23Apr12:56 pmEST

Maybe He Could Sing But He Couldn't Fly

Stocks continue to take liberties to enjoy a relief bounce in front of many other "Magnificent 7" names reporting earnings this week, be it TSLA tonight or META tomorrow, then GOOGL MSFT on Thursday evening.

You may have noticed more and more folks assuming the bottom is in for equities after the recent 5% dip on the S&P 500. And if the big names keep blowing out earnings that may very well happen. However, NFLX set a harsh tone late last week, and I suspect the stickiness of inflation and rates may ultimately squeeze profit margins for even the best of the best.

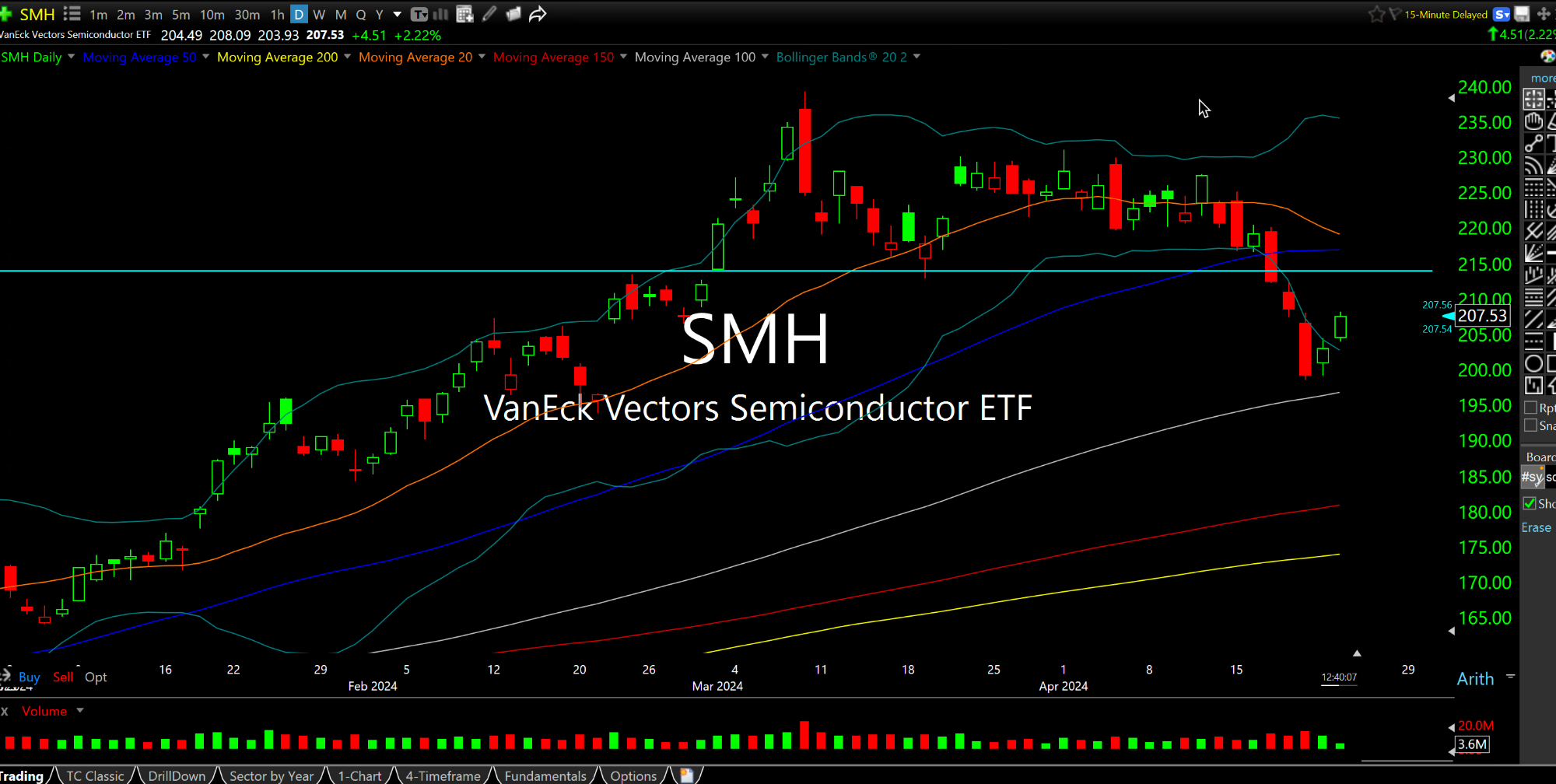

As for semiconductors, they are also enjoying relief. NVDA and SMCI are relatively hot today, though still well below last week's breakdown levels for both names. On that note the SMH ETF for the chips, below on the daily chart, shows the same setup--A bounce below the breakdown point.

Should SMH bounce up to $212/$213 I would view it as a strong short entry just as everyone's assumes the bottom is definitely in. The semis can sure sing, but at this point I do not think they can fly anymore.

Elsewhere, oil and precious metals and miners are firming up after their shakeouts. They seem to be in better daily chart formations than tech, yet sentiment is flipped--Here, many assume tops in commodities.