12Mar1:09 pmEST

Some Can Spot It

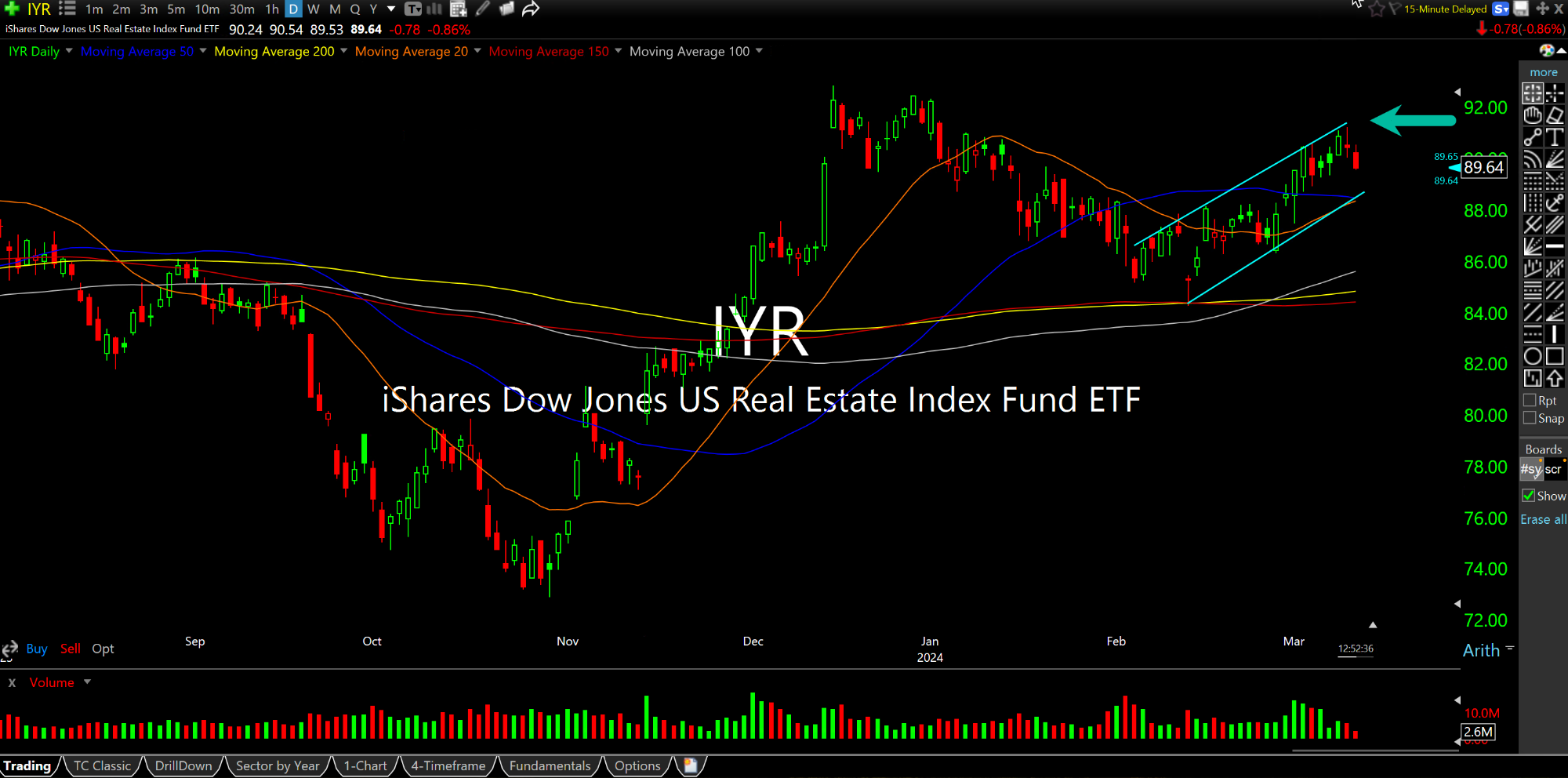

I remain perplexed by the Nasdaq's ability to laugh off a hot CPI print this morning (and just about anything else for that matter), even as rates rise. However, many other parts of the market can spot the issues caused by higher rates going forward, be it the small caps, transports, biotechs, and the REITs (below on the IYR ETF daily chart) all red.

While the Nasdaq is off session highs as I write this, I would need to see the Nasdaq Composite cash Index back below 16,100 to get me thinking today marks a serious reversal.

For now, I remain convinced that the recent rally in the IYR was merely a relief bounce based on more hope for imminent rate cuts. And now the potential rate cuts look like June at the earliest, if that.

Overall, the disconnect taking place in the Nasdaq remains historical--Bulls are pricing in rate cuts, continued economic growth, and the AI revolution with sky-high PE ratios clustered into the largest market cap firms in the world. The boat is uniquely crowded as many sell volatility, and that is why I maintain that playing for that eventual violent unwind is more fruitful in the end, despite all the bumps and bruises along the way.

Very Well. I Accept Your Bla... Finally Feels Like the 1970s...