29Jul12:30 pmEST

Those Chips Suddenly Aren't Paula Deen Sweet Anymore

As we embark on one of the busiest midsummer weeks you will ever see in markets, between the biggest firms reporting earnings alongside about 40% of the S&P 500 Index's components, plus the FOMC and non-farm payrolls in the heat of an election year and heightened geopolitical tensions, you may have noticed the increasing intraday violence of the price swings picking up. Just today, for example, the semiconductors, or chips, opened up nicely and screamed higher, then faded all the way to soundly red before bouncing back to mildly green as I write this. Again, violent price swings in and of themselves often tell a story of a market struggling with price discovery more and more, which is often a bearish omen.

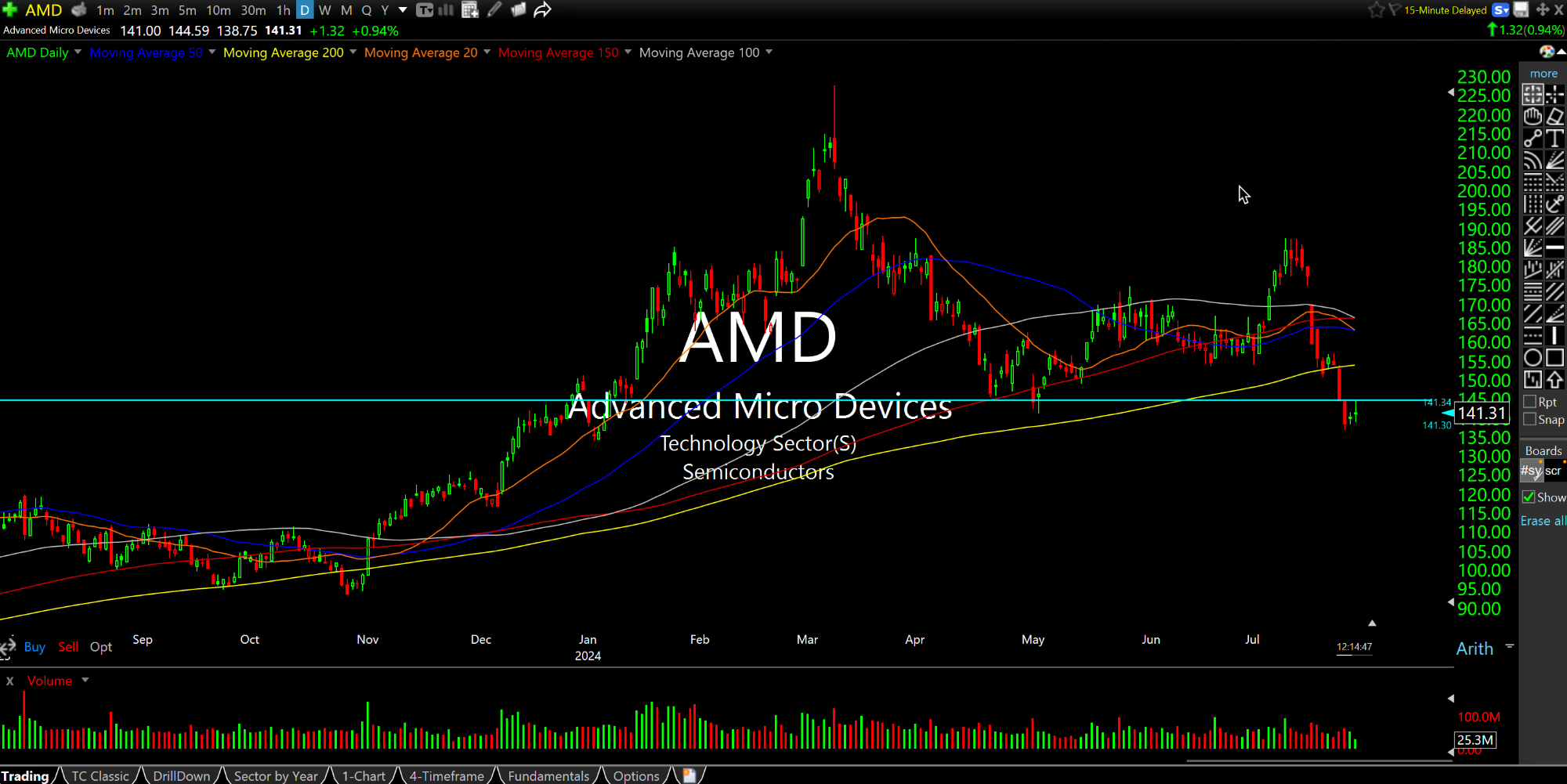

On that note, AMD, one of the more prominent chips, reports tomorrow evening along with Microsoft. I consider AMD a "tell" and have for a good while now, as we noted with Members in the service back in the spring months when AMD had topped out well before its peers. While it has taken a while for bears (what hasn't in this market?) we are seeing more tangible evidence that the once Paula Deen sweet chips are now more akin to the low sugar keto version--Really not very sweet at all and perhaps not even worth the effort in lieu of the real thing.

On the AMD daily chart, updated below, we can see the stock lost its 200-day moving average (yellow line) as well as prior key support from earlier this year (light blue line), All of this is to say I consider the AMD reaction tomorrow evening almost as significant as MSFT, despite Microsoft's much larger size in market cap.

Courting the Financials; Che... Simon Says Pay Attention to ...