06Aug12:20 pmEST

Vol of Vols

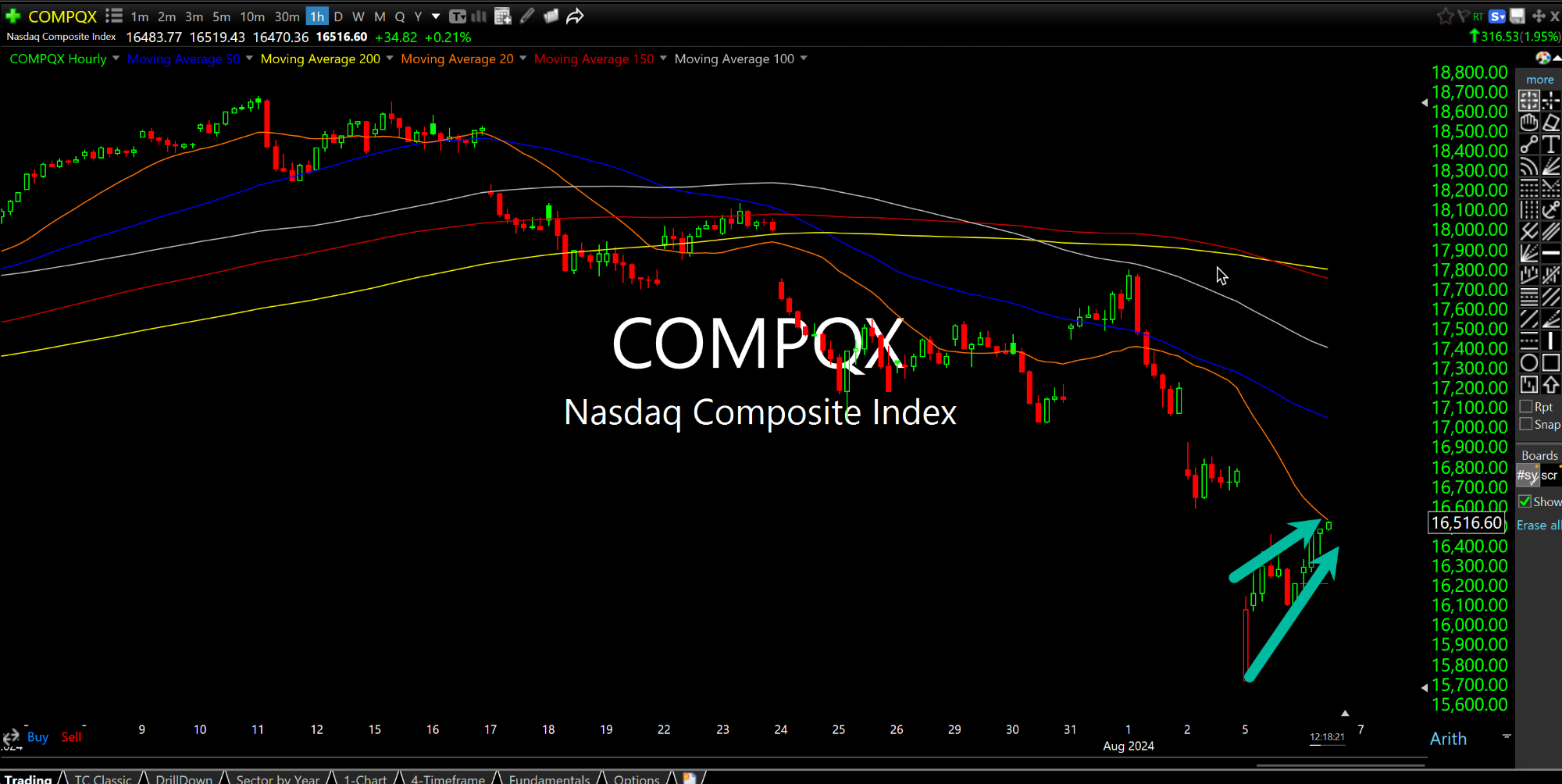

Looking at the updated hourly chart for the Nasdaq, below, the rally today seems rather rudimentary as far as relief bounces go in the context of downtrends (on this timeframe, of course). We are drifting up to the 20-period hourly chart moving average and still making lower highs and lower lows by price over the last few weeks.

However, bulls are obviously latching onto the massive downdraft in the VIX and the VIX ETFs as a bullish sign for markets calming down. The moves are indeed massive.

But, then again, the VVIX, which is calculated as the volatility of volatility, has been uniquely elevated and thus we should not be surprised to see the VIX itself flop around violently.

In other words, the swings even within the VIX itself should not come as a shock, just as the price swings in equities of late have presaged increasingly violent indecision and a general bearish bias.

That said, if this is a mere shakeout in the VIX, then we should probably see volatility pick back up sooner than later--Today's move likely encapsulates several sessions rolled into one in the VIX ETFs.

Turning back to the Nasdaq, as you can see we have not even filled the gap from Monday's open, up to 16,700 or so from last Friday afternoon. That may act like a price magnet, but failure to even fill that gap would surely be a bearish sign the rest of this week despite the jubilation today surrounding the VIX unwind.

You Don't Know What This is,... Close Together Doesn't Mean ...