07Mar12:51 pmEST

Reminiscent of a Certain Time and Place

As NVDA and the semiconductors continue to blow-off (headed into AVGO earnings tonight), I cannot help but recall this same early-March period in 2009.

Of course, back then instead of going up every day we had the market going down nonstop.

There were many bold calls for the S&P eventually go down to 400, some even calling for 200 and 100 with great confidence. Instead, as we know, on a sleepy early-March day we tagged 666, turned on a dime higher, and never looked back.

The lesson back then was that even the most seemingly one-way markets, for extended periods of time, are capable of turning on a dime just when one side thinks they are fully in control for the foreseeable future.

Fast-forward to today, and there are more than enough underlying negative divergences to go around, just as in March 2009 there were tons of positive divergences being ignored.

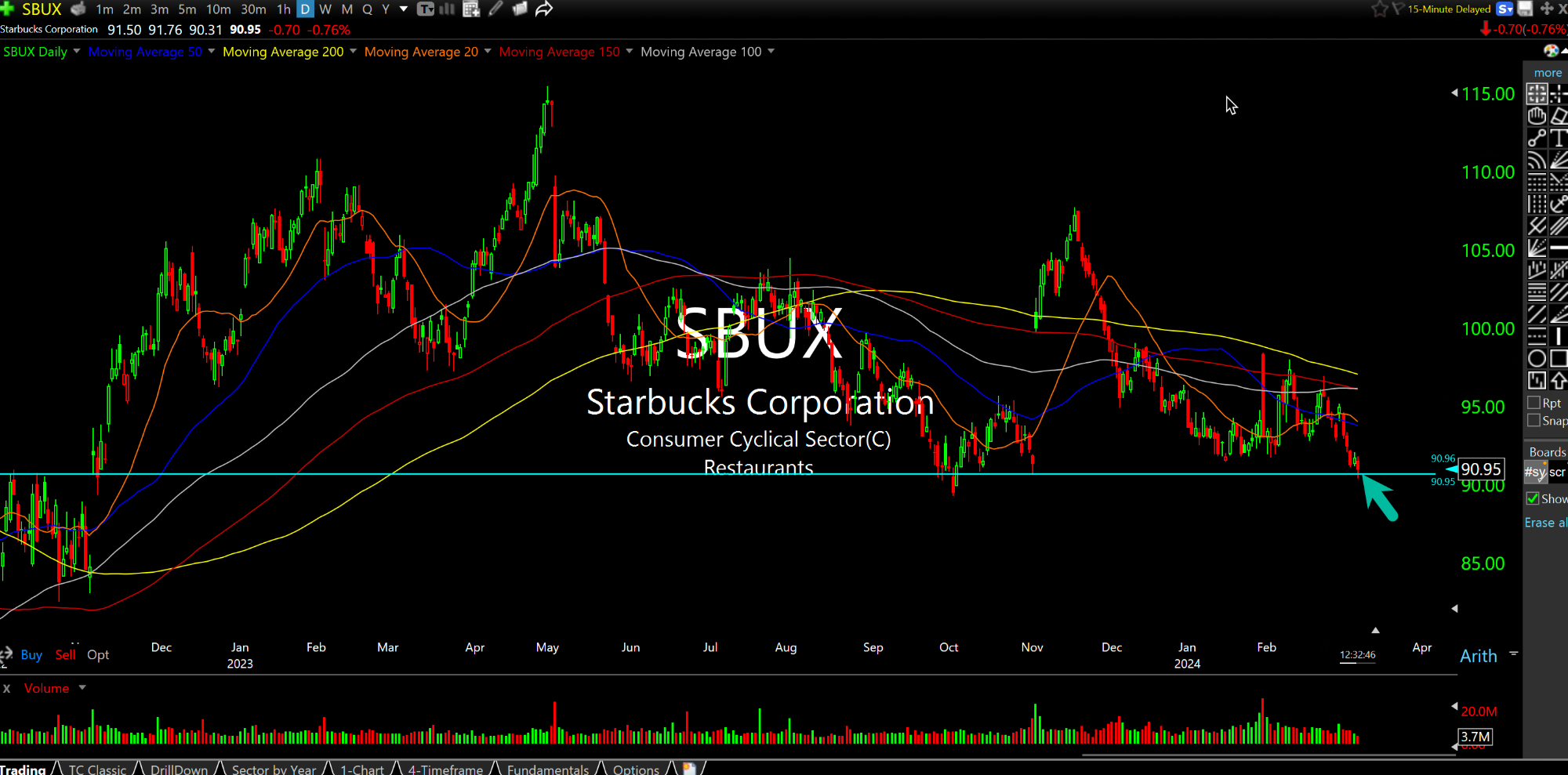

We know AAPL GOOGL TSLA have been weak, but also recall the NKE SBUX weakness we had previously flagged here and with Members for weeks on end.

On the respective NKE SBUX daily charts, below, we can clearly see the ongoing weakness which should ring alarm bells for the consumer amid sticky high inflation, as we head into COST earnings tonight at that.