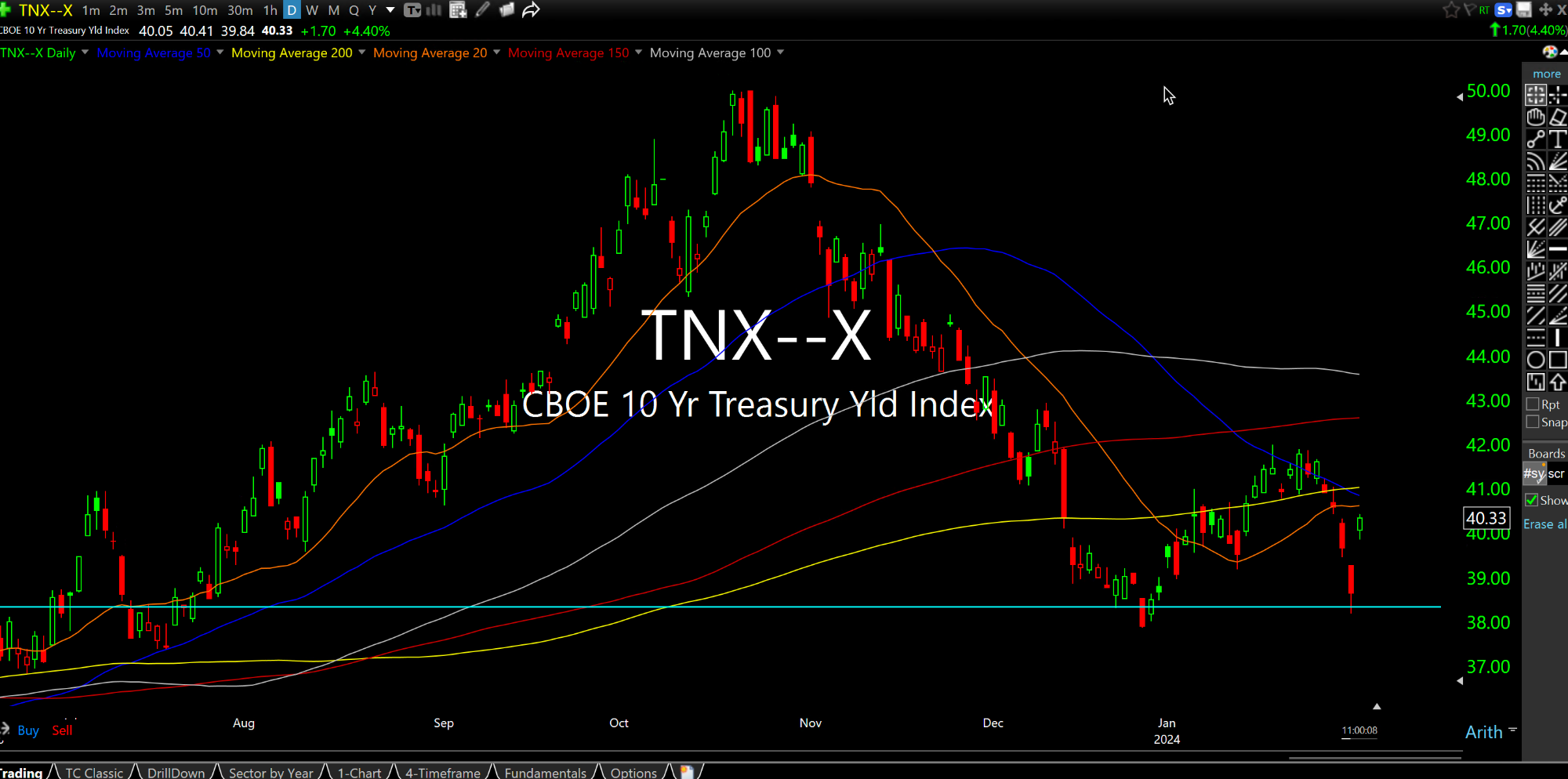

However, as we saw this week rates may temporarily head lower, but they do not want to stay down for very long. Case in point: After a strong jobs report this morning we have rates on the 10-Year Note (below on the TNX Index daily chart) back over 4% as I write this.

The simple fact is that the more Nasdaq bulls try to front-run rate cuts and QE, the more unlikely it is we get them, making the entire situation absurd.

But, then again, this is the Pavlovian response that The Fed has created, not just with Powell but actually dating back to Greenspan and especially Ben Bernanke. In other words, folks are so overzealous about front-running the inevitable next Fed easing that they want to bypass the crisis entirely--And yet it is the crisis which is most likely to get us to rate cuts and QE.

So what about a "soft landing," where The Fed can cut without a crisis as inflation eases? History, once again, says it is highly unlikely we get a soft landing. Moreover, the strong jobs report this morning throws cold water on the inflation easing rapidly view, as do rates moving quickly back over 4%.

I continue to be flabbergasted at how many financial pros truly believe that trillions of dollars in easing, coupled with ultra low artificial rates since 2008 generated inflation which quickly abates in a year or two after the pandemic. Is it really that simple? Not likely.

I still view the pain trade in rates and inflation as much higher from here, with the tech growth bulls basing their models off a world which no longer exists.