22Aug3:34 pmEST

I'm Sorry Ms. Jackson Hole, The Jobs Numbers Are Not for Real

The front-running of major events has been one of the hallmarks of this market for a while now, with inside information rumored to be circulating to the well-connected in a timely manner. The simple fact is that we will probably never know for sure whether that is the case.

And, frankly, that is life on Wall Street and has been for over a century, in various aspects--This is the life we have chosen, and all strings come attached.

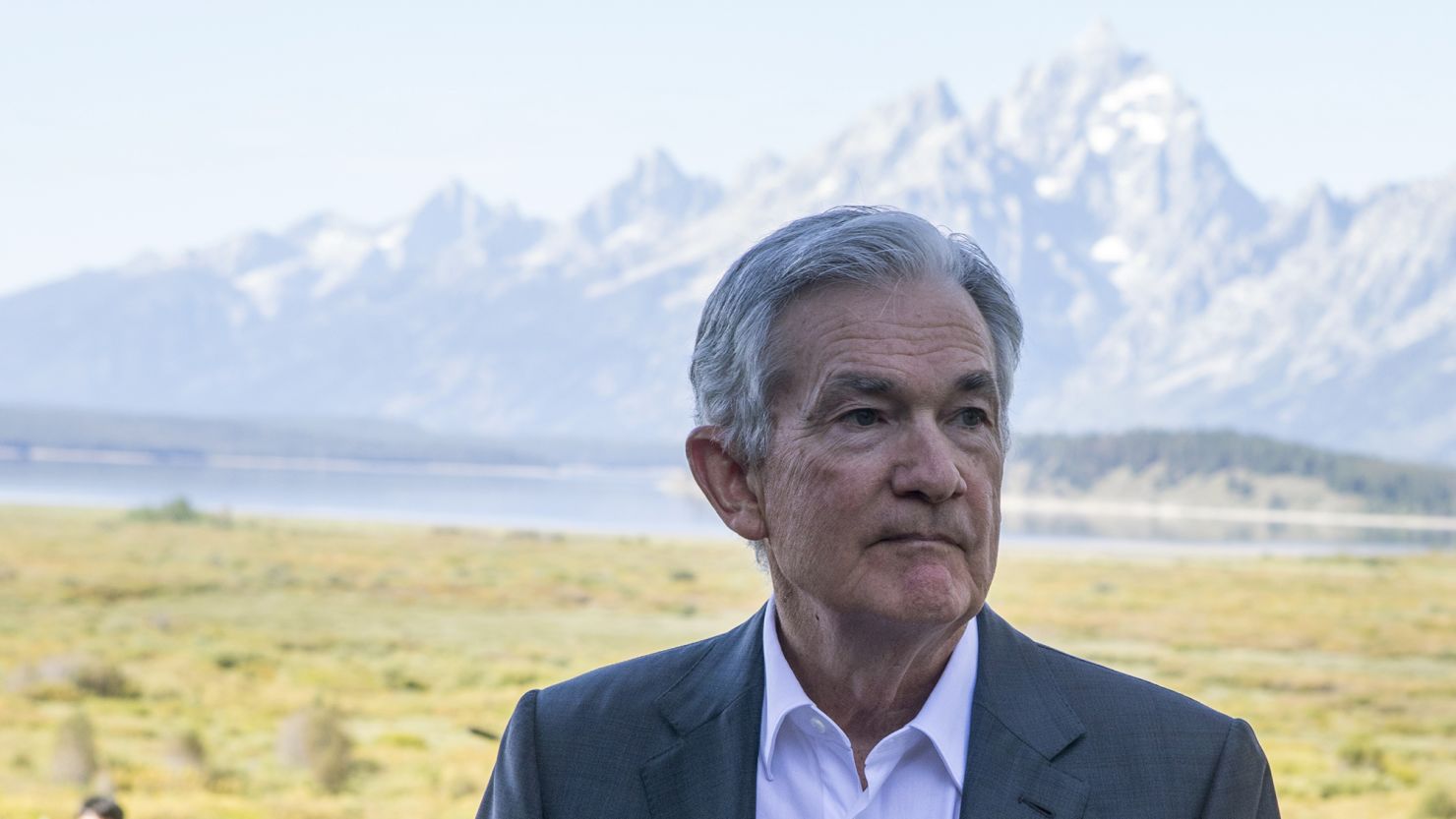

With this in mind, stocks are selling off in front of Powell's Jackson Hole speech tomorrow morning. An inter-meeting rate cut is highly unlikely. However, it is likely Powell will telegraph a cut at the September FOMC. The main issue is whether the market construes his speech and body language as being more consistent with a 25 bps or a 50 bps cut next month. As we noted yesterday, the massive BLS jobs revisions gives Powell ample cover to cut.

But it interesting to see rates jumping higher today as stocks sell off, especially the leaders like the "Magnificent 7" names. MSFT and GOOGL, for example, have been unimpressive throughout the last few weeks of market rallying. My best guess is that we see a parallel to September 2007 with then-Chair Ben Bernanke only cutting 25 bps to a disappointed market. Of course, there are tons of differences between now and 2007, but Powell is not unlike Bernanke back then in the sense that he does not want to appear desperate and panicked to markets.

This time around, I also firmly believe Powell has much less wiggle room for major cuts down the road, as opposed to Bernanke in 2007-2009, due to the entrenched inflationary factors not likely to abate so easily.

In other words, if it sounds like The Fed is in the early stages of being discovered by markets to be "trapped" between inflationary and deflationary pressures (as well as the Bank of Japan, and the ECB, etc.) that is because they are indeed trapped, which makes this recent unwind in volatility a likely quality long entry (See Also: This brilliant paper on the topic of trapped central banks and volatility)