13Feb12:33 pmEST

We're Just Sweeping Dirty Dishes Under the Rug

It almost seems as though the market, and indeed many pundits, are still reeling from hot CPI print this morning. In other words, I seriously doubt we have seen the full brunt of the fallout from the notion that inflation is back on the upswing.

Hence, imminent rate cuts are almost assuredly off the table, even for this Fed. And that is especially the case if this gap up multi-month breakout on rates for the 10-Year Note above 4.2% holds.

While I fully understand this is an election year, complete with tons of explicit and implicit political pressure to cut rates, the truth of the matter is that inflation is a top issue for most voters this cycle. The Fed must, inevitably, choose which side they will fight more decisively and cast aside the pie-in-the-sky soft landing hopes, lest they permit inflation to run free to the upside and rates head back over 5% on the 10-Year.

As for equities, bulls are back in NVDA and SMCI to try to keep the game going. Once again, I suspect the full weight of today's report has not been realized by some market players who will be left holding the bag, soon enough.

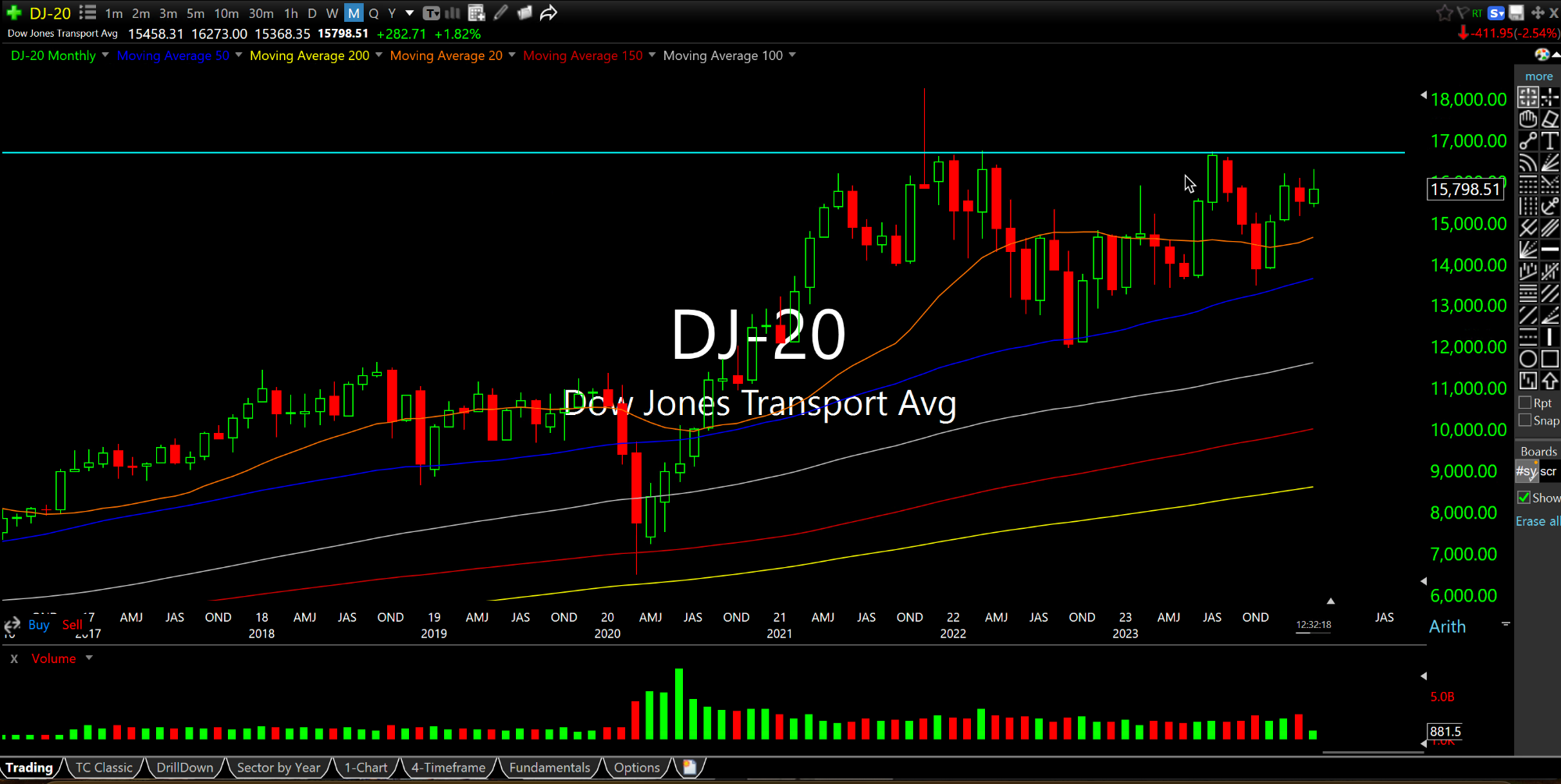

Finally, note the lingering bearish divergence between the transports (below on the monthly chart) versus the Dow Jones Industrials--The transports never made a new high this year. And now we have cruise liners weak alongside FDX and UPS, especially. I am sure bulls will counter that Amazon is eating their (FDX UPS) lunch, and that Dow Theory is now obsolete.

But how many dirty dishes are we supposed to keep sweeping under the rug, Edith?