25Jun11:25 amEST

The Daily Swindle

Although I still do not subscribe to the, "It's All Rigged!" view of markets, on days like today, in the context of yesterday's action, it all sure can seem a bit too coincidental.

Specifically, we have the inverse of yesterday: NVDA, semis, and tech are leading while virtually everything else is down or flattish.

That said, as I write this I see crude oil fighting back from red to green/flat.

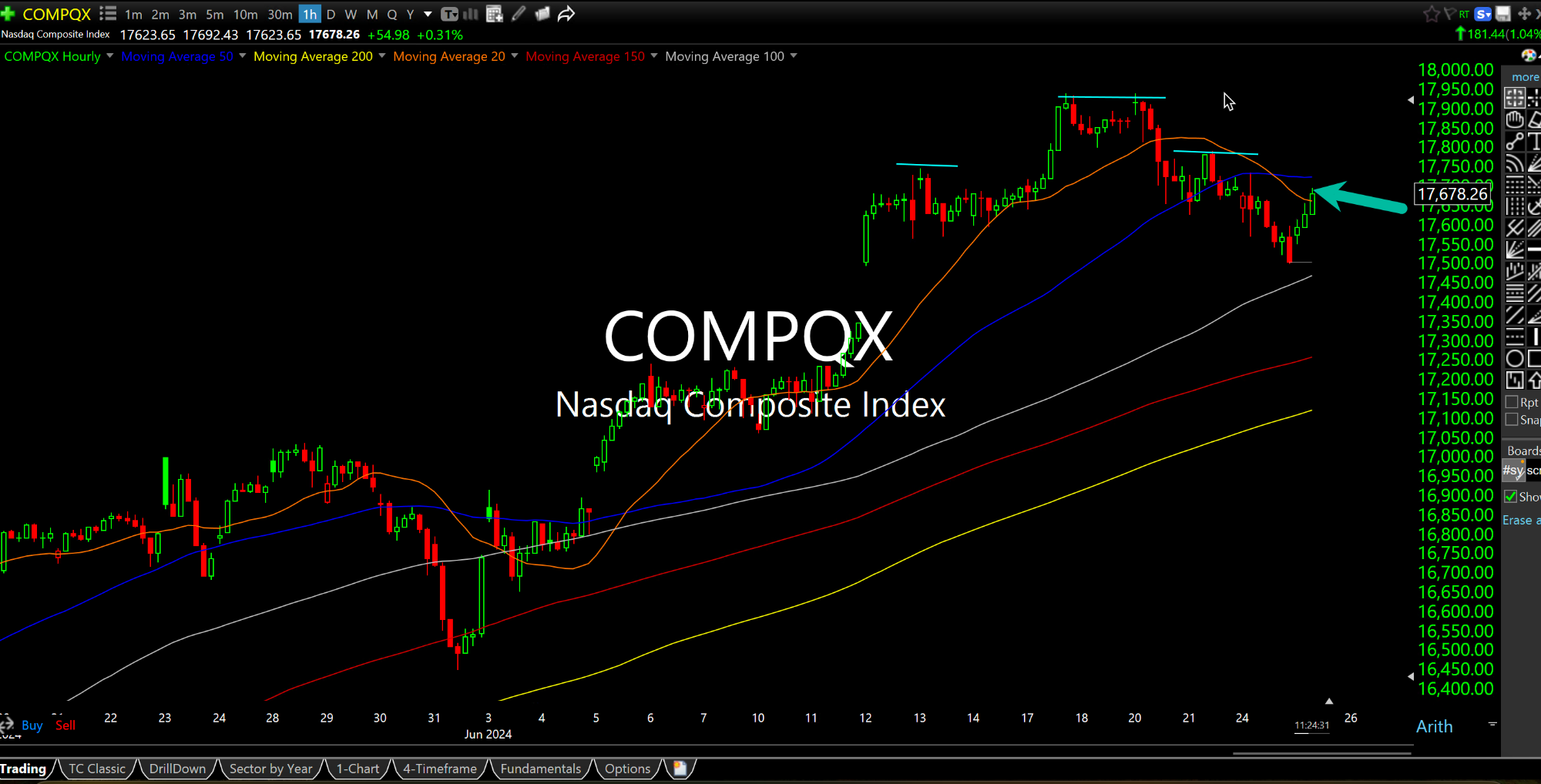

Overall, however, the pertinent issue the rest of this week will be whether the Nasdaq, seen below on the hourly timeframe, is putting in a mere lower swing high before heading on lower and confirming the highlighted topping structure we have seen throughout this month of June or, instead, bulls are correct that there is more of a melt-up/chase to come yet.

In order for bears to prevail, I would surmise the bounce needs to begin to run out of steam right around these levels. In other words, a multi-day bounce from here is not likely bearish.

Finally, the Dollar/Yen is toying just below the key $160 level. Recall that is where Japan intervened to defend their currency in late-April. And now headlines are swirling about the Bank of Japan on the cusp of a major hawkish move(s).

While the BoJ has a history of being much more bark than bite, I still think the USDJPY barreling over $160 again (as opposed to finessing it like it has of late) would begin to cause some global turbulence.