15May1:06 pmEST

Making Sense of Irrationality

Stocks continue to celebrate virtually any and all news, be it hot prints, cool prints, strong or soft economic data. History tells us we are seeing all of the classic signs of a major market top, from the meme stock squeezes to sentiment, positioning, valuation of a narrow group of leaders, to divergences for years in small caps, transports, and REITs all not making new highs since 2021/2022.

However, tops can take extraordinary long times to form and can span many months. As an example the 2007 bull market tops on most indices spanned 6-8 months--The 2000 top took even longer on some indices.

That said, commodities, a classic late-stage rotation group, are acting well in the face of such a supposedly "cool" CPI print, alongside the ice cold retail sales data we had this morning.

In other words, while the bond market is cocksure this is all cool as a cucumber data, commodities seem to disagree.

One would certainly think that commodities would get pounded in the face of such allegedly deflationary data this morning. But the opposite is occurring.

Silver is shooting higher as we speak, and natural gas is continuing to improve. Gold and the precious miners are coiled up and strong. Copper has been red-hot of late, too, while soft commodities have seen rotation out of cocoa and into wheat (not to mention orange juice acting great).

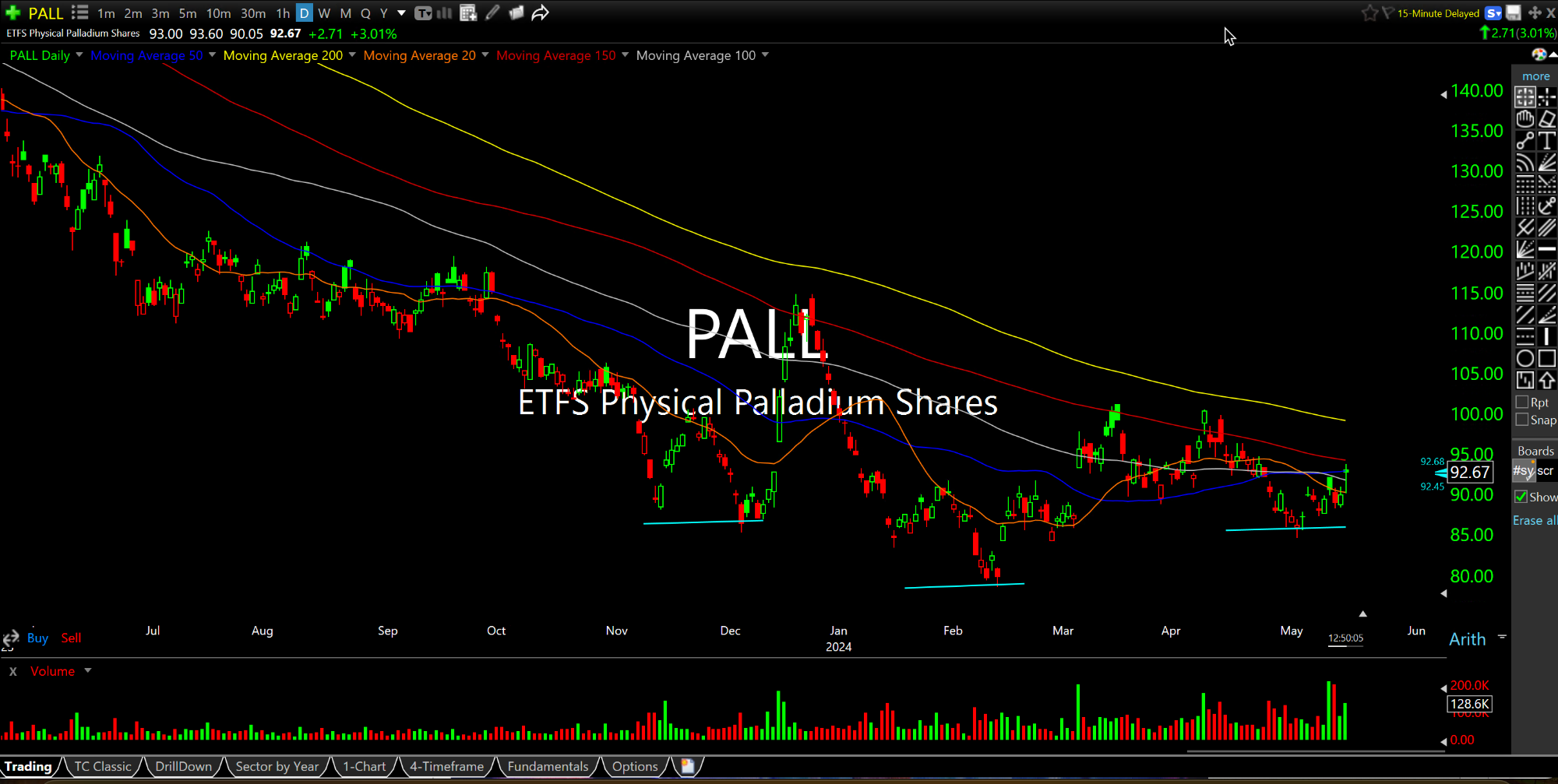

And that brings us to a laggard like palladium, below on the PALL ETF.

Palladium is used in catalytic converters, which become the targets of thieves during inflationary times. Palladium is also used in jewelry, dentistry, watch making, blood sugar test strips, aircraft spark plugs, surgical instruments, and electrical contacts. I still think we are looking at a bottoming formation here, as Palladium is easily the most overlooked precious metal there is. Heck, even platinum has caught a bid of late.

Overall, commodities seem like the main asset class right now which can freely disagree with the powers that be that inflation has in no way been conquered. And for today they are speaking rather loudly.