08May12:28 pmEST

You Cannot Anime Your Way to Prosperity

A diving Japanese Yen currency in April began to worry the developed economy central banks and governments to the point where we saw a clear Japanese intervention into their own currency.

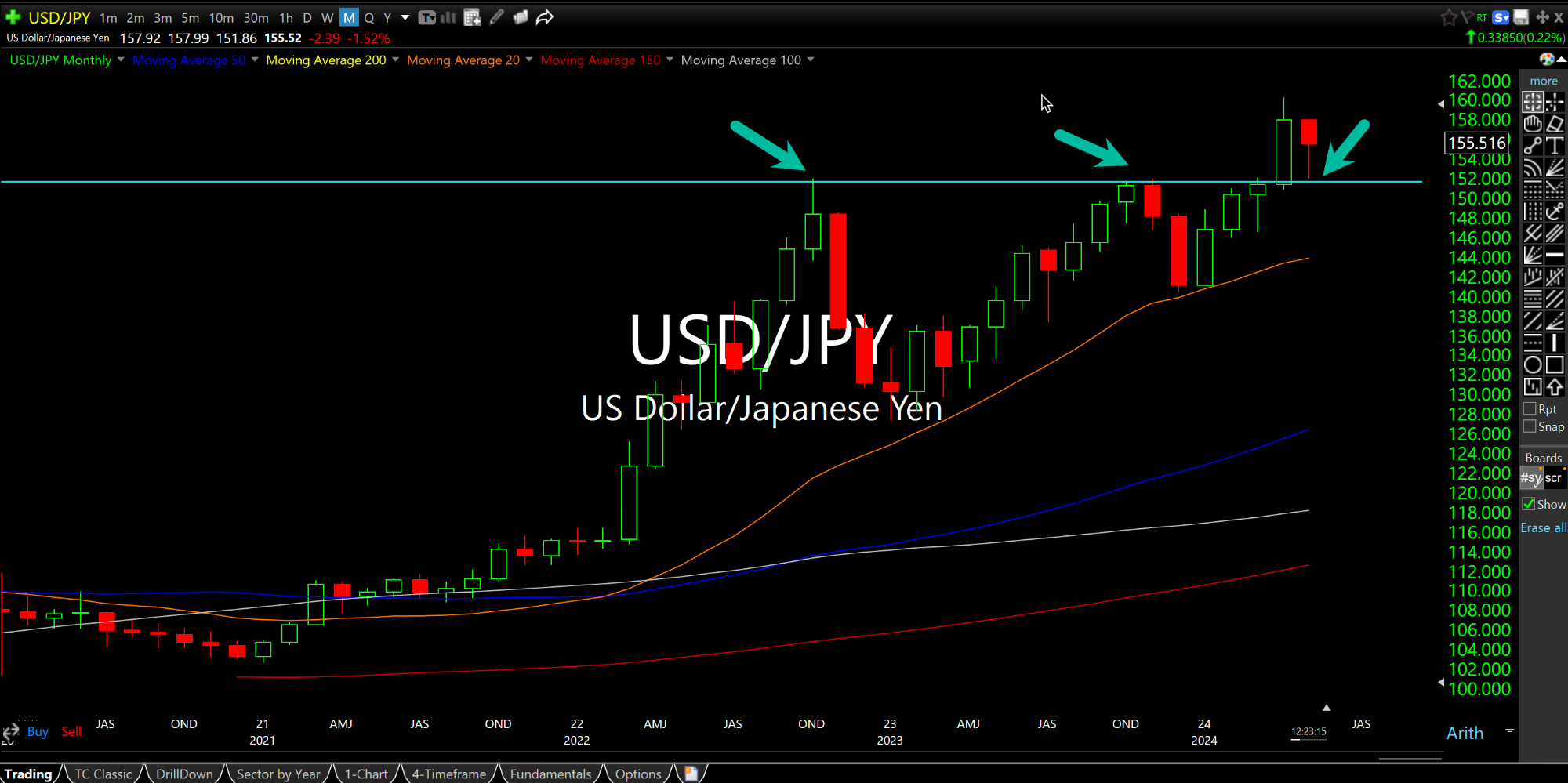

The level which seemed to cause the most alarm was $160 on the Dollar/Yen cross, seen on the monthly chart, below.

Given that the Yen is the denominator in this USD/JPY cross, alongside the EUR/JPY for the Euro/Yen, the higher this chart goes the weaker the Yen grows against the Dollar (or Euro, depending on the chart).

As you may know, Japan has a murky history with interventions.

Robin Brooks, a Senior Fellow at the Brookings Institution and a Goldman alum, noted on Twitter:

"Japan has a long and unsuccessful history of Yen intervention. The recent episode is no different, with Yen falling once again. If Japan really wants to stabilize Yen, it must let 10-year JGB yield rise, but that would cause a fiscal crisis. Japan is trapped by its high debt..."

I agree completely with those views.

And the reason why we are discussing it, to keep this actionable, is the global pin action we should see if the Dollar/Yen heads back up to $160, or higher, and laughs in the face of the recent intervention.

At that point, volatility should finally rise. While it may not be appropriate to call it a "Black Swan," since this risk has been a flashing red light for a while, it would certainly humble folks who have been literally laughing it off as another false alarm for worrywarts.

I would also like to point out the support level: Below $152, as you can see on the monthly chart of the USD/JPY, has been a critical level going back to 2022--First resistance, and now as support after the initial invention move where the Yen rose against the Dollar (and hence this chart went down a bit).

Elsewhere, rates and oil are trying to stabilize after recent pullbacks, too, while the semiconductors are battling their 50-day moving average.