08Aug11:17 amEST

Daily Dose of Perspective

One of the more interesting aspects about a market which sees increasingly violently and random price swings is that you see folks try to claim victory for each and every single move. Mind you, I, too, was once a young man in this business so I understand the temptation. But even some veterans cannot resist the urge to be on top of every single market machination which we know is patently absurd, especially over any reasonable period of time.

Thus, when equities ripped hard this morning off a slightly better-than-expected jobless claims report it not shock me particularly much. What we strive to do at Market Chess is stay consistent and offer perspective, which helps to mentally and emotionally wade through these rough waters without the daily emotional roller coasters you see so many taking, which inevitably is grating for everyone involved.

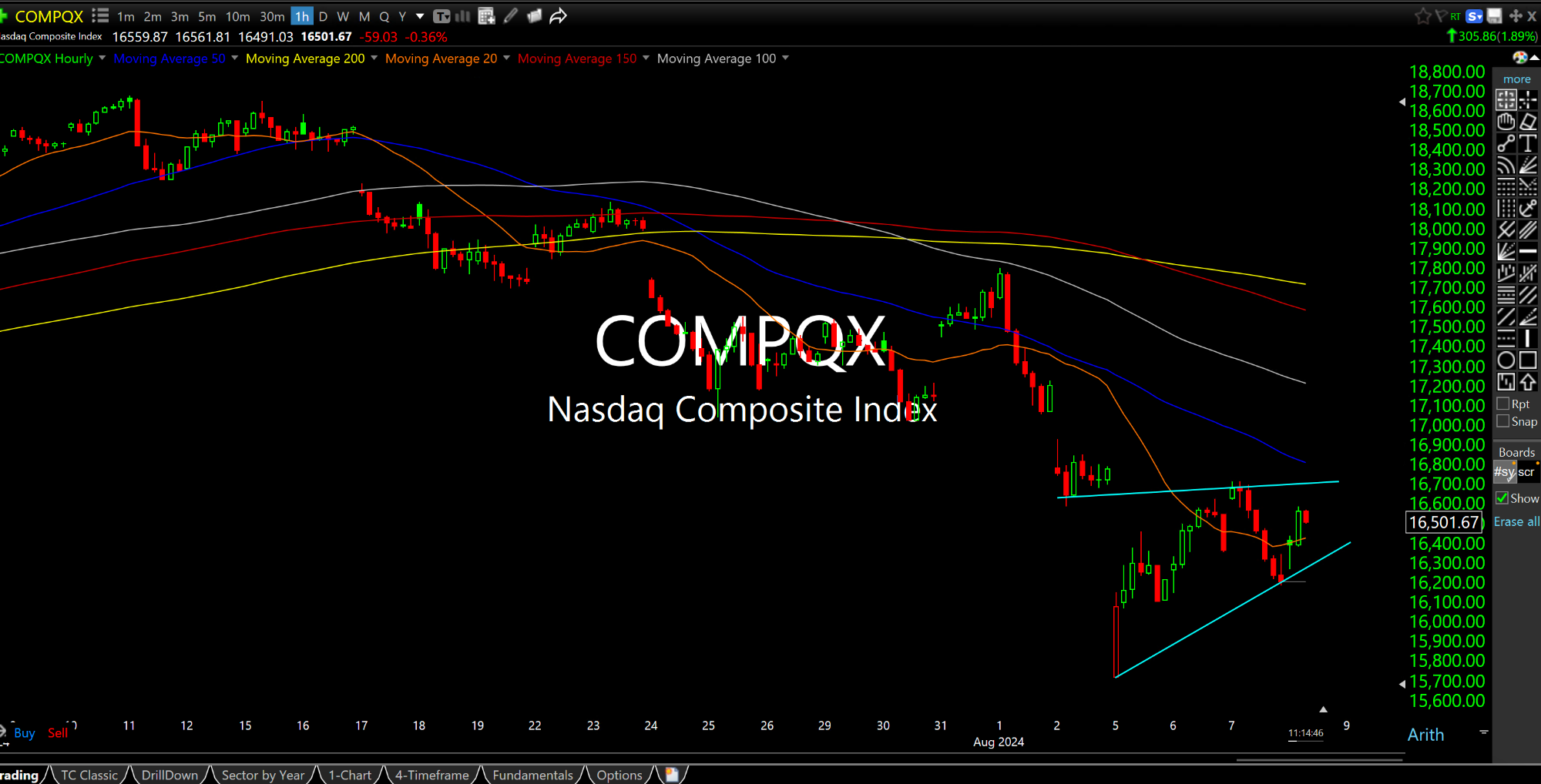

And when we do, gauging the updated hourly chart for the Nasdaq, below (a kind of visual motif of a timeframe for us during the last few weeks) we continue to gain valuable clarity and perspective on this action.

The Nasdaq is still working through a potential bear flag pattern. Even with the large gap up this morning, we are still well below the 16,700 resistance area we noted for Members previously. Bears want to see a move back below 16,200 to get the bear flag breakdown rolling.

And that's it. That is all we have to focus on right now in lieu of calling random daily whipsaws.

Elsewhere, natural gas is staging an impressive upside reaction to the weekly inventory report. I still want to see the UNG ETF hold over $14.

Close Together Doesn't Mean ... Afternoon Update 08/09/24 {V...