09Apr1:00 pmEST

Here's the Thing About Rip Van Winkle

.jpg)

...even he woke up, eventually.

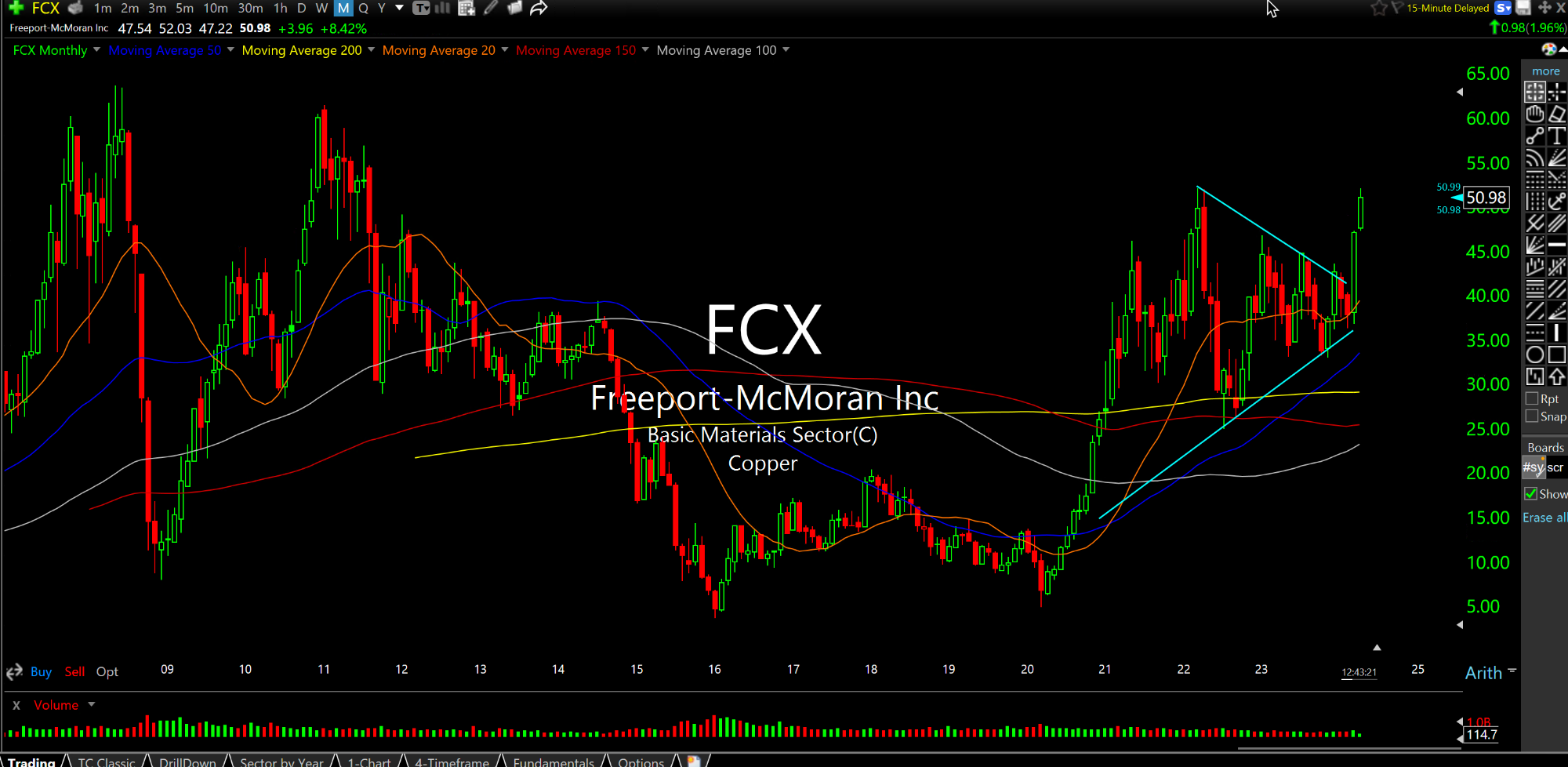

You may notice that the monthly chart for the premier copper miner, Freeport McMoran, below, looks an awful lot like the monthly chart of the silver metal. Both charts are threatening to emerge from multi-year symmetrical triangles within the context of decade-plus sideways/dead money periods.

And just as Rip Van Winkle woke up two decades later, so too may these commodity names be waking up as inflation is entrenched against the wishes of a great many folks.

The simple test, going forward, to see if these breakouts usher in sustained moves higher is to avoid a high sell volume reversal down. On FCX, for example, a heavy sell volume event back below $40 which holds is clearly something which would undermine this entire view.

But there are no signs of that yet, as commodities remain woefully underweighted by retail and institutions alike, even after this pop in precious miners, for example.

And when it comes to copper, you can be sure virtually no one is talking about the global copper shortage, which ought to be a surprise to no one considering how out of favor the sector has been by now. Thus, the bullish commodity cycle is born.