01Apr11:12 amEST

April Bond Fool in the Rain

I almost never headline a blog post with a chart. Typically, I use a photo relevant to the title or body of the post.

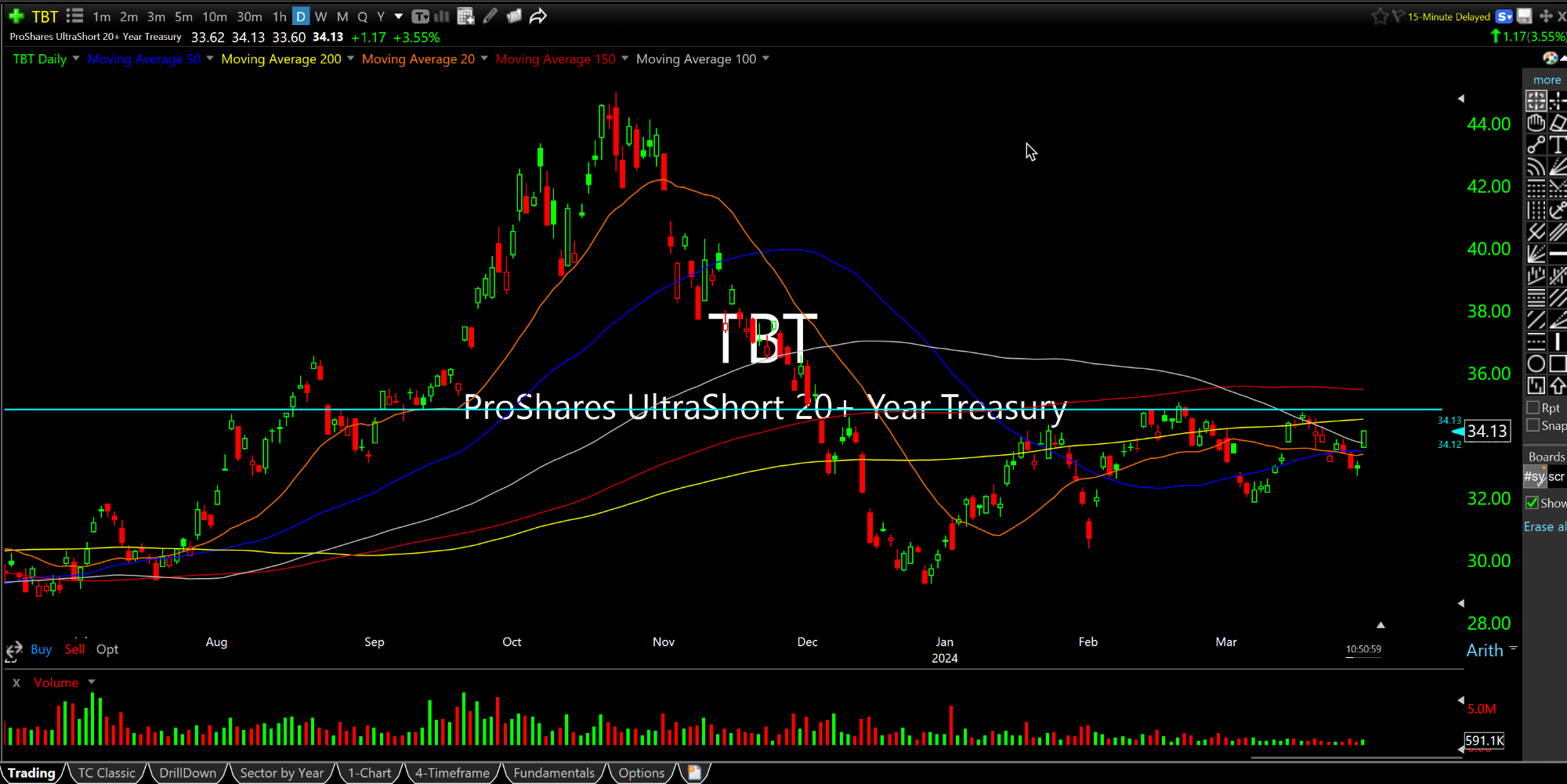

However, and this certainly is no April Fools' Day joke, TBT (ultra-SHORT ETF for Treasuries, essentially a bet on higher rates by being long TBT) has been the mainstay in my portfolio for over fifteen months now with Members. And as frustrating as the exuberance in equities/tech/semis has been, buying TBT on dips below $30 and then selling a chunk last autumn into the run-up above $40 worked well.

As it stands now, TBT is basing below resistance, as you can see above on the TBT daily chart. On the 10-Year Note, 4.3% is in play as I write this, with a push above here that holds being a meaningful move considering how many bond bulls desperately are pinning for lower rates this year.

But as we have noted many times here and with Members, it is highly unlikely we see smoothly lowered rates--The most likely scenario is stocks cratering (and commodities teetering) which gives The Fed cover to cut aggressively. Apart from that, the soft landing scenario still seems like pie in the sky.

In addition, with gold percolating of late, the scenario of rates and commodities spiking in unison seems dangerous to The Fed, where they would have to eat humble pie again like they did with "Transitory" a few years back and begin hiking rates imminently.

Simply put, my view remains that TBT is coiled to spring much higher and squeeze The Fed in a reversal of roles of late, where The Fed has been squeezing bears for quarters on end with their loosey-goosey rhetoric.