26Feb11:54 amEST

Two Tickers Fogging Up a Resilient Market

With GDP, PCE, a plethora of Fed speakers, plus increasing buzz about a government shutdown this week, the broad market is still resilient albeit mixed.

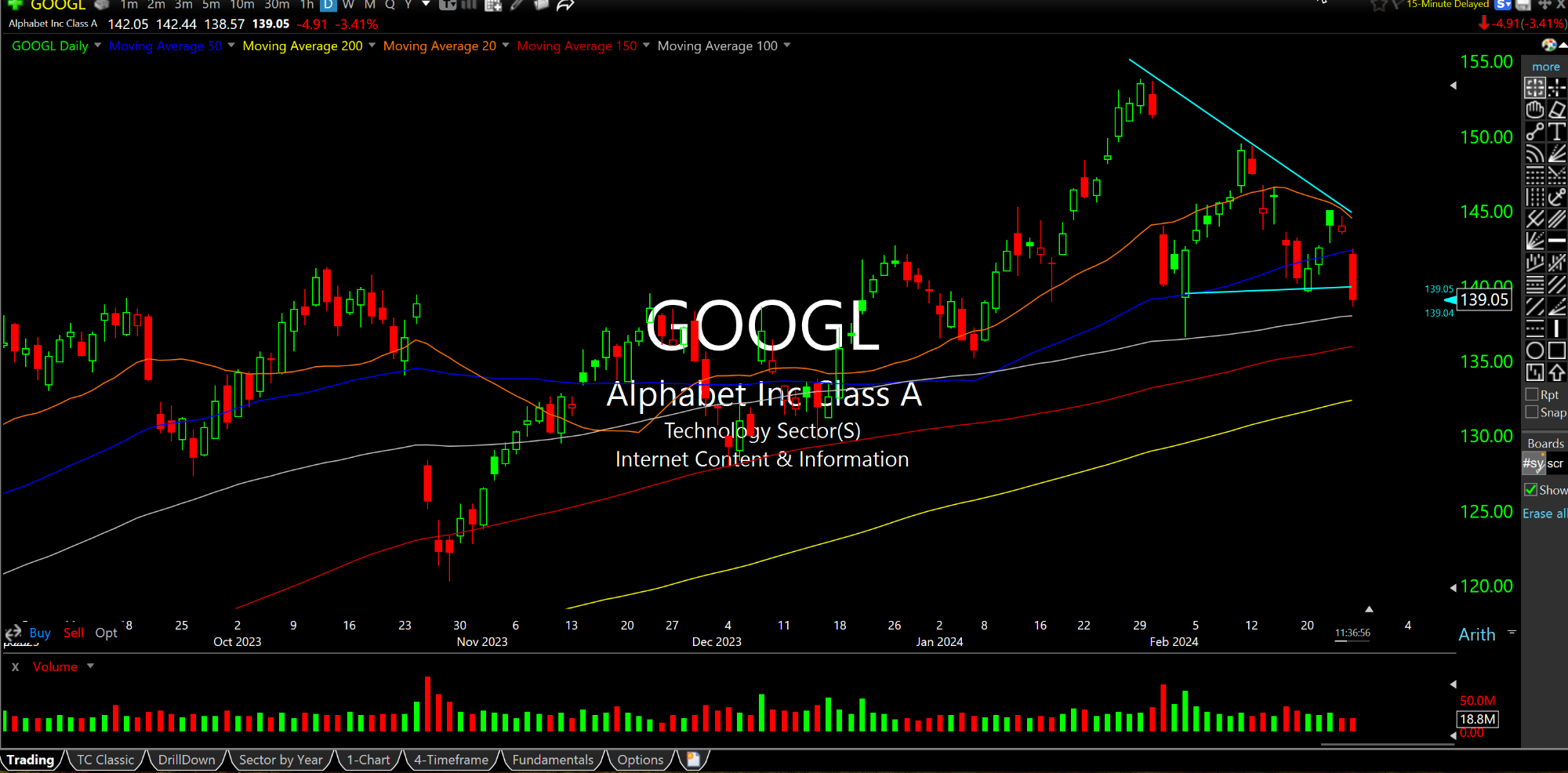

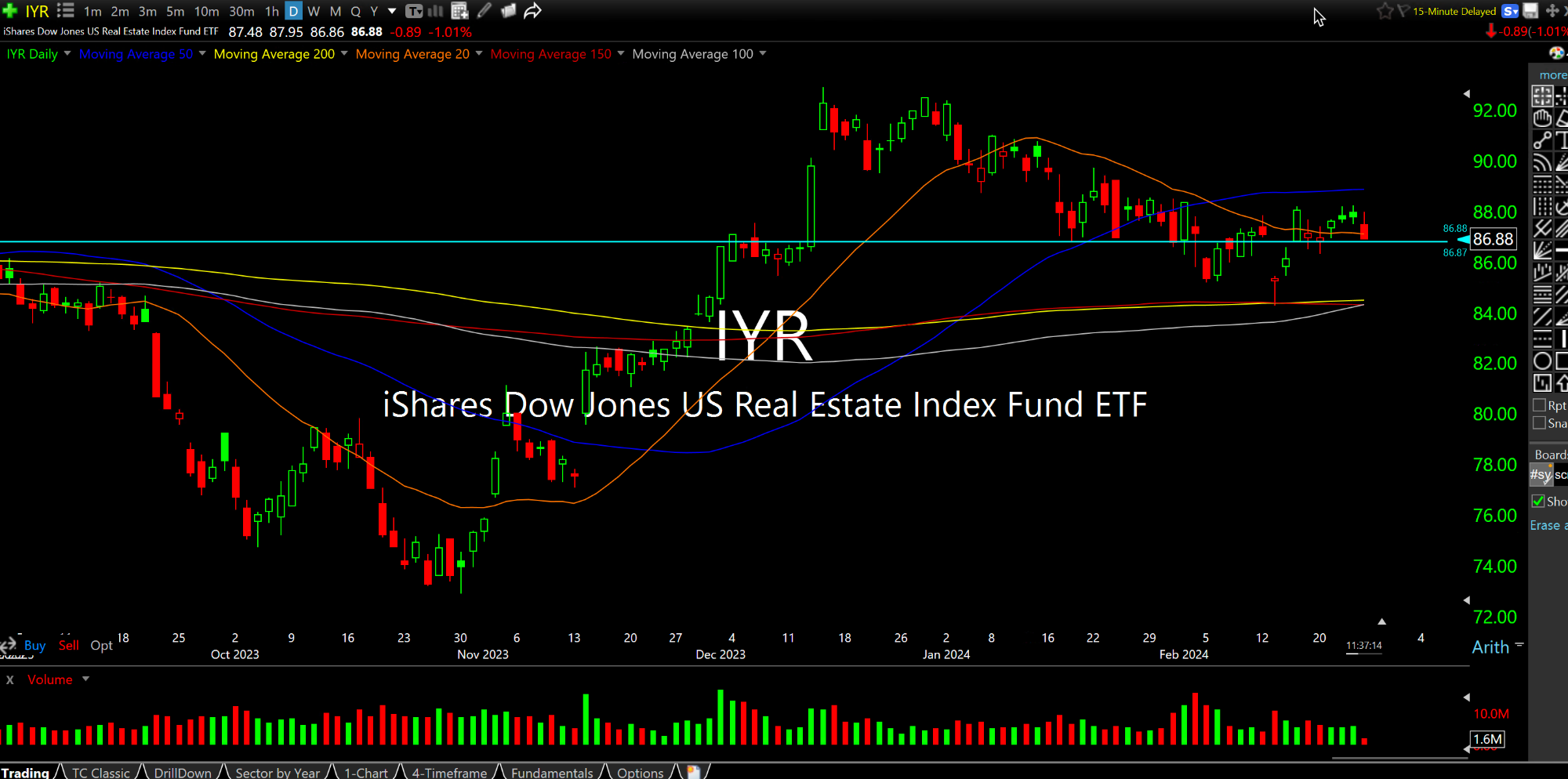

That said, Alphabet and the REITs in the IYR ETF, respectively below on their daily charts, stick out so far today as two of the more glaringly weak parts of the market.

I am, specifically, now looking to see whether the likes of MSFT follow GOOGL lower to finally increase some selling pressure via the heavyweights "Magnificent 7" names, eventually tugging on NVDA and the chips to crack.

Also note rates remain stubbornly firm. As epic as the melt-up in tech has been, defying my view on them for a good while, we have been correct on rates and the bond market where many others have been looking for much lower rates by now.