02May11:42 amEST

A Hangover Into Apple

Although I have strong personal opinions about Powell and The Fed, the fact remains that the market is still sorting out the FOMC yesterday and all of its possible ramifications. Hence, it is probably not too instructive to spend much more time in a blog post bloviating about the current monetary policy.

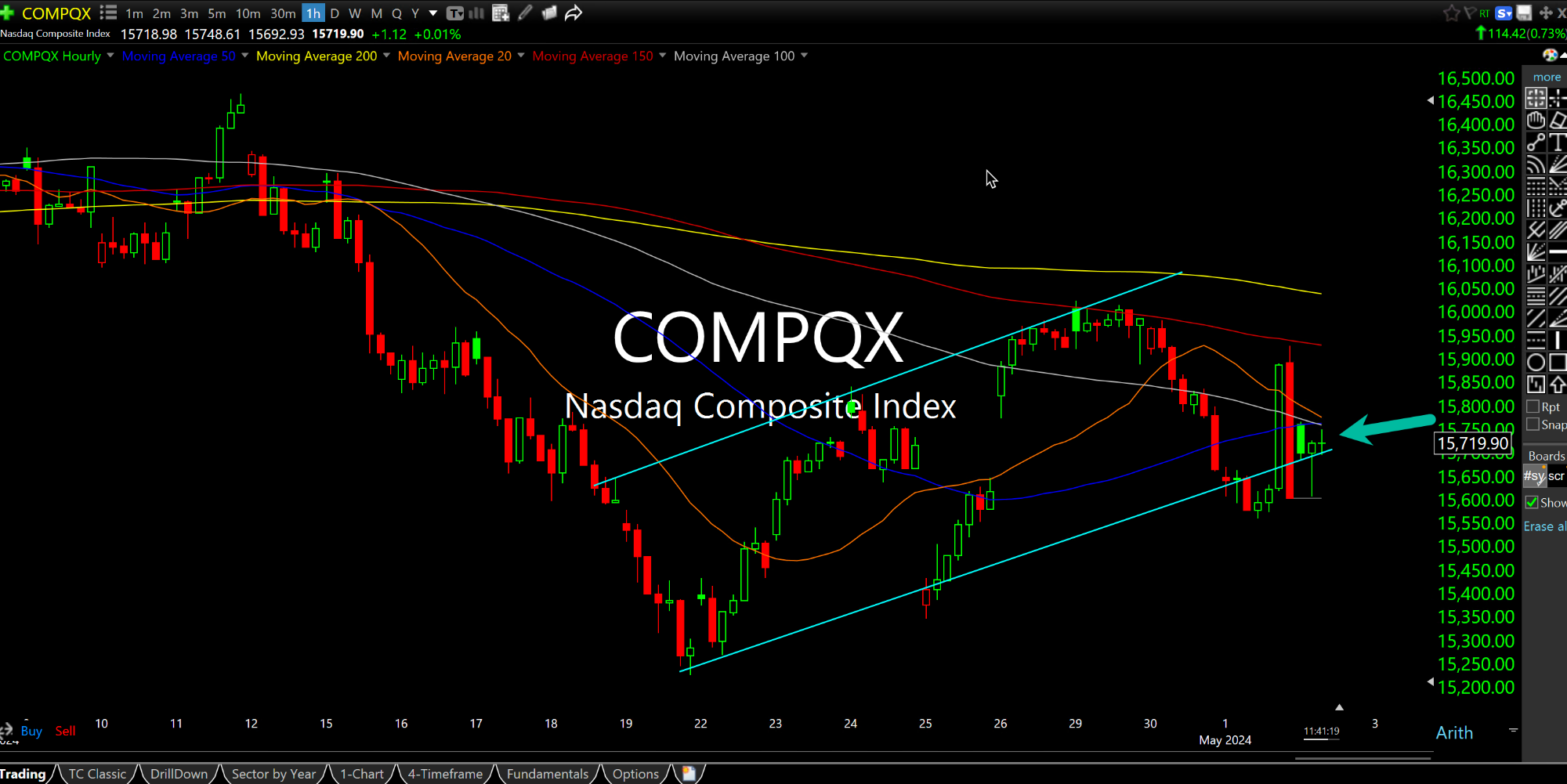

Far more relevant and tangible for us is that the multi-week potential bear flag on the Nasdaq Composite, updated below on the hourly chart, which we noted yesterday with Members, remains very much in play as we head into Apple earnings tonight. After AAPL, we have the jobs report Friday morning which could be a market moving event, too.

As for the Nasdaq, a move below 15,550 likely confirms the bear flag lower and gets the ball rolling downhill for bears. On the upside, bulls can negate the pattern likely with a close and hold above 16,100.

Today we have natural gas and uranium stocks outperforming, two areas we noted earlier this week. Big banks are notable laggards.

Also note that even with Apple's decline in recent months it is not yet a cheap stock. Nor have we really seen much panic from bulls. I would think the path of least resistance is now lower.