17Apr11:52 amEST

One DJT is More Important Than the Other DJT

During this election year, especially, amid the news flow and court proceedings it is completely understandable why the Trump Media new ticker, DJT, would garner plenty of attention from traders and even Main Street casual market watchers alike.

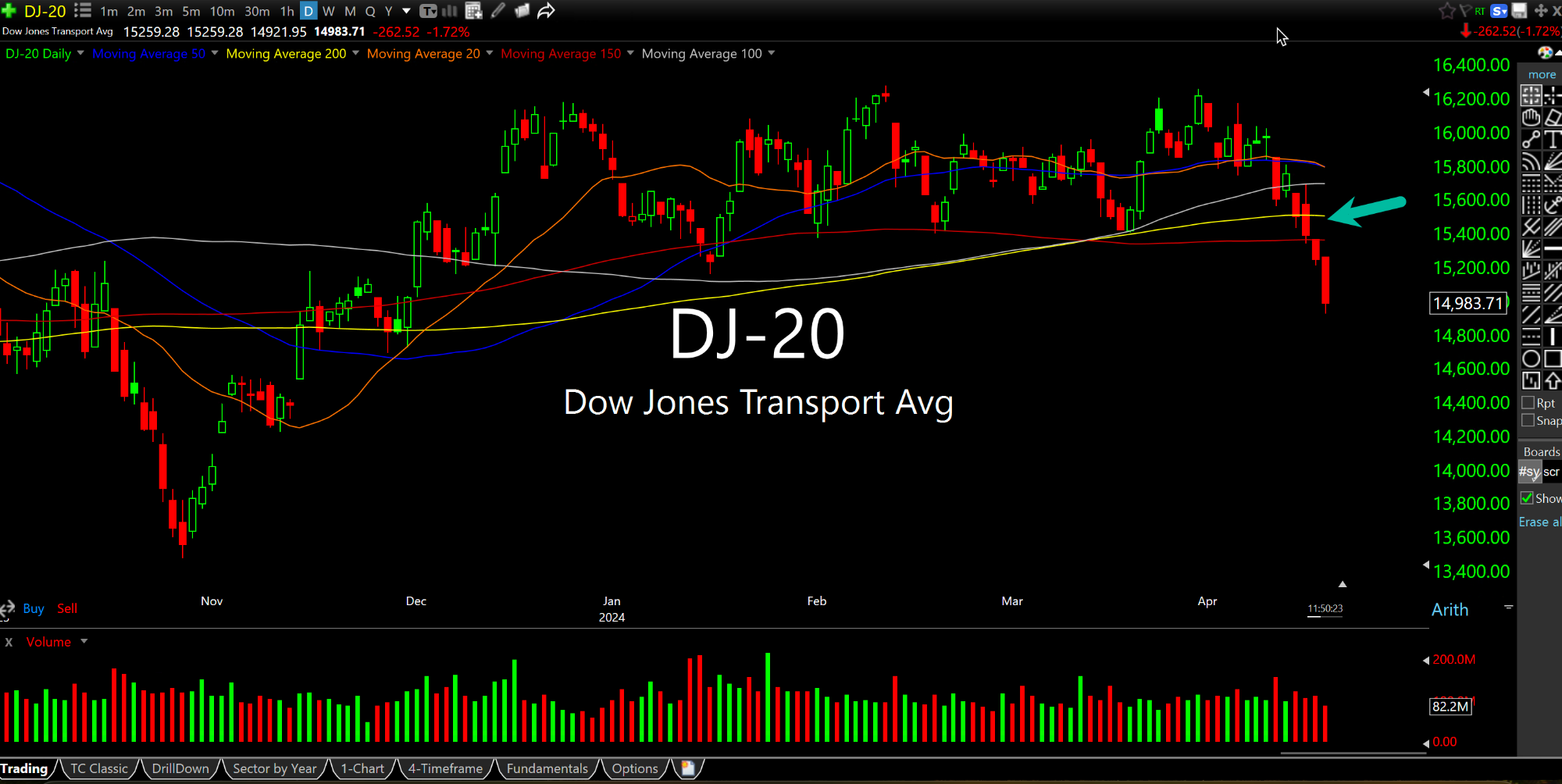

However, from my perch the other DJT, which stands for Dow Jones Transportation Average ticker, on the daily chart, below, is far more interesting from a market perspective (the actively traded ETF for the transportation sector is IYT).

The transports never surpassed their 2021 highs, which marks a clear and glaring, long-running negative divergence to the Dow Jones Industrials making new all-time highs in March of this year.

Now, many would argue in this new day and age that a bearish transportation divergence no longer matters (i.e. Dow Theory is obsolete). And while I agree that the world economies are subject to change and innovation, that arguments also sounds an awful lot like the plethora of, "this time is different" echoes we have heard nonstop from bulls.

As you can see, below, the transports recently went from a seemingly healthy base above all daily moving averages to knifing below a now-declining (arrow) 200-day moving average. This type of about-face is consistent with a given market realizing it needs to aggressively reprice lower, which likely aligns with the realization that The Fed will probably not be cutting rates anytime soon without a legitimate crisis first sending stocks much lower from current levels.

Sending Out an SOS on the SP... Now We See How Much of a Lea...